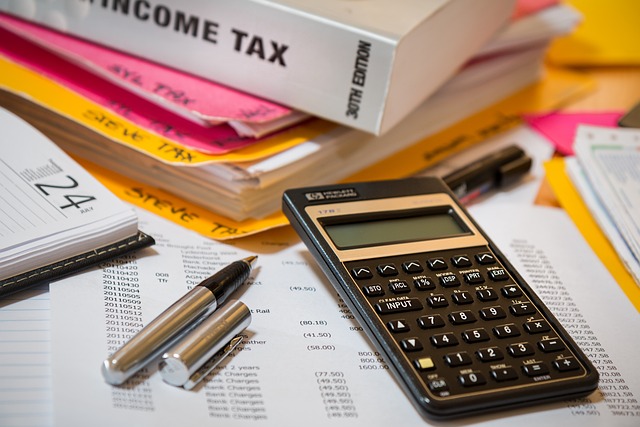

Self-employment offers the freedom to chart your own course, yet it brings a unique set of financial considerations, particularly when tax season rolls around. The intricacies of tax laws can be daunting for those who work for themselves, but they also present opportunities to significantly reduce tax liabilities through strategic planning and savvy utilization of deductions and credits. This article delves into the essentials of tax management for self-employed individuals, highlighting strategies like maximizing Tax Exemption Eligibility, staying vigilant about IRS Penalties and Interest, and mastering Nonprofit Tax Filing procedures. It also guides you through Leveraging Tax-efficient Investments to optimize your income and outlines the importance of adapting to Tax Code Changes for Filing Status Optimization. With each section crafted to empower you with the knowledge to navigate these waters confidently, this article is an indispensable resource for self-employed entrepreneurs looking to thrive financially.

- Maximizing Tax Exemption Eligibility for Self-Employed Individuals

- Navigating IRS Penalties and Interest: Key Deadlines for Tax Compliance

- Streamlining Nonprofit Tax Filing: A Guide for Self-Employed Entities

- Leveraging Tax-Efficient Investments to Optimize Self-Employment Income

- Strategic Tax Planning: Adapting to Tax Code Changes and Choosing Optimal Filing Status

Maximizing Tax Exemption Eligibility for Self-Employed Individuals

Self-employed individuals have a unique set of opportunities to maximize their Tax Exemption Eligibility through strategic planning and a thorough understanding of the tax code. To begin with, staying abreast of IRS Penalties and Interest that accrue due to late or incorrect filings is crucial for maintaining financial health. The IRS imposes penalties and interest on unpaid taxes, which can be substantial, so it is imperative to file accurately and on time. By understanding the nuances of the tax code, particularly regarding nonprofit tax filing, self-employed individuals can leverage tax-efficient investments that not only support charitable causes but also provide financial benefits. These nonprofit contributions can serve as deductions against taxable income, thereby reducing the overall tax burden.

Moreover, exploring the latest Tax Code Changes is essential for identifying new opportunities for tax exemptions. The tax code is subject to frequent updates and revisions, which may introduce or alter provisions that can benefit the self-employed. For instance, adjustments to the rules surrounding home office deductions or changes in the eligibility criteria for various credits can lead to significant savings. Additionally, optimizing one’s filing status can have a material impact on tax liabilities. Self-employed individuals should carefully consider their marital status, dependents, and other relevant factors to ensure they are utilizing the most advantageous filing status to maximize Tax Exemption Eligibility. By combining this with careful planning for retirement through vehicles like a Simplified Employee Pension (SEP) IRA, self-employed individuals can not only prepare for the future but also optimize their current tax situation, ensuring they take full advantage of all available tax exemptions and credits.

Navigating IRS Penalties and Interest: Key Deadlines for Tax Compliance

Self-employment necessitates a keen understanding of tax laws and deadlines to avoid incurring IRS penalties and interest, which can be burdensome. For instance, recognizing the specific deadlines for quarterly estimated tax payments is pivotal for self-employed individuals to ensure timely remittance of taxes. Failing to adhere to these deadlines may result in the accumulation of penalties and interest, which can erode profits and disrupt financial planning. To mitigate such issues, it’s essential to stay abreast of the latest tax code changes, as they often introduce new opportunities for tax exemption eligibility or alter existing rules. This proactive approach enables self-employed individuals to optimize their filing status and leverage tax-efficient investments, such as a Simplified Employee Pension (SEP) IRA, which can offer substantial benefits for retirement savings. By aligning with the tax year’s end, these individuals can also take advantage of nonprofit tax filing incentives, should they contribute to or support such organizations. Understanding and applying these strategies not only helps in navigating the complexities of self-employment taxes but also ensures compliance and maximizes financial benefits throughout the year.

