Self-employment offers a realm of autonomy and opportunity, yet it brings its own set of financial challenges, particularly when tax season rolls around. Navigating the intricate world of self-employed taxes requires a keen eye for detail and an understanding of the deductions and credits at your disposal. This article serves as a guide to help you capitalize on tax exemption eligibility, strategically manage IRS penalties and interest, and optimize your filing status. From maximizing home office deductions to understanding the nuances of health insurance premiums, and exploring tax-efficient investments like SEP IRAs, each section is crafted to ensure you leverage every advantage in the ever-shifting tax code landscape. Additionally, for those who operate nonprofit entities, we’ll delve into simplifying your tax filing process. By staying abreast of tax code changes, self-employed individuals can maintain compliance and maximize their financial well-being year after year.

- Navigating Self-Employment Tax Exemption Eligibility: Understanding Who Qualifies and How to Claim

- IRS Penalties and Interest: Deadlines and Strategies for Compliance-Minded Entrepreneurs

- Home Office Deductions: Maximizing Your Workspace's Tax Benefits

- Health Insurance Premiums: A Financial Lifeline for the Self-Employed

- Nonprofit Tax Filing: Streamlining Your Filings as a Charitable Entity

- Tax-Efficient Investments: Leveraging Retirement Accounts with SEP IRAs and Beyond

- Staying Current with Tax Code Changes: Adapting to the Evolving Tax Landscape for Self-Employment

Navigating Self-Employment Tax Exemption Eligibility: Understanding Who Qualifies and How to Claim

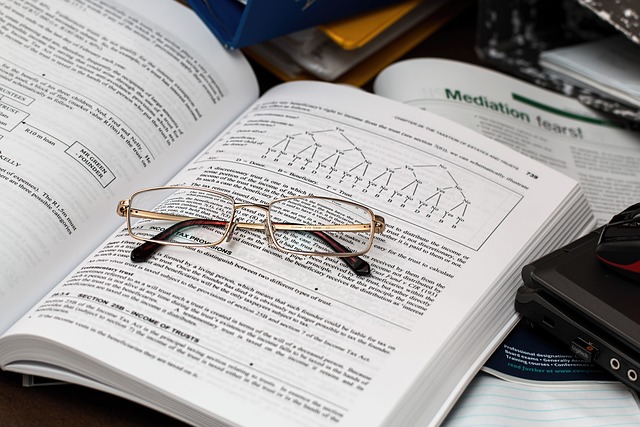

Self-employment offers a unique position for individuals to manage their finances and optimize tax outcomes. A key aspect of this is understanding tax exemption eligibility as outlined by the IRS. Not all self-employed individuals qualify for tax exemptions; eligibility hinges on specific criteria set forth in the tax code. For instance, certain expenses related to running a business, such as home office deductions and health insurance premiums, may be claimed as long as they are ordinary and necessary expenses that fall within the scope of your self-employed activity. To claim these deductions accurately and avoid IRS penalties and interest, it is imperative to maintain meticulous records and stay updated on tax code changes. Self-employed individuals should also be mindful of their filing status, as optimizing this can lead to further tax savings. Exploring tax-efficient investments, like a Simplified Employee Pension (SEP) IRA, is another strategy that can provide significant benefits, particularly for those who qualify for the self-employment tax exemption. Regular financial planning tailored to tax considerations ensures that self-employed individuals not only comply with the IRS regulations but also capitalize on the tax advantages available to them, which can be particularly advantageous when compared to the standard tax filing requirements of nonprofit organizations. By proactively engaging with these financial planning practices and staying abreast of the evolving tax landscape, self-employed individuals can navigate their tax obligations with greater confidence and potentially reduce their overall tax liability.

IRS Penalties and Interest: Deadlines and Strategies for Compliance-Minded Entrepreneurs

Self-employed individuals must navigate the complexities of tax filing with particular attention to deadlines and strategic planning to avoid incurring IRS penalties and interest. The Internal Revenue Service (IRS) imposes strict timelines for filing taxes, and failure to adhere to these can result in costly charges. To mitigate such penalties, it’s imperative for entrepreneurs to be well-versed in the tax exemption eligibility criteria and to keep abreast of any changes in the tax code. Understanding which deductions and credits apply to their situation, such as home office expenses and health insurance premiums, is crucial for reducing taxable income. Moreover, staying informed about nonprofit tax filing requirements, if applicable, ensures compliance.

