Small business owners have a unique opportunity to significantly impact their financial health through strategic tax planning. By leveraging tax-saving tips and focusing on income tax reduction, businesses can not only reduce taxable income but also bolster cash flow. This article delves into the intricacies of tax-efficient investments, offering actionable advice for entrepreneurs looking to optimize their fiscal position. We’ll explore how timing income and expenses plays a pivotal role in managing tax liabilities, and why regular consultations with a tax advisor are indispensable for uncovering hidden savings and ensuring compliance. Additionally, we will address tailored tax strategies for high-income earners, emphasizing retirement planning and wealth management tax considerations. With the right approach to small business tax planning, businesses can achieve substantial annual savings and secure their financial future.

- Maximizing Tax Savings for Small Businesses: Strategic Deductions and Smart Investments

- Leveraging Tax-Deferred Accounts to Enhance Annual Savings for Entrepreneurs

- Mastering Income and Expense Timing to Optimize Your Small Business's Tax Liabilities

- The Role of Regular Consultations with Tax Advisors in Small Business Tax Planning

- Tailored Tax Strategies for High-Income Earners: Retirement Planning and Wealth Management Considerations

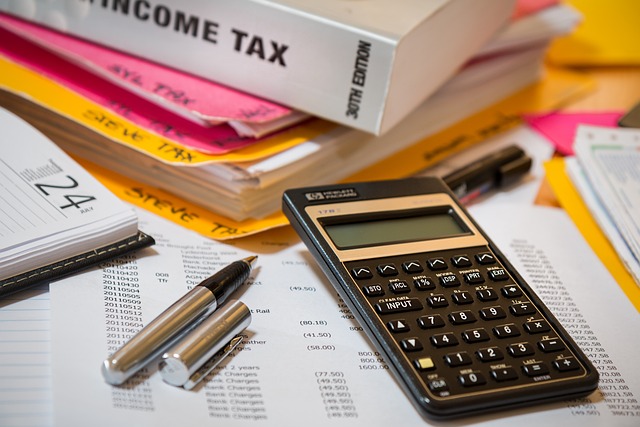

Maximizing Tax Savings for Small Businesses: Strategic Deductions and Smart Investments

For small business owners, effective tax-saving tips are pivotal in reducing income tax and maximizing financial efficiency. A strategic approach to deductions can significantly lower taxable income. It’s imperative to be meticulous in identifying all eligible deductions, such as those for business expenses, office supplies, and vehicle usage. By keeping thorough records and leveraging the full scope of allowable deductions, businesses can optimize their tax situation. Moreover, tax-efficient investments should be a cornerstone of any robust small business tax planning strategy. These investments not only contribute to retirement tax planning but also serve as wealth management tax strategies that yield long-term benefits. By allocating funds into tax-deferred accounts, such as IRAs or SEP IRAs, entrepreneurs can defer taxes until a later date, thereby improving immediate cash flow and enhancing overall financial health. For high-income earners, the importance of tax optimization strategies cannot be overstated. Consulting with a tax advisor regularly is crucial to navigate these complexities, ensuring that all available legal avenues for tax savings are being utilized. Through diligent planning and informed decision-making, small businesses can significantly reduce their tax liabilities and secure a stronger financial standing.

Leveraging Tax-Deferred Accounts to Enhance Annual Savings for Entrepreneurs

Entrepreneurs have a unique opportunity to enhance their annual savings through strategic tax planning, particularly by leveraging tax-deferred accounts. These accounts are pivotal in income tax reduction, as they allow high-income earners to defer taxes on investment earnings until a later date, often upon retirement. By contributing to such accounts, small business owners can significantly reduce their current taxable income, thereby increasing their cash flow. This not only provides immediate financial relief but also sets the foundation for robust retirement tax planning. It’s imperative to explore tax-efficient investments early on, as compounded growth within these accounts can accumulate substantially over time, thanks to the absence of annual taxes on investment gains. Tax optimization strategies must be an integral part of wealth management for entrepreneurs, ensuring they reap the benefits of their foresight and planning when retirement arrives. Regular consultations with a tax advisor are essential to navigate these complex yet rewarding tax-saving avenues, guaranteeing that small business owners are making informed decisions that align with their long-term financial goals.