Streamlining Nonprofit Tax Filing: A Guide for Self-Employed Entities

Self-employed entities operating as nonprofits face a specific set of tax challenges that require careful navigation to maintain their tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Understanding eligibility for Tax Exemption Eligibility is paramount, as it allows these organizations to avoid IRS Penalties and Interest that could otherwise accumulate from unpaid taxes. The journey towards maintaining tax-exempt status involves a thorough grasp of Nonprofit Tax Filing requirements, particularly the Form 990 series, which serves as an annual information return for tax-exempt entities.

Staying abreast of Tax Code Changes is essential, as these can impact filing procedures and eligibility criteria. Self-employed nonprofits must also consider Filing Status Optimization to ensure that their operations align with the latest IRS guidelines. This includes meticulously documenting all activities and expenditures, particularly those related to tax-efficient investments, such as charitable contributions and grants received. By leveraging these deductions effectively, nonprofits can minimize their taxable income and focus resources on their mission-driven objectives. Additionally, exploring opportunities for Tax-efficient Investments not only aids in financial sustainability but also demonstrates accountability and transparency to donors and stakeholders. Regularly consulting with a tax professional or utilizing IRS resources can help self-employed nonprofits navigate the complexities of their fiscal responsibilities and take full advantage of available deductions, ensuring compliance and strategic financial planning.

Leveraging Tax-Efficient Investments to Optimize Self-Employment Income

Self-employed individuals have a unique opportunity to optimize their income through strategic investment in tax-efficient vehicles. By exploring the landscape of tax-exempt investments, self-employed entities can significantly reduce their taxable income, thereby lessening their overall tax burden. For instance, certain retirement accounts like Roth IRAs or Roth 401(k)s offer tax exemption eligibility on contributions and earnings, provided specific conditions are met. This not only provides a financial cushion for the future but also aligns with one’s retirement planning while leveraging the benefits of the tax code.

It is imperative for self-employed individuals to stay abreast of IRS penalties and interest that can accumulate from noncompliance. The tax code is subject to changes, which may alter eligibility criteria or the favorability of certain deductions and credits. Therefore, it’s essential to be vigilant about these adjustments and how they impact your financial strategy. Nonprofit tax filing entities, for example, must adhere to distinct rules and reporting requirements, which differ from those of self-employed individuals. By understanding the nuances of the tax code and how it affects your specific situation, you can optimize your filing status, ensuring that you are positioned to take full advantage of available tax benefits while avoiding the pitfalls of IRS penalties and interest. Regular financial planning with a focus on taxes is not just a compliance measure but a strategic move to secure your financial well-being as a self-employed individual.

Strategic Tax Planning: Adapting to Tax Code Changes and Choosing Optimal Filing Status

Self-employment necessitates a proactive approach to tax planning, particularly in light of frequent changes to the tax code. Staying abreast of Tax Code Changes is pivotal for self-employed individuals to adapt their strategies effectively. Strategic Tax Planning involves not only leveraging current tax exemption eligibility, such as deductions for home office expenses and health insurance premiums, but also anticipating future adjustments. By doing so, one can ensure that their financial decisions remain aligned with evolving tax laws, potentially reducing taxable income and optimizing tax liabilities.

To further enhance their fiscal position, self-employed individuals should explore Tax-efficient Investments as part of their retirement planning. A prime example is contributing to a Simplified Employee Pension (SEP) IRA, which can offer substantial benefits upon retirement. Additionally, choosing the optimal Filing Status Optimization can yield additional advantages. The filing status not only affects tax calculations but also determines eligibility for certain credits and deductions. For those operating as nonprofit organizations, Nonprofit Tax Filing comes with its own set of considerations, including adherence to specific tax-exempt requirements set forth by the IRS. Thus, a thorough understanding of one’s unique situation is essential to navigate these complexities and evade IRS Penalties and Interest that may arise from noncompliance or oversights. Regular financial planning for taxes, with a keen eye on both current rules and anticipated changes, ensures self-employed individuals can maximize their tax advantages while maintaining compliance.

Self-employed individuals stand at a financial crossroads, where the intricacies of tax law both present challenges and offer opportunities for fiscal optimization. By mastering tax exemption eligibility and understanding IRS penalties and interest associated with timely filings, self-employed entrepreneurs can sidestep potential pitfalls and capitalize on deductions such as home office expenses and health insurance premiums. Guidance on navigating nonprofit tax filing and leveraging tax-efficient investments further equips these individuals to optimize their income streams. As the tax code evolves, strategic planning becomes indispensable for adapting to changes and selecting an optimal filing status. In essence, a proactive and informed approach to financial planning ensures that self-employed individuals can not only remain compliant but also harness the full spectrum of available tax benefits, positioning them for sustained success in their business ventures.