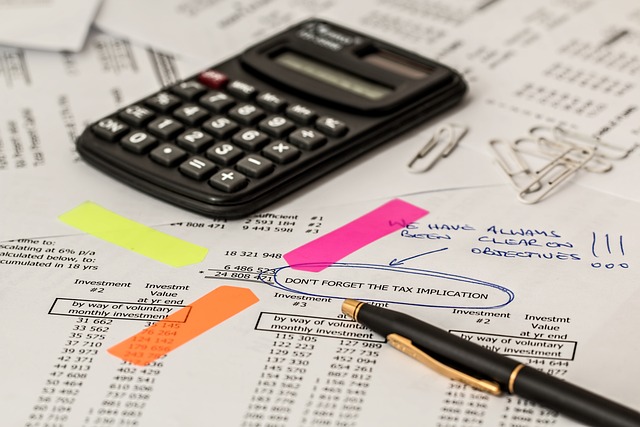

Small business owners are at a pivotal point to harness the intricacies of the tax code for financial advantage. The maze of deductions available can be a boon for savvy entrepreneurs looking to reduce their taxable income. From IRA contributions offering tax benefits to the strategic use of educational tax credits, there’s a wealth of opportunities for small business owners to optimize their finances. This article demystifies the process of leveraging deductions for office supplies, business travel, and employee benefits, while also exploring advanced strategies like tax-loss harvesting and estate planning tax strategies. Additionally, understanding how capital gains tax reduction tactics can impact your bottom line is crucial for long-term financial health. Entrepreneurs will gain valuable insights into maximizing their deductions, including the often overlooked student loan interest deduction, ensuring they keep more of their hard-earned money where it matters most—in their business’s growth and success.

- Leveraging IRA Contributions for Tax Benefits for Small Business Owners

- Utilizing Tax-Loss Harvesting to Optimize Your Small Business Portfolio

- Navigating Estate Planning Tax Strategies and Educational Tax Credits for Entrepreneurs

Leveraging IRA Contributions for Tax Benefits for Small Business Owners

Small business owners have a strategic financial tool at their disposal that can offer both retirement savings and significant tax benefits: Individual Retirement Accounts (IRAs). Contributions to IRAs, particularly Roth IRAs, can be leveraged to reduce taxable income. For those with higher incomes, funding a Roth IRA may not be directly possible due to income restrictions; however, through a process known as the Back Door Roth IRA, business owners can contribute post-tax dollars, which then grow tax-free and are withdrawn tax-free in retirement. This strategy effectively utilizes IRA contributions for tax benefits, allowing entrepreneurs to defer taxes and build retirement savings concurrently.

In addition to the immediate tax benefits, leveraging IRAs also encompasses long-term estate planning tax strategies. By designating beneficiaries, small business owners can pass on their IRA assets upon death, potentially avoiding probate and minimizing estate taxes. This approach not only ensures the continuation of the business by preserving capital but also reduces the overall tax burden across generations. Furthermore, for those pursuing further education or funding a child’s education, exploring educational tax credits in conjunction with IRA contributions can lead to further tax savings. Meanwhile, when it comes to managing investments, tax-loss harvesting within an IRA can offset gains elsewhere, contributing to capital gains tax reduction. This sophisticated approach to investment management within retirement accounts not only maximizes investment growth but also optimizes the overall tax position of small business owners.

Utilizing Tax-Loss Harvesting to Optimize Your Small Business Portfolio

Small business owners can leverage tax-loss harvesting as a strategy to optimize their investment portfolios and minimize taxes. This approach involves selling investments that have experienced losses and replacing them with similar assets to maintain portfolio balance, thereby realizing capital losses that can offset capital gains for tax purposes. By doing so, businesses can effectively reduce their capital gains tax burden. For instance, if a business has investments that have depreciated in value, selling these at a loss and reallocating funds into comparable investments can result in significant tax savings. This strategy not only applies to stocks and bonds but can also encompass other investment assets like IRA contributions, where timing the entry into certain investment vehicles can yield additional tax benefits.

Furthermore, small business owners should consider other tax-saving opportunities such as educational tax credits and estate planning tax strategies. Educational tax credits can provide substantial relief for small business owners who are also pursuing higher education or vocational training for themselves or their dependents. These credits can directly reduce the amount of taxes owed, offering a more immediate financial advantage. On the other hand, estate planning tax strategies ensure that the transition of business ownership is managed in a way that minimizes tax liabilities and preserves the value of the estate for heirs. By taking advantage of these various tax-saving measures, small business owners can effectively manage their tax liabilities, reinvesting capital into their enterprises to foster growth and stability.

Navigating Estate Planning Tax Strategies and Educational Tax Credits for Entrepreneurs

Small business owners can leverage various tax strategies to optimize their financial outcomes, particularly in the realms of estate planning and education funding. One such strategy involves utilizing IRA contributions to accrue tax benefits. By contributing to traditional IRAs, entrepreneurs can defer taxes on investment earnings until a later date, effectively managing their tax liabilities. Additionally, when it comes to estate planning tax strategies, careful consideration of the business’s structure and assets is crucial. Implementing trusts, bequests, or other estate planning vehicles can minimize estate taxes and transfer wealth more efficiently.

Furthermore, for those pursuing or supporting further education, educational tax credits offer significant relief. These credits can offset a portion of tuition fees, textbook costs, and other qualified education expenses. The Lifetime Learning Credit (LLC) and the American Opportunity Tax Credit (AOTC) are two such credits that entrepreneurs may take advantage of to lessen the burden of student loan interest. By understanding and utilizing these educational tax credits, small business owners can reduce capital gains taxes, thereby retaining more capital to reinvest in their ventures or assist family members in their educational pursuits. Tax-loss harvesting within investment portfolios also plays a role in this process, allowing for the offset of capital gains with capital losses, which can further enhance the tax efficiency of an entrepreneur’s financial strategy.

Small business owners play a pivotal role in driving economic growth and innovation. By leveraging specific tax benefits and strategic deductions, such as those related to IRA contributions for tax benefits and capital gains tax reduction through Tax-loss harvesting, entrepreneurs can not only comply with tax obligations but also strengthen their financial position. The intricacies of student loan interest deduction, estate planning tax strategies, and educational tax credits further underscore the importance of proactive tax planning. When diligently applied, these tax-saving measures enable small business owners to optimize their portfolios and invest more effectively in their ventures’ growth. In essence, staying abreast of tax laws and utilizing available deductions is a critical component of a robust financial strategy for small businesses.