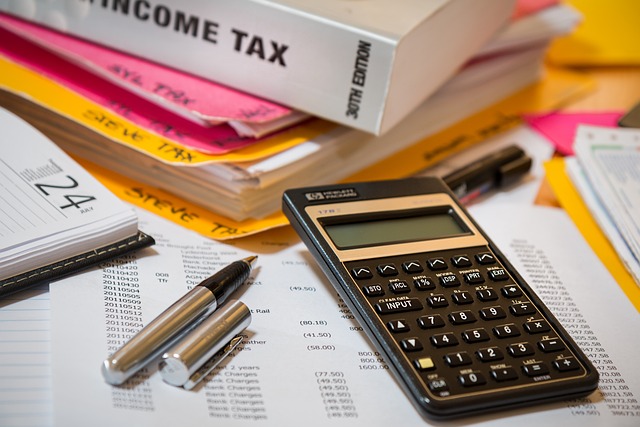

Effective tax planning emerges as a pivotal strategy for individuals and businesses alike to optimize their financial standing. By harnessing tax-saving tips and strategically utilizing tax-advantaged accounts such as IRAs and 401(k)s, one can substantially reduce their taxable income, thereby maximizing income and minimizing burdensome tax liabilities. This article delves into the nuances of tax optimization, offering insights on income tax reduction through tax-efficient investments, particularly beneficial for those approaching retirement. Additionally, it provides tailored tax planning advice for small businesses and high-income earners, ensuring they navigate the complexities of tax laws to their advantage. We’ll also explore wealth management tax strategies for retirement, emphasizing the importance of staying current with tax optimization strategies as laws evolve. Understanding these principles is not just about compliance; it’s a proactive approach to financial empowerment and securing your financial future.

- Mastering Tax-Saving Tips to Lower Your Taxable Income

- Utilizing Tax-Advantaged Accounts for Comprehensive Income Tax Reduction

- Strategic Tax Planning for Small Businesses and High-Income Earners

- Navigating Retirement Tax Planning: Making Every Dollar Count

- Embracing Tax-Efficient Investments to Protect and Grow Future Wealth

- Staying Ahead: Updating Your Tax Optimization Strategies with Changing Laws

Mastering Tax-Saving Tips to Lower Your Taxable Income

Effective tax-saving tips are pivotal for individuals and small businesses aiming to reduce their taxable income and optimize their financial position. A proactive approach to income tax reduction involves careful planning throughout the year, not just during tax season. Utilizing tax-efficient investments is a cornerstone of this strategy. For instance, contributing to IRAs and 401(k)s can provide immediate tax benefits while setting aside funds for retirement. These accounts often offer tax deferrals or deductions, effectively lowering your taxable income. Additionally, high-income earners should explore advanced tax optimization strategies tailored to their unique financial situation. These strategies may include charitable contributions, health savings accounts, and other tax-advantaged vehicles that can reduce tax liabilities.

For those in the retirement phase of life, tax planning becomes even more critical. Retirement tax planning demands a focus on converting traditional IRAs to Roth IRAs if it aligns with your financial goals, as this can provide tax-free income during retirement. Furthermore, selecting tax-efficient investments within retirement accounts can minimize RMDs (required minimum distributions) and their associated tax impacts. Wealth management tax strategies often involve a mix of tax-deferred and tax-exempt instruments to maximize after-tax returns. Staying abreast of changing tax laws is indispensable, as legislation updates can offer new opportunities for tax savings or close loopholes that were previously advantageous. By integrating these considerations into your financial planning, you can effectively navigate the complexities of income tax reduction and position yourself for a more secure financial future.

Utilizing Tax-Advantaged Accounts for Comprehensive Income Tax Reduction

Incorporating tax-advantaged accounts into one’s financial strategy is a pivotal aspect of achieving comprehensive income tax reduction. Contributing to traditional IRAs and 401(k)s allows individuals to defer taxes on the contributions and investment earnings until retirement, effectively reducing current taxable income. This deferral can significantly lessen the tax burden for high-income earners, who often face higher marginal tax rates. Moreover, for those in small businesses, setting up a SEP IRA or a SIMPLE plan can provide substantial tax savings. These plans enable business owners to contribute generously—far more than individual IRAs—reducing both current and future taxes.

Retirement tax planning extends beyond mere deferral; it encompasses the strategic withdrawal of funds as well. By carefully timing withdrawals and converting traditional IRAs to Roth IRAs, individuals can manage their tax exposure throughout retirement. Tax optimization strategies must also consider the types of investments held within these accounts. Tax-efficient investments such as municipal bonds can provide income without the federal (and often state and local) tax burden, further contributing to overall income tax reduction. Wealth management tax strategies require a nuanced approach, taking into account not only current laws but also anticipating future changes in tax legislation to maintain tax efficiency. Staying informed and agile with respect to these accounts is crucial for high-income earners and those approaching retirement to optimize their financial position and ensure they are making the most of their tax planning opportunities.

Strategic Tax Planning for Small Businesses and High-Income Earners

Small businesses and high-income earners can greatly benefit from tailored tax optimization strategies that go beyond mere income tax reduction. Strategic tax planning for small businesses involves a comprehensive approach to manage their finances in a tax-efficient manner. This includes carefully timing the deduction of business expenses, utilizing the full extent of available tax credits, and maximizing the use of Section 179 to expense equipment and assets rather than depreciating them over several years. Small businesses should also consider the benefits of incorporating to potentially take advantage of lower corporate tax rates and to shield personal assets from business liabilities.

