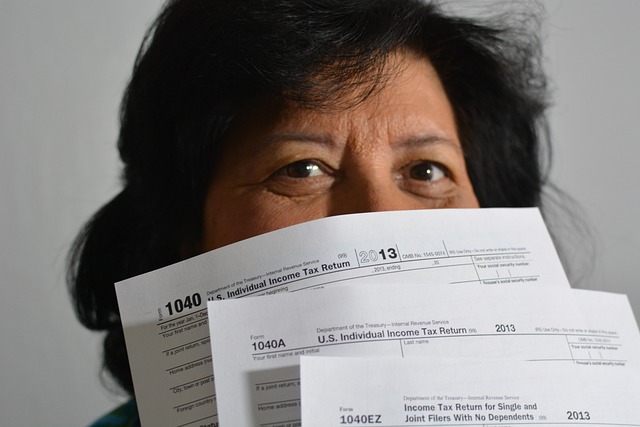

Homeownership comes with a multitude of financial considerations, and among these are significant tax advantages. This article delves into the array of homeowner tax breaks available, from leveraging IRA contributions for tax benefits to capitalizing on educational tax credits for families. Homeowners can optimize their finances through strategic moves such as Tax-loss harvesting, the Student loan interest deduction, and Estate planning tax strategies, ensuring they maximize their savings during tax season. Additionally, understanding how to navigate the intricacies of Mortgage interest deductions and Energy-efficient upgrades credits can lead to substantial reductions in both taxable income and potential Capital gains tax obligations upon home sale. Explore these topics and more to harness the full potential of homeowner tax breaks.

- Leveraging IRA Contributions for Tax Benefits

- Understanding Tax-loss Harvesting for Homeowners

- The Student Loan Interest Deduction Explained

- Estate Planning Tax Strategies for Homeowners

- Navigating Educational Tax Credits for Homeowner Families

- Capital Gains Tax Reduction on Home Sales

- Mortgage Interest Deductions and Energy-Efficient Upgrades Credits

Leveraging IRA Contributions for Tax Benefits

Homeowners exploring ways to leverage their Individual Retirement Account (IRA) contributions for tax benefits should consider the potential advantages of making tax-deductible IRA contributions if they or their spouse are covered by a retirement plan at work. These deductible IRA contributions can reduce taxable income in the year they are made, providing immediate tax relief. Moreover, when it comes time to take distributions from an IRA during retirement years, strategic planning can further minimize tax liabilities. This includes converting traditional IRAs into Roth IRAs under certain conditions, which can transform future growth and withdrawals into tax-free income.

In addition to IRA contributions, homeowners should be aware of other tax strategies that can complement their overall financial plan. For instance, tax-loss harvesting within investment portfolios can offset capital gains taxes realized from the sale of property or investments. Additionally, homeowners with students should take note of the student loan interest deduction, which allows for a partial deduction of the interest paid on qualified student loans. For those considering estate planning, it’s crucial to understand how various tax strategies can be integrated into their overall estate plan to maximize inheritance and minimize estate taxes. Furthermore, educational tax credits can provide significant tax benefits for families investing in higher education, reducing the overall tax burden associated with tuition expenses. These strategies, when implemented as part of a comprehensive financial plan, can offer substantial tax savings, contributing to a more secure and financially sound retirement.

Understanding Tax-loss Harvesting for Homeowners

For homeowners looking to optimize their financial situation, understanding tax-loss harvesting and leveraging it in conjunction with other tax strategies can yield substantial benefits. Tax-loss harvesting involves strategically selling investments at a loss and replacing them with similar assets to offset taxes on investment gains or income. This tactic is particularly advantageous when applied to an Individual Retirement Account (IRA). Contributions to a traditional IRA may offer tax deductions that reduce taxable income, allowing homeowners to save on their current-year taxes while their investments grow tax-deferred until withdrawal in retirement.

Furthermore, beyond the scope of IRAs, homeowners can explore additional tax benefits by considering estate planning tax strategies. These strategies often involve repositioning assets or making lifetime gifts to heirs, which can reduce the size of an estate subject to estate taxes. Moreover, educational tax credits provide another avenue for homeowners with dependents in higher education to mitigate the impact of tuition expenses on their taxable income. Similarly, the student loan interest deduction can alleviate part of the financial burden associated with student loans. By meticulously planning and utilizing these various tax breaks—including capital gains tax reduction through strategic selling of assets—homeowners can significantly decrease their overall tax liability, thereby enhancing their financial well-being and investment portfolio’s performance.