For those looking to enhance their financial standing, exploring tax-efficient investments can offer a dual benefit of wealth accumulation and tax optimization. Contributing to a Simplified Employee Pension (SEP) IRA is one such strategy that can provide significant benefits for self-employed individuals. Additionally, optimizing one’s filing status to align with the most advantageous option can further minimize tax liabilities. By proactively engaging with a tax professional and staying informed about the latest updates in tax laws, self-employed entrepreneurs can strategically plan their financial activities throughout the year, thereby ensuring compliance and making the most of available tax advantages. This diligence not only helps in evading IRS penalties and interest but also sets a foundation for long-term financial stability and success.

Home Office Deductions: Maximizing Your Workspace's Tax Benefits

Self-employed individuals can leverage home office deductions to significantly reduce their taxable income, provided they adhere to specific guidelines set forth by the IRS. To be eligible for this tax exemption, it’s imperative that the designated workspace is used regularly and exclusively for business purposes. This includes a portion of the space being used consistently for conducting business, which can include a room or even an area within a room. The deduction is based on the square footage of the home office relative to the total area of the home, allowing for a proportionate deduction that covers direct expenses such as painting or renovations specific to the office, as well as indirect expenses like mortgage interest, utilities, and home insurance. Keeping meticulous records and understanding the latest tax code changes is essential to ensure that these deductions are claimed correctly. Missteps here could lead to IRS penalties and interest, which can be costly and time-consuming to resolve.

For those who operate their business as a nonprofit organization or are considering this status, the tax filing process becomes more complex but can be very rewarding with proper planning. Nonprofits are exempt from certain taxes but must adhere to strict reporting requirements. It’s crucial for these entities to maintain transparency in all financial dealings and to file timely and accurate returns to avoid potential penalties. Additionally, self-employed individuals should explore tax-efficient investments, such as contributing to a Simplified Employee Pension (SEP) IRA, which can provide significant benefits at retirement. Furthermore, optimizing one’s filing status can also yield additional savings. For instance, being married and filing jointly rather than separately can often result in a lower overall tax liability. Regular financial planning with a focus on taxes ensures that self-employed individuals remain compliant while taking full advantage of the myriad tax benefits available to them. This proactive approach not only minimizes tax exposure but also contributes to long-term financial health and stability.

Health Insurance Premiums: A Financial Lifeline for the Self-Employed

Self-employment offers a level of freedom and autonomy that many entrepreneurs cherish; however, it also comes with the responsibility of managing one’s own health insurance premiums. For the self-employed, these premiums are not just a necessity for maintaining good health but also serve as a critical tax-efficient investment. The IRS recognizes the importance of healthcare coverage for individuals running their own businesses and provides a deduction for the cost of health insurance premiums on one’s federal income tax return. This deduction can significantly reduce the financial burden, acting as a safety net for those without employer-provided coverage. It’s imperative to stay abreast of the eligibility criteria and changes in the tax code, as these deductions are subject to specific guidelines and may evolve with each tax year. Understanding how these health insurance deductions fit into one’s overall financial plan is essential for self-employed individuals, especially when considering the potential IRS penalties and interest for late or incorrect filings.

Navigating the complexities of the U.S. tax system can be daunting for the self-employed, but with careful planning and a keen eye on the ever-changing tax laws, significant tax savings can be achieved. Nonprofit tax filing entities can provide guidance and assistance to those who qualify, ensuring compliance while optimizing filing statuses. In addition to health insurance deductions, exploring tax-efficient investments such as a Simplified Employee Pension (SEP) IRA can offer additional financial benefits. By contributing to a SEP IRA, self-employed individuals can set aside a substantial amount of income for retirement, which not only reduces current taxable income but also secures future financial well-being. Regular financial planning, taking into account one’s unique situation and the latest tax code changes, is key to leveraging these deductions and credits effectively and avoiding costly IRS penalties and interest.

Nonprofit Tax Filing: Streamlining Your Filings as a Charitable Entity

Nonprofit organizations, as they navigate their tax obligations, must adhere to specific guidelines and filing requirements under the IRS’ nonprofit Tax Exemption Eligibility rules. To maintain their tax-exempt status, these entities are required to file annual returns, typically using Form 990 series. A key aspect for nonprofits is understanding which category they fall under within the IRS’ classifications, as this determines the form they must submit. For instance, charitable organizations that are exempt from federal income tax under Section 501(c)(3) of the Tax Code must file Form 990 or Form 990-EZ to provide detailed financial information to the IRS and the public. It is imperative for these organizations to stay abreast of Tax Code Changes, as updates can affect their reporting obligations and potentially alter their eligibility for tax exemption.

