Small business owners are often the architects of their financial success, and a pivotal aspect of this is mastering the art of tax planning. A strategic approach to taxes can translate into substantial savings, allowing entrepreneurs to channel more resources back into their ventures. This article delves into the intricacies of small business tax deductions, highlighting opportunities to leverage IRA contributions for tax benefits, strategize with tax-loss harvesting, claim student loan interest deductions, develop estate planning tax strategies, and maximize educational tax credits while reducing capital gains taxes. By navigating these areas effectively, small business owners can enhance their financial footing and set a foundation for sustainable growth.

- Leveraging IRA Contributions for Tax Benefits: A Strategic Move for Small Business Owners

- Utilizing Tax-Loss Harvesting to Offset Business Income

- Student Loan Interest Deduction: A Financial Lifeline for Entrepreneurs

- Estate Planning Tax Strategies for Long-Term Financial Security

- Maximizing Educational Tax Credits and Reducing Capital Gains Taxes for Small Business Growth

Leveraging IRA Contributions for Tax Benefits: A Strategic Move for Small Business Owners

Small business owners have a plethora of opportunities to leverage IRA contributions for substantial tax benefits. Contributing to an Individual Retirement Account (IRA) can significantly reduce taxable income, particularly for those with higher incomes who are barred from making SEP or traditional IRA deductions due to coverage rules. In such cases, considering a Roth IRA can be advantageous, as it allows earnings to grow tax-free provided certain conditions are met. This strategic move not only secures financial stability post-retirement but also provides immediate tax relief.

Furthermore, savvy small business owners utilize their IRAs in conjunction with other financial strategies, such as tax-loss harvesting, to maximize their tax benefits. By offsetting gains from investments with losses, they can further reduce their taxable income, leading to a more favorable tax position. Additionally, the strategic use of educational tax credits can complement these efforts by providing breaks on tuition and fees for either themselves or their employees’ children. Beyond immediate tax considerations, small business owners should also contemplate estate planning tax strategies, ensuring that their IRAs are structured in a way that minimizes taxes upon inheritance. This holistic approach to IRA contributions and related tax benefits is a critical component of effective financial planning for small business owners aiming to minimize their tax liabilities, including through capital gains tax reduction strategies. By integrating these tactics, entrepreneurs can effectively manage their current tax situation while positioning themselves for a more tax-efficient future.

Utilizing Tax-Loss Harvesting to Offset Business Income

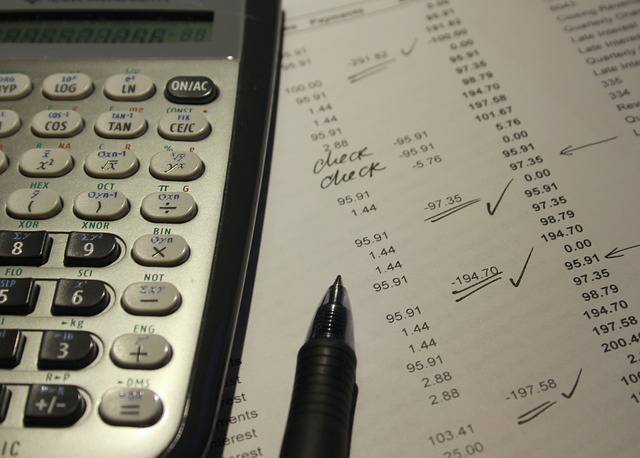

Small business owners have a multitude of opportunities to leverage tax-saving strategies that can significantly reduce their taxable income. One such strategy is tax-loss harvesting, which involves the strategic sale of investments that result in capital losses to offset capital gains within the same tax year. This tactic not only helps in reducing the tax burden on capital gains but also allows for a more favorable tax position. By carefully selecting investments and executing trades at strategic times, entrepreneurs can mitigate taxes effectively while maintaining their investment portfolio’s overall performance.

In addition to capital gains tax reduction, small business owners can tap into various other tax benefits that extend beyond the operational expenses. For instance, IRA contributions can yield substantial tax benefits. Contributions to a traditional IRA may be tax-deductible, depending on the individual’s income level and coverage by an employer’s retirement plan. Furthermore, tax-loss harvesting extends beyond just investment portfolios; it’s a principle that can be applied to other financial decisions. Estate planning tax strategies and educational tax credits are other areas where savvy small business owners can utilize tax benefits to their advantage. These strategies not only provide immediate tax relief but also contribute to long-term financial stability by reducing student loan interest, which can be a significant burden for many entrepreneurs. By integrating these tax-saving measures into their overall financial planning, small business owners can optimize their expenses and reinvest more capital into their businesses, setting the stage for sustainable growth and success.

Student Loan Interest Deduction: A Financial Lifeline for Entrepreneurs

Entrepreneurs with student loan debt can find solace in the Student Loan Interest Deduction, which allows them to deduct up to $2,500 of interest paid on qualified education loans each year. This deduction is not only a financial lifeline for those managing educational expenses but also a strategic tool for tax planning. By claiming this deduction, small business owners can reduce their taxable income, thereby mitigating the burden of high-interest payments and channeling more resources into their ventures. Additionally, savvy entrepreneurs often explore IRA contributions as a means to secure tax benefits. Contributions to traditional IRAs may be tax-deductible, depending on the individual’s income level, which can provide an immediate reduction in taxable income. This dual approach of utilizing the Student Loan Interest Deduction and maximizing IRA contributions can lead to substantial savings and contribute to a stronger financial footing for small businesses.