The Student Loan Interest Deduction Explained

Homeowners have access to a multitude of tax breaks designed to offer financial relief and incentivize prudent financial planning. Among these, the Student Loan Interest Deduction stands out as a valuable benefit for those still repaying their student loans. This dedication allows eligible homeowners to deduct up to $2,500 in interest paid on student loans each year from their taxable income. To qualify, the homeowner or their spouse must be legally obligated to repay the loan, and their modified adjusted gross income (MAGI) must be within certain limits. This deduction can provide substantial relief for borrowers, easing the financial burden of higher education.

In addition to the Student Loan Interest Deduction, homeowners can explore other tax-saving strategies aligned with their broader financial goals. IRA contributions, for instance, offer tax benefits by allowing pre-tax dollars to grow tax-deferred until withdrawal, which is particularly advantageous for those in lower tax brackets now but anticipate being in higher brackets later. Similarly, tax-loss harvesting can be an effective strategy for reducing capital gains taxes by offsetting gains with losses incurred from the sale of investments. For those looking to the future, estate planning tax strategies should be considered to minimize the tax burden on one’s estate. This includes leveraging educational tax credits, which can offer a reduction in taxes for homeowners contributing to their or their dependents’ education, and careful consideration of capital gains tax reduction opportunities on property sales. These strategic moves not only provide immediate tax relief but also contribute to long-term financial security and wealth accumulation.

Estate Planning Tax Strategies for Homeowners

For homeowners with an eye on both current and future financial health, estate planning tax strategies are a critical component of wealth management. As individuals age and their circumstances change, leveraging tax-advantaged accounts like IRAs becomes increasingly important for retirement savings. Contributions to these accounts can offer substantial tax benefits, reducing the taxable income during contributing years and allowing assets to grow tax-deferred until withdrawal in retirement. This strategic planning not only secures financial stability post-employment but also minimizes the overall tax burden throughout one’s life.

In addition to maximizing IRA contributions for long-term tax benefits, savvy homeowners also employ estate planning tax strategies that include capital gains tax reduction techniques. By carefully timing the sale of a primary residence or investment properties, homeowners can take advantage of capital losses on other investments through tax-loss harvesting. This approach can significantly lower taxable income, offsetting capital gains and potentially reducing the overall tax liability. Furthermore, incorporating educational tax credits into estate planning can provide financial support for beneficiaries pursuing higher education while also offering tax savings to the estate. These multifaceted strategies underscore the importance of a comprehensive approach to estate planning, ensuring that homeowners not only protect their assets but also optimize their tax position across various financial instruments and life stages.

Navigating Educational Tax Credits for Homeowner Families

Homeowner families have access to a range of educational tax credits that can significantly alleviate the financial burden of higher education. Among these, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) stand out, offering up to $2,500 and $2,000 in annual tax savings respectively for qualified education expenses. These credits are particularly beneficial when combined with other financial aid, such as scholarships and grants, enabling families to invest more effectively in their children’s or their own education.

Additionally, savvy homeowners can leverage IRA contributions to bolster their educational planning tax strategies. By making non-deductible IRA contributions, individuals can potentially reduce their adjusted gross income, which may qualify them for higher education tax credits. Moreover, the strategic use of Tax-loss harvesting within investment portfolios can further minimize taxable income, freeing up funds that might otherwise be allocated to tax liabilities. This approach allows homeowners to maintain a diversified investment strategy while maximizing their educational tax credit eligibility. Meanwhile, those with student loan debt can take advantage of the student loan interest deduction, which permits the deduction of up to $2,500 of student loan interest paid per year, directly reducing their taxable income and, in turn, potentially increasing their eligibility for educational tax credits. Lastly, when it comes to capital gains tax reduction, homeowners can consider gifting appreciated assets to a qualifying education institution or using proceeds from the sale of a primary residence to fund educational expenses, thereby potentially reducing their capital gains tax liability. Integrating these various tax-related benefits and strategies into a comprehensive estate planning approach ensures that homeowner families can effectively navigate the complex landscape of educational tax credits while securing their financial future.

