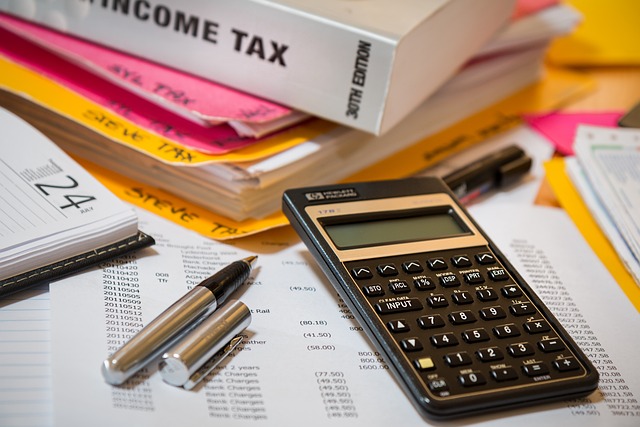

E-filing taxes has revolutionized the way individuals and self-employed taxpayers handle their annual tax obligations. With the advent of user-friendly online platforms, managing income tax e-filing has become a streamlined process. These platforms offer a suite of services, including easy tax filing options, comprehensive online tax forms guidance, and precise tax refund tracking tools. The integration of secure online tax filing systems ensures that taxpayers can confidently manage their financial responsibilities while accessing free online tax filing services tailored to diverse financial situations. This article delves into the benefits of these advanced e-filing solutions, providing valuable insights on how to optimize your tax experience and stay compliant with deadlines. Whether you’re an individual or a self-employed entrepreneur, understanding tax filing assistance and utilizing online tax calculators can significantly ease the burden of tax season.

- Leveraging Income Tax E-filing for Streamlined Tax Management

- The Advantages of Easy Tax Filing Online for Individuals and Self-Employed Taxpayers

- Navigating Online Tax Forms: A Step-by-Step Guide to Efficient Filing

- Utilizing Online Tax Calculators to Estimate Liabilities and Anticipate Tax Refunds

- Accessibility of Free Online Tax Filing Services for Diverse Financial Situations

- Staying Compliant with Tax Filing Deadlines Through Digital Tools and Reminders

- Ensuring Secure Online Tax Filing: Protecting Your Information During the E-filing Process

Leveraging Income Tax E-filing for Streamlined Tax Management

Income tax e-filing has revolutionized the way self-employed individuals and taxpayers in general manage their annual tax obligations. By utilizing easy tax filing platforms, filers can access a suite of online tools designed to streamline the entire process. These platforms offer a convenient interface where taxpayers can fill out online tax forms with precision and efficiency. The platforms are equipped with intuitive design and user-friendly features that guide users through each step, from data entry to final submission. This not only saves time but also reduces the likelihood of errors that might arise from manual paper filings. Additionally, these services often include secure online tax filing options, ensuring that sensitive financial information is protected throughout the process.

Furthermore, leveraging e-filing for income tax allows for real-time tax refund tracking and access to tax filing assistance. Taxpayers can easily monitor the status of their returns and receive guidance when needed, which is particularly beneficial for those navigating complex self-employed tax filing requirements. The availability of comprehensive online resources means that individuals are well-equipped to understand their tax situation better, including identifying potential deductions and maximizing their refunds. With the advent of free online tax filing services, the barriers to effective tax management are significantly lowered, making it accessible for a broader range of taxpayers. The convenience, security, and assistance provided by these e-filing solutions make them an indispensable tool for anyone looking to simplify their income tax e-filing experience.

The Advantages of Easy Tax Filing Online for Individuals and Self-Employed Taxpayers

Income tax e-filing has revolutionized the way individuals and self-employed taxpayers manage their annual tax obligations. Easy tax filing online streamlines the process, offering a user-friendly interface that simplifies the complex task of preparing and submitting tax returns. The convenience factor is paramount, as taxpayers can access online tax forms at any time, eliminating the need to physically visit tax offices or sift through piles of paperwork. This digital transition not only saves time but also reduces the likelihood of errors that often occur with manual entry. For those who are self-employed, tracking income and expenses is made easier with e-filing platforms that categorize transactions and automatically calculate deductions. These platforms often feature online tax calculators to assist in estimating liabilities and potential refunds, ensuring taxpayers have a clear understanding of their financial obligations before the final submission.

