Roadside assistance and Personal Injury Protection (PIP) are vital car insurance add-ons that offer support in unexpected situations, including mechanical issues, stranded driving, and medical emergencies. To manage rising premiums, compare quotes from multiple insurers focusing on policies with these coverage options, considering driving habits and personal changes for affordable, comprehensive protection.

With a significant surge in car insurance premiums, drivers are increasingly seeking policies that offer both comprehensive coverage and financial protection. Roadside assistance and Personal Injury Protection (PIP) stand out as vital components, ensuring support during emergencies and covering unexpected medical expenses. This article guides you through unlocking peace of mind with roadside assistance benefits, understanding PIP’s crucial role, and navigating strategies to secure value-driven insurance premiums. Additionally, it provides insights into comparing quotes to find a comprehensive policy tailored to your needs, offering essential protection for the road ahead.

- Unlocking Peace of Mind: Roadside Assistance Benefits

- PIP Protection: Covering Medical Expenses in Accidents

- Navigating Insurance Premiums: Strategies for Value

- Comparing Quotes: Finding Comprehensive Coverage

Unlocking Peace of Mind: Roadside Assistance Benefits

Roadside assistance is a valuable service that goes beyond traditional car insurance, offering peace of mind for every driver. It provides immediate support in various unexpected situations, ensuring you’re never stranded on the side of the road. This benefit covers a range of services, including towing to the nearest repair facility, battery boosts, tire changes, and even fuel delivery if you run out of gas.

Having roadside assistance means help is just a call away. It offers a sense of security, especially when you’re far from home or in an unfamiliar area. This service can save you time and money by efficiently addressing common car problems and preventing minor issues from turning into major breakdowns.

PIP Protection: Covering Medical Expenses in Accidents

Personal Injury Protection (PIP) is a crucial component of car insurance that covers medical expenses for you and your passengers if involved in an accident, regardless of fault. This means that even if you’re at-fault for the incident, PIP will step in to help with immediate medical needs. The coverage can include expenses such as hospital stays, doctor visits, rehabilitation costs, and even loss of income if a driver or passenger is unable to work due to injuries sustained in the accident.

Having PIP ensures that you have financial protection during an unexpected event. It provides peace of mind knowing that your medical bills will be covered, allowing you to focus on recovery rather than worrying about financial obligations. This coverage is especially valuable for drivers with pre-existing health conditions or those who frequently drive long distances, as it offers comprehensive support in case of emergencies.

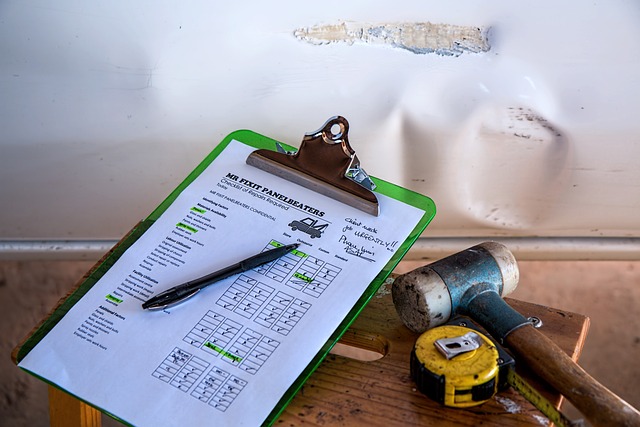

Navigating Insurance Premiums: Strategies for Value

Navigating rising insurance premiums requires a strategic approach to ensure drivers get the best coverage without breaking the bank. One effective strategy is to compare quotes from multiple insurers, focusing on policies that include roadside assistance and PIP. These add-ons are invaluable during unexpected events like vehicle breakdowns or accidents, offering peace of mind by providing immediate assistance and financial protection for medical bills.

Additionally, understanding your driving habits can significantly impact premium costs. Insurers consider factors such as miles driven, driving history, and claims made when calculating premiums. Drivers with clean records and low annual mileage often qualify for discounts. Regularly reviewing policy terms and considering changes in personal circumstances, like moving to a safer area or improving driving skills, can also lead to more affordable coverage options, ensuring value for money without compromising on protection.

Comparing Quotes: Finding Comprehensive Coverage

When comparing car insurance quotes, it’s crucial to look beyond the base price. While cost is a significant factor, so are the inclusions and coverage limits. Seek out policies that encompass comprehensive protection, including roadside assistance and PIP. These add-ons offer invaluable support in various scenarios—from flat tires and locked vehicles to medical emergencies following an accident.

By carefully evaluating quotes, you can identify providers who offer these essential services at competitive rates. Remember, the goal is to find a balance between affordability and adequate coverage. Thus, take the time to scrutinize each quote’s details, ensuring you’re getting the best value for your money in terms of both protection and peace of mind on the road.

In a time of rising insurance costs, drivers now more than ever need to be informed and proactive. By understanding the value of roadside assistance and personal injury protection (PIP), and by comparing quotes that include these essential components, individuals can make informed decisions that offer both peace of mind and financial security on the road. Embracing these strategies allows drivers to navigate changing premium landscapes while ensuring they are adequately protected in case of emergencies.