Capital Gains Tax Reduction on Home Sales

Homeowners looking to sell their primary residence may benefit from a favorable provision in the tax code known as the Capital Gains Tax exemption. This exemption allows individuals to exclude up to $250,000 ($500,000 for married couples filing jointly) of capital gains on the sale of their home if certain conditions are met. These conditions include the home being the seller’s primary residence and having lived in it for at least two out of the past five years. This provision is a significant advantage for many homeowners, as it can effectively halve the taxable gain from the sale, providing a substantial savings opportunity.

In addition to this exemption, savvy homeowners may employ various tax strategies to further minimize their tax burden upon selling their property. For instance, by making IRA contributions or engaging in tax-loss harvesting within investment accounts, homeowners can offset capital gains with capital losses, thereby reducing the overall taxable income. Moreover, if a home sale results in a gain that exceeds the exemption limit, understanding and implementing estate planning tax strategies can help manage the tax implications. These strategies often involve bequests or other mechanisms to leverage the step-up-in-basis rule, which can significantly alter the capital gains tax calculation for an inherited property. Additionally, homeowners with dependents may explore educational tax credits as part of their broader tax planning, which can provide immediate relief and potentially influence the taxable income in subsequent years. Each of these tax benefits and strategies plays a crucial role in optimizing the financial outcomes associated with buying, improving, and eventually selling a home.

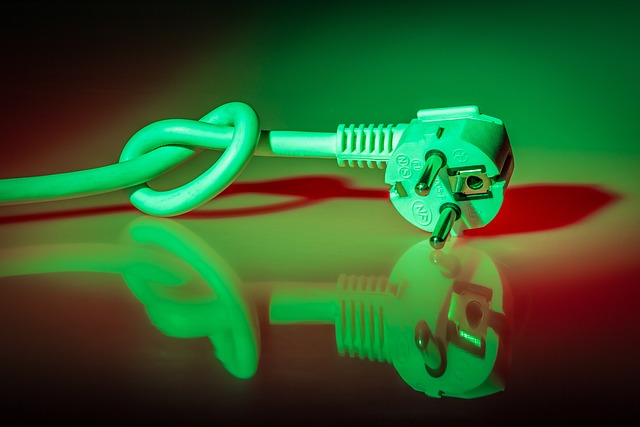

Mortgage Interest Deductions and Energy-Efficient Upgrades Credits

Homeowners have access to a range of tax benefits that can significantly reduce their tax liability. Among these, the mortgage interest deduction stands out as a key financial advantage. This deduction allows homeowners to subtract the interest paid on up to $750,000 ($375,000 if married filing separately) of their home acquisition debt from their taxable income. It’s particularly beneficial for those with significant mortgage debt, as it can lead to substantial savings during tax season. Additionally, the government encourages energy conservation through various credits for energy-efficient upgrades. These improvements may include installing energy-efficient windows, insulation, roofs, and HVAC systems. By claiming these credits, homeowners can receive a tax credit worth a percentage of the cost of these enhancements, which directly reduces their tax liability dollar for dollar. This incentive not only promotes sustainable living but also offers immediate financial benefits.

Furthermore, homeowners can leverage other tax-saving strategies to complement these deductions and credits. For instance, contributions to Individual Retirement Accounts (IRAs) offer tax benefits by potentially reducing taxable income today while allowing investments to grow tax-deferred until retirement. Additionally, tax-loss harvesting can be employed to offset capital gains taxes from the sale of property or stocks. It involves selling investments at a loss and then re-investing in similar assets to mitigate tax liabilities. For those with student loan debt, the interest deduction can lighten the financial burden by reducing the amount of income subject to tax. Moreover, when it comes to estate planning, strategic decisions can minimize estate taxes, ensuring more of your assets pass to your heirs rather than to the government. Lastly, educational tax credits can provide relief for families investing in higher education, offering a reduction in tax liability based on qualified educational expenses, further illustrating the multifaceted tax benefits available to homeowners and savvy investors.

Homeowners have a wealth of tax strategies at their disposal, offering both immediate and long-term financial benefits. From leveraging IRA contributions for tax benefits to capitalizing on estate planning tax strategies, the landscape of homeowner tax advantages is robust. Strategic moves such as tax-loss harvesting can further optimize your financial position, while educational tax credits serve as a boon for families investing in their children’s futures. Additionally, the student loan interest deduction provides targeted relief for borrowers. When it comes time to sell a home, the capital gains tax reduction offers a significant incentive. These opportunities, including mortgage interest deductions and energy-efficient upgrades credits, underscore the importance of understanding and utilizing these homeowner tax breaks effectively to enhance your financial wellbeing.