Furthermore, secure online tax filing provides an additional layer of protection for sensitive personal and financial information. With encryption and secure data transmission protocols, e-filing ensures that tax returns reach the relevant tax authorities safely and confidentially. Tax refund tracking is also made more efficient through these platforms, allowing individuals to monitor the status of their returns in real-time. The availability of free online tax filing services further democratizes access to tax filing assistance, making it possible for taxpayers of all financial backgrounds to optimize their tax experience. By leveraging e-filing solutions, self-employed taxpayers, in particular, can focus on their business operations, confident that their tax compliance is handled efficiently and accurately.

Navigating Online Tax Forms: A Step-by-Step Guide to Efficient Filing

Embarking on the process of income tax e-filing can be a straightforward and efficient endeavor when armed with the right guidance. The initial step involves gathering all necessary documentation, such as W-2s, 1099 forms, and records of any deductions or credits you’re eligible for. Once your information is organized, you can select an online tax filing platform that caters to your specific needs. These platforms are designed with user-friendliness in mind, guiding you through the process of completing easy tax filing forms with step-by-step instructions. As you navigate through the online tax forms, the platform will prompt you for information, calculate your taxes, and estimate your potential tax refund or liability.

For the self-employed, finding the right tax filing assistance is crucial, as this group often faces a more complex return due to business income and expenses. The selected e-filing service should ideally offer comprehensive support for self-employed individuals, including scheduling C corps taxes if necessary. Online tax forms for the self-employed can be intricate, but with the aid of these platforms, you can effortlessly input your revenue, deduct business-related expenses, and ensure that your self-employment tax filing is accurate and compliant with tax laws. Additionally, secure online tax filing ensures that sensitive financial data remains protected throughout the process. After submitting your return, you can utilize the tax refund tracking feature provided by many e-filing services to monitor the status of your refund, adding another layer of convenience to the tax filing experience. With these tools and resources at your disposal, e-filing your taxes becomes a manageable and secure task, making it an increasingly popular choice for taxpayers nationwide.

Utilizing Online Tax Calculators to Estimate Liabilities and Anticipate Tax Refunds

Online tax calculators are integral tools within income tax e-filing systems, providing easy tax filing solutions for individuals and self-employed tax filers alike. These sophisticated instruments enable users to input their financial data accurately, which in turn generates precise estimates of their liabilities and potential tax refunds. By leveraging these calculators, taxpayers can anticipate the outcomes of their tax returns before final submission, ensuring they are fully prepared for any financial obligations or pleasantly surprised by refunds due. This proactive approach to self-assessment helps individuals plan their finances more effectively and make informed decisions regarding their tax filing assistance needs.

Furthermore, the use of online tax calculators as part of the e-filing process offers a secure online tax filing environment. Taxpayers can rest assured that their sensitive financial information is protected with state-of-the-art security measures, which safeguard against unauthorized access and data breaches. The convenience of these calculators extends beyond mere estimation; they also streamline the entire tax filing process by integrating seamlessly with online tax forms. Tax refund tracking becomes a straightforward affair, as individuals can monitor the status of their returns in real-time. This level of transparency and ease is a testament to the advancements made in digital tax solutions, making the traditionally complex task of tax filing more manageable for everyone involved.