For high-income earners, retirement tax planning is a critical component of their overall wealth management tax strategies. These individuals can leverage tax-deferred growth opportunities within Roth IRAs or after-tax dollar contributions to traditional IRAs, which can provide significant tax savings over time. Additionally, they should explore tax-efficient investment vehicles like municipal bonds that are exempt from federal income taxes and, in some cases, state and local taxes as well. High-income earners must stay vigilant about changes in tax laws, particularly those pertaining to high-earner penalties for late IRA rollovers or the phase-out of certain tax benefits. By planning ahead and continuously monitoring their financial situation, both small businesses and high-income earners can implement effective strategies to optimize their taxes, reduce their tax burdens, and secure a more stable financial future.

Navigating Retirement Tax Planning: Making Every Dollar Count

Effective retirement tax planning is a cornerstone for individuals aiming to maximize their wealth and minimize their tax burden. As one approaches retirement, the focus shifts from accumulating wealth to preserving and optimizing it. Tax-efficient investments play a pivotal role in this phase. Contributing to tax-advantaged accounts such as IRAs and 401(k)s, which offer substantial tax savings now and deferred tax benefits in retirement, should be a priority. High-income earners, in particular, can benefit from these strategies, as they often face higher tax rates. By understanding the nuances of each account type—Roth versus traditional IRA, for example—individuals can tailor their contributions to align with their anticipated tax bracket at retirement age.

Moreover, small business owners have unique opportunities for tax optimization through strategic planning. Business structures like S corporations, for instance, can provide a blend of salary and distributions that allows for income splitting among family members, potentially reducing overall taxes. Additionally, maximizing deductions for business expenses and carefully timing the recognition of income can further reduce tax liabilities. Wealth management tax strategies should be an integral part of one’s financial plan, with ongoing education about changing tax laws ensuring that all available deductions and credits are utilized to their fullest extent. This proactive approach not only aids in income tax reduction but also contributes to the long-term preservation of one’s retirement assets, allowing every dollar to work harder for the retiree.

Embracing Tax-Efficient Investments to Protect and Grow Future Wealth

Incorporating tax-efficient investments into one’s portfolio is a prudent approach for individuals and small business owners alike, aiming to protect and grow future wealth while also reducing income tax. Tax-saving tips are integral components of a robust tax optimization strategy, where the focus is on leveraging instruments that offer both tax deferral and tax exemption benefits. For instance, contributions to traditional IRAs and 401(k) plans for those under 72 years of age allow for pre-tax dollars to be invested, which can result in substantial income tax reduction at retirement age when these funds are withdrawn. Similarly, Roth IRAs and Roth 401(k)s offer after-tax contributions that grow tax-free, proving particularly advantageous for high-income earners who anticipate being in a higher tax bracket during retirement.

Retirement tax planning extends beyond the accumulation phase; it also encompasses the distribution phase where careful selection of investment vehicles can minimize tax liabilities. Tax-efficient investments such as municipal bonds may be appealing due to their tax-exempt income, which is exempt from federal income taxes and, in many cases, state and local taxes as well. Additionally, strategic asset allocation, including a mix of taxable and tax-advantaged accounts, can further enhance tax efficiency and align with wealth management tax strategies. Staying abreast of the latest tax laws and utilizing the most favorable account types is crucial for maximizing retirement savings and ensuring that hard-earned wealth is safeguarded against unnecessary tax burdens throughout one’s life. By adopting these tax optimization strategies, individuals can not only reduce their current income tax but also ensure a more secure financial future.

Staying Ahead: Updating Your Tax Optimization Strategies with Changing Laws

As tax laws are subject to frequent changes and updates, maintaining a robust tax optimization strategy is crucial for individuals and small businesses alike. Staying ahead in tax-saving requires continuous education and proactive planning. For high-income earners, it’s particularly important to adapt their tax strategies to maximize income tax reduction while minimizing exposure to unnecessary tax burdens. This includes a keen understanding of tax-efficient investments that can offer both immediate tax benefits and long-term wealth growth. By leveraging tax-advantaged accounts such as IRAs and 401(k)s, individuals can effectively manage their retirement tax planning, ensuring they reap the full advantages of these financial tools. Wealth management tax strategies should be dynamic, taking into account the latest legislative changes that could affect one’s fiscal position. By staying informed about these alterations, taxpayers can better navigate the complexities of the tax code and take advantage of every deduction and credit available to them, thereby optimizing their overall financial health. Small business tax planning is equally as nuanced, with owners needing to consider a wide array of factors from depreciation methods to the timing of income and expenses. By adopting a proactive approach and aligning oneself with knowledgeable tax professionals, one can ensure that their tax-saving tips are current, effective, and tailored to their specific financial situation. This diligence not only prepares for the present but also safeguards against potential fiscal challenges in the future.

Effective tax planning is a cornerstone strategy for individuals and businesses alike to optimize their financial position. By implementing tailored tax-saving tips and strategically utilizing tax-advantaged accounts such as IRAs and 401(k)s, one can significantly reduce their tax burdens, thereby maximizing income. This comprehensive approach also extends to small business tax planning and wealth management tax strategies for high-income earners, ensuring that each opportunity for an income tax reduction is seized. As retirement approaches, transitioning to tax-efficient investments becomes paramount, not only to safeguard accumulated wealth but also to reap the immediate benefits of a lower tax burden. In light of the ever-evolving tax landscape, it is crucial to stay informed about new laws and adjust one’s tax optimization strategies accordingly. By doing so, individuals can ensure they are making the most of every available deduction and credit, thereby enhancing their financial security and well-being in the long term.