- Maximizing Retirement Savings through Expert Retirement Tax Planning with an Income Tax Advisor

- Navigating International Waters: The Essence of International Tax Services for Global Businesses

- Capital Gains Tax Advice: Strategic Moves for Optimal Financial Outcomes

- Streamlining Sales Tax Compliance and Consulting for Efficient Business Operations

- Tailored Payroll Tax Assistance: A Comprehensive Approach for Employers of All Sizes

- Specialized Self-Employed Tax Help: Leveraging Tax Optimization Services for Entrepreneurial Success

Maximizing Retirement Savings through Expert Retirement Tax Planning with an Income Tax Advisor

Navigating International Waters: The Essence of International Tax Services for Global Businesses

Capital Gains Tax Advice: Strategic Moves for Optimal Financial Outcomes

Streamlining Sales Tax Compliance and Consulting for Efficient Business Operations

Engaging an Income Tax Advisor is pivotal for businesses seeking to streamline sales tax compliance, a complex and ever-evolving aspect of financial operations. These experts not only help in accurately calculating and remitting sales taxes but also ensure that businesses stay abreast of the myriad state and local tax regulations. Their guidance is indispensable in navigating the intricate web of tax laws, which can vary significantly from one jurisdiction to another. By implementing robust sales tax consulting services, businesses can avoid costly penalties and make informed decisions that positively impact their bottom line.

For the self-employed or small business owners, the intricacies of capital gains tax advice, retirement tax planning, and payroll tax assistance are areas where an expert’s input is invaluable. Tax optimization services provided by these advisors encompass a comprehensive approach to financial management, which includes optimizing income streams, minimizing liabilities, and strategically planning for long-term financial goals. Moreover, when it comes to international tax services, these professionals offer the necessary expertise to ensure compliance with cross-border regulations, thereby facilitating efficient business operations on a global scale. Their holistic approach to tax planning empowers businesses to focus on their core activities while confidence in their tax positions is maintained.

Tailored Payroll Tax Assistance: A Comprehensive Approach for Employers of All Sizes

Specialized Self-Employed Tax Help: Leveraging Tax Optimization Services for Entrepreneurial Success

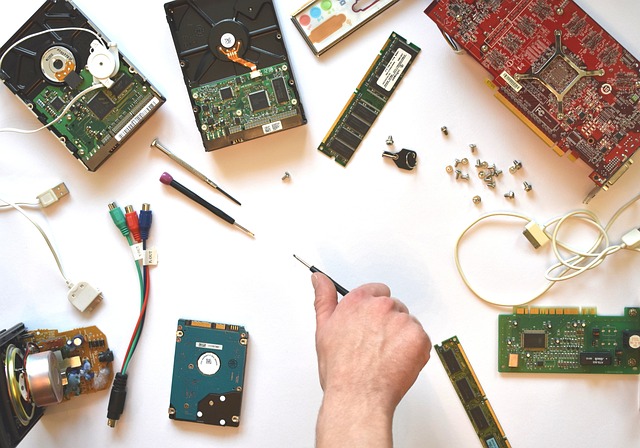

Entrepreneurs and the self-employed have unique tax considerations that require specialized attention. An Income Tax Advisor with expertise in tax optimization services can be instrumental in crafting a strategy tailored to an individual’s entrepreneurial ventures. These professionals understand the complexities of self-employed tax help, which includes navigating the intricacies of capital gains tax advice and ensuring compliance with sales tax consulting regulations. By leveraging their knowledge, entrepreneurs can effectively manage their finances, optimize their tax liabilities, and strategically plan for retirement tax planning, all while maintaining a competitive edge in their industry.

Furthermore, for those with international business interests, an Income Tax Advisor offering international tax services is indispensable. They provide guidance on cross-border transactions, help mitigate the risks associated with different jurisdictions’ tax laws, and ensure that businesses comply with the multifaceted rules governing payroll tax assistance. With a comprehensive approach to tax planning, these advisors enable self-employed individuals and small businesses to not only survive but thrive in today’s complex economic landscape. Their expertise is particularly valuable for those looking to navigate the challenges of tax compliance and optimize their financial outcomes, ensuring sustainable growth and profitability.

In conclusion, effective tax strategy planning is a cornerstone for both individuals and businesses seeking to navigate the complexities of the financial landscape. With the guidance of an Income Tax Advisor, individuals can optimize their retirement savings through tailored Retirement Tax Planning, ensuring they are poised for a secure future. Businesses, particularly those with international operations, benefit from the expertise of Tax Optimization Services, which provide essential International Tax Services to manage global tax implications effectively. Capital Gains Tax Advice plays a pivotal role in enhancing financial outcomes by aligning investment strategies with tax considerations. Sales Tax Consulting offers businesses the clarity and compliance needed for efficient operations, while Payroll Tax Assistance caters to the diverse needs of employers of all sizes, promoting payroll accuracy and legal compliance. For self-employed individuals, specialized tax help is a strategic asset, offering personalized solutions to capitalize on entrepreneurial ventures. These comprehensive tax services not only aid in minimizing liabilities but also empower clients to maximize their returns, ensuring financial health and long-term success.