Furthermore, entrepreneurs looking to further optimize their tax situation may consider estate planning tax strategies. These include leveraging educational tax credits, which can offset taxes due on returns, and ensuring that business assets are structured in a way that minimizes estate taxes upon inheritance. Similarly, tax-loss harvesting is an effective method for reducing capital gains tax exposure. By strategically selling investments at a loss and reallocating to similar investments, entrepreneurs can offset capital gains, thereby lowering their overall tax liability. These tax-saving strategies, when implemented thoughtfully, not only provide immediate relief but also build a foundation for long-term financial resilience for small business owners.

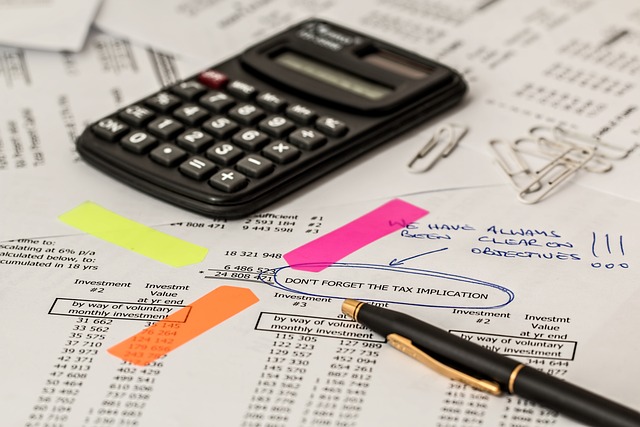

Estate Planning Tax Strategies for Long-Term Financial Security

Small business owners have access to a variety of tax deductions that can significantly reduce their taxable income, thereby optimizing expenses and allowing for reinvestment into their businesses. Estate planning tax strategies are a critical component of long-term financial security, encompassing a range of tactics designed to minimize tax liabilities while preserving the value of an estate. One such strategy involves leveraging IRA contributions, which offer substantial tax benefits. By contributing to an IRA, business owners can defer taxes on those funds until a later date, allowing for compounded growth within the account. Furthermore, strategic tax-loss harvesting can offset gains realized from capital investments, effectively reducing the overall capital gains tax burden. This approach involves selling securities at a loss and replacing them with similar investments to maintain portfolio value without sacrificing potential future gains.

Additionally, certain educational tax credits can provide additional financial support for business owners seeking to enhance their skills or those of their employees. These credits can be particularly advantageous when considering the long-term growth and development of the business. Moreover, the student loan interest deduction can offer relief to small business owners who are also managing personal educational debt. By claiming this deduction, they can reduce their taxable income, thereby alleviating some of the financial pressure associated with repaying student loans. These strategies, when integrated into a comprehensive estate plan, ensure that business owners can protect and manage their assets effectively, providing a solid foundation for long-term financial stability and security.

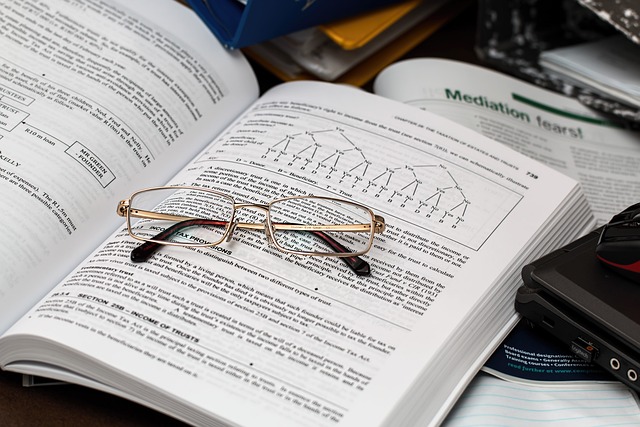

Maximizing Educational Tax Credits and Reducing Capital Gains Taxes for Small Business Growth

Small business owners have access to a range of tax-saving strategies that can facilitate growth and financial stability. One such area is education, where small business owners can leverage educational tax credits to offset the cost of furthering their own or their employees’ knowledge. The American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC) are two valuable credits that can significantly reduce the tax bill when pursuing higher education. These credits can be claimed for tuition, fees, and course-related expenses, providing a direct benefit to both the business owner and their employees.

Additionally, smart tax planning can help small business owners reduce their capital gains tax liabilities, an essential consideration for those looking to reinvest profits or transition ownership. By carefully timing the sale of assets, business owners can take advantage of tax-loss harvesting to offset capital gains and minimize tax exposure. IRA contributions can offer additional tax benefits, acting as a shield against current income while providing for future financial security. Estate planning tax strategies are also crucial for ensuring that the business’s transition to new ownership is both tax-efficient and aligned with the owner’s long-term vision. Strategic gifting of stock or assets during one’s lifetime can reduce the estate’s value, thereby diminishing potential capital gains taxes upon death. Similarly, charitable contributions or donations of business equipment to qualified organizations can also offer capital gains tax reductions while supporting community initiatives. By staying abreast of these and other tax-saving opportunities, small business owners can effectively manage their tax liabilities, optimize their financial resources, and pave the way for sustainable growth.

Small business owners play a vital role in the economic landscape, and with strategic tax planning, they can retain more of their hard-earned profits. By capitalizing on deductions for routine expenses like office supplies and leveraging opportunities such as IRA contributions for tax benefits, entrepreneurs can significantly reduce their taxable income. Strategies like Tax-loss harvesting offer a sophisticated approach to offsetting business income, while the Student loan interest deduction provides welcome relief. Furthermore, thoughtful estate planning tax strategies ensure long-term financial security and stability. Additionally, maximizing educational tax credits alongside efforts to reduce capital gains tax can pave the way for small business growth and expansion. In essence, a comprehensive understanding of these tax advantages equips small business owners with the tools necessary to navigate the complexities of the tax code effectively, positioning them to thrive in an ever-evolving marketplace.