In addition to adhering to the correct filing status, nonprofits must also be vigilant about deadlines to avoid IRS Penalties and Interest. Late filings can result in costly penalties and interest charges, which can strain an organization’s budget and divert funds from their mission-critical activities. To mitigate these risks, nonprofits should implement a systematic approach to their tax filing process. This includes designating a knowledgeable individual or team responsible for monitoring Tax Code Changes, preparing accurate filings, and ensuring timely submissions. Moreover, nonprofits can engage in tax-efficient investments by strategically managing their endowments and reserves, aligning their financial decisions with their long-term goals while optimizing their tax position. By staying informed and proactive, charitable entities can not only fulfill their legal obligations but also ensure they are utilizing Tax Exemption Eligibility to its fullest extent, thereby maximizing the impact of their resources for their intended purpose.

Tax-Efficient Investments: Leveraging Retirement Accounts with SEP IRAs and Beyond

Self-employed individuals have a unique set of financial planning considerations, particularly when it comes to tax-efficient investments. One of the most advantageous tools for building retirement savings while enjoying potential tax exemption eligibility is the SEP IRA. A SEP IRA allows for high contribution limits, making it an attractive option for those with self-employment income. By contributing pre-tax income into a SEP IRA, these entrepreneurs can significantly reduce their taxable income, which is especially beneficial during years of higher earnings. It’s imperative to stay informed about the changes in the tax code, as these can affect eligibility and contribution limits.

In addition to SEP IRAs, exploring a range of tax-efficient investments beyond retirement accounts can further optimize one’s financial strategy. For instance, understanding how different assets perform under varying market conditions can help self-employed individuals diversify their portfolios in ways that minimize taxes. Regularly consulting the IRS guidelines is crucial to ensure compliance and to avoid costly IRS penalties and interest that can arise from errors or oversights. Nonprofit tax filing entities, for example, must adhere to specific rules regarding their investments and endowments to maintain their tax-exempt status. Self-employed individuals can take cues from these organizations’ strategies when planning their own investment portfolios. Filing status optimization is another key factor; the correct filing status can unlock additional deductions and credits, further reducing one’s overall tax liability. With careful planning and a keen eye on IRS guidelines, self-employed individuals can leverage tax-efficient investments to secure their financial future while maximizing the benefits of their self-employment status.

Staying Current with Tax Code Changes: Adapting to the Evolving Tax Landscape for Self-Employment

Self-employed individuals must remain vigilant as tax code changes frequently alter the landscape for optimization and compliance. Staying current with tax code changes is not just a matter of keeping abreast of the latest Tax Exemption Eligibility rules but also understanding how these updates impact your Filing Status Optimization and overall financial strategy. The IRS regularly updates its guidelines, and failing to adapt can result in costly IRS Penalties and Interest. For instance, recent amendments may have introduced new Nonprofit Tax Filing requirements or altered the criteria for Tax-efficient Investments. By actively monitoring these changes and adjusting your tax planning accordingly, you can ensure that your self-employment activities align with the evolving tax landscape. This proactive approach not only mitigates the risk of incurring penalties but also maximizes the opportunities to leverage tax deductions and credits effectively. The dynamic nature of tax laws means that what was optimal last year may no longer be so this year, emphasizing the importance of continuous education and strategic planning for self-employed individuals. Regularly consulting with a tax professional who is well-versed in the nuances of the tax code can provide invaluable guidance to navigate these changes successfully.

Self-employment presents a dynamic tax environment where challenges coexist with lucrative opportunities for deductions and credits. As highlighted in this article, mastering the intricacies of tax exemption eligibility, staying vigilant about IRS penalties and interest, and utilizing home office deductions are pivotal for self-employed individuals to optimize their filing status and minimize tax liabilities. Moreover, strategic planning, such as integrating nonprofit tax filing if applicable or investing in tax-efficient vehicles like SEP IRAs, can yield substantial benefits. With the tax landscape constantly evolving due to code changes, proactive financial planning is indispensable for self-employed entrepreneurs aiming to remain compliant and capitalize on the ever-shifting advantages available within the tax code.