When navigating the complexities of car insurance, understanding the nuances of liability coverage is paramount. This article delves into the essentials of liability coverage within car insurance policies, including its significance in safeguarding against financial losses stemming from accidents involving injury or property damage to others. We’ll explore various facets, such as how rental car insurance extends beyond personal vehicles, the critical role of commercial auto insurance for businesses, and tailored classic car coverage that caters specifically to vintage automobiles. Additionally, we’ll demystify car insurance deductibles and address the needs of high-risk drivers, offering valuable strategies to access discounts on car insurance premiums without skimping on protection. Whether you’re a driver seeking to enhance your coverage or a business owner managing a fleet, this comprehensive guide will equip you with the knowledge needed to make informed decisions about your car insurance choices.

- Understanding Liability