Mastering Income and Expense Timing to Optimize Your Small Business's Tax Liabilities

Small business owners have a unique opportunity to optimize their tax liabilities through strategic income and expense timing. By carefully planning when to recognize income and when to deduct expenses, entrepreneurs can significantly reduce their overall income tax burden. For instance, deferring income into the next tax year or accelerating deductible expenses into the current year can lead to substantial tax savings. This approach is particularly effective for businesses that experience seasonal fluctuations in revenue. Tax-saving tips such as these are essential components of sound small business tax planning and should be integrated into the financial management strategy early on.

In addition to income and expense timing, small business owners must consider retirement tax planning as a key aspect of their broader tax optimization strategies. Contributing to tax-deferred investment accounts like 401(k)s or IRAs can shield current earnings from taxes, allowing these funds to compound tax-free until withdrawal. Similarly, high-income earners should explore wealth management tax strategies that leverage the full extent of available deductions and credits. Consulting with a knowledgeable tax advisor is indispensable in this process, as they can provide tailored advice to ensure compliance and maximize tax efficiencies, thereby enhancing both short-term cash flow and long-term financial security.

The Role of Regular Consultations with Tax Advisors in Small Business Tax Planning

Regular consultations with tax advisors play a pivotal role in the effective tax planning for small businesses. These experts are adept at navigating the complex tax code, offering tailored tax-saving tips that can significantly reduce income tax and capitalize on tax-efficient investments. By staying abreast of the latest tax optimization strategies, small business owners can ensure their financial decisions align with tax-saving principles throughout the year. Tax advisors are invaluable partners in this process, providing guidance that goes beyond mere compliance; they help identify opportunities for long-term wealth management tax strategies, such as retirement tax planning, which are crucial for high-income earners to maximize their after-tax income and secure their financial future. These consultations empower entrepreneurs to make informed decisions that not only optimize their current tax liabilities but also contribute to the sustainable growth of their businesses.

Small business owners often find themselves juggling various responsibilities, making the role of a knowledgeable tax advisor even more critical. Through diligent planning and frequent collaboration with these advisors, small businesses can implement strategies that are both tax-efficient and conducive to their overall financial health. The insights provided by tax professionals during these consultations are not just reactive but proactive, ensuring that business owners are equipped to make decisions that consider the long-term implications on their wealth and tax situation. This proactive approach to tax planning for high-income earners can lead to substantial savings, positioning small businesses to thrive despite the ever-changing economic landscape.

Tailored Tax Strategies for High-Income Earners: Retirement Planning and Wealth Management Considerations

For high-income earners, small business tax planning is a critical component of their overall financial strategy, especially when it comes to retirement planning and wealth management. Tailored tax-saving tips for this demographic often revolve around identifying and leveraging tax-efficient investments that align with long-term financial goals. These individuals can significantly reduce income tax through strategic investment choices that offer both tax deferral and growth potential, thereby optimizing their financial portfolio. By focusing on retirement tax planning, high earners can take advantage of specialized accounts designed to shelter contributions and earnings from current taxes, allowing investments to compound more effectively over time.

In addition to selecting the right types of investments, tax optimization strategies for small businesses owned by high-income individuals must consider the timing of income recognition and deductible expense claims. This approach not only manages cash flow more effectively but also ensures a lower effective tax rate. Consultations with knowledgeable tax advisors are invaluable, as they can provide personalized advice on how to structure business operations to minimize tax liabilities while staying compliant with current tax laws. Wealth management tax strategies for high-income earners are multifaceted and require a nuanced understanding of various tax codes and regulations. By integrating these considerations into their financial planning, high earners can secure their financial future and maximize the benefits of their hard-earned income.

Effective small business tax planning is a cornerstone of financial health and can significantly reduce annual tax liabilities. By leveraging tax-saving tips such as claiming all eligible deductions, investing in tax-efficient investments, and timing income and expenses strategically, entrepreneurs can optimize their tax situation and enhance cash flow. Additionally, retirement tax planning and wealth management tax strategies are crucial for high-income earners to ensure they are taking advantage of all available options to minimize their tax burden. Regular consultations with a knowledgeable tax advisor are indispensable for staying abreast of the latest income tax reduction methods and identifying opportunities for tax optimization strategies tailored to one’s unique financial situation. With diligent planning and expert advice, small businesses can navigate the complexities of the tax code effectively, securing their financial future.