Accessibility of Free Online Tax Filing Services for Diverse Financial Situations

The advent of income tax e-filing has democratized tax preparation, making it accessible for individuals across diverse financial situations. Free online tax filing services have emerged as a boon for taxpayers, offering easy tax filing solutions that cater to everyone from wage earners to the self-employed. These platforms provide a user-friendly interface where taxpayers can navigate through online tax forms with ease, ensuring that their income tax returns are prepared accurately and efficiently. The services often include a range of tools such as tax refund tracking and secure online tax filing, which allow users to monitor their refund status and submit their taxes without compromising on security. This accessibility is particularly beneficial for those who might not have the means to afford expensive tax preparation software or the time to sift through complex paper-based forms. Moreover, with tax filing assistance readily available online, individuals can receive step-by-step guidance throughout the process, addressing any questions or concerns they may have. This ensures that no matter one’s financial complexity, from simple returns to more intricate self-employed tax filing, the process of fulfilling one’s tax obligations becomes a streamlined and manageable task. The convenience and accessibility of these services are not just limited to their affordability but also extend to their availability year-round, providing taxpayers with the opportunity to prepare and file their taxes at their own pace.

Staying Compliant with Tax Filing Deadlines Through Digital Tools and Reminders

In the digital era, income tax e-filing has streamlined the process for individuals and self-employed taxpayers alike, ensuring compliance with tax filing deadlines is more manageable than ever. Digital tools integrated into online tax filing platforms offer a range of functionalities, including setting up reminders for upcoming deadlines and providing a dashboard that tracks the progress of your tax submission. These platforms are designed to make tax filing easy by offering intuitive online tax forms that guide users through each step, from data entry to the final submission. For those who have complex financial situations or are self-employed, these tools are particularly valuable as they can handle more intricate tax scenarios with precision and accuracy. The convenience of being able to e-file taxes from any location at any time, coupled with the ability to track your tax refund if you’re due one, makes the process transparent and user-friendly. Moreover, the platforms employ robust security measures to ensure that sensitive financial data remains protected throughout the entire online tax filing process. With continuous updates and support provided by these services, taxpayers can navigate their obligations with confidence, knowing they are in compliance with all relevant tax laws and regulations. The integration of secure online tax filing solutions with tax filing assistance means that even those who may struggle with the traditional tax filing methods have access to a simplified, efficient process tailored to their individual needs.

Ensuring Secure Online Tax Filing: Protecting Your Information During the E-filing Process

In an era where digital transformation has reshaped countless processes, income tax e-filing stands out as a testament to efficiency and convenience in managing financial obligations. The e-filing process for income tax is designed to be easy tax filing for individuals and self-employed tax filers alike, streamlining the submission of online tax forms with just a few clicks. This transition to digital has democratized access to tax refund tracking, allowing taxpayers to monitor their returns with transparency and accuracy. Central to this shift is the commitment to secure online tax filing; robust cybersecurity measures are implemented to safeguard sensitive financial data throughout the e-filing process. Taxpayers can rest assured that their personal and fiscal information is protected by state-of-the-art encryption and secure servers, which act as a digital fortress around their tax data. The platforms offering these services prioritize user authentication, two-factor authentications, and other security protocols to prevent unauthorized access and ensure the integrity of the self-employed tax filing process. Furthermore, these online tax filing platforms provide comprehensive tax filing assistance, including step-by-step guidance and customer support to navigate complex tax codes confidently. With such stringent security measures and accessible support systems in place, e-filing income tax is not only a convenient option but also a secure one, providing peace of mind for taxpayers as they fulfill their tax obligations online.

In conclusion, the shift towards income tax e-filing has revolutionized how individuals and self-employed taxpayers manage their annual tax obligations. With its ease of use and efficiency, e-filing stands out as a preferred method for filing taxes, offering a user-friendly platform that simplifies the complexities of tax forms and calculations. The article has highlighted the comprehensive services available through online tax filing platforms, from easy tax filing to tax refund tracking, ensuring that taxpayers can navigate their financial responsibilities with confidence and precision. By leveraging secure online tax filing solutions and staying informed on compliance deadlines, taxpayers can optimize their tax experience, maximizing savings and minimizing the risk of errors. As we continue to embrace digital innovation in tax filing, it is clear that e-filing not only streamlines the process but also provides a robust and secure means for fulfilling our tax obligations. With the accessibility of free online tax filing services for diverse financial situations, there’s no question that e-filing is the future of tax management. Taxpayers are encouraged to take advantage of these resources to ensure their income tax submissions are timely, accurate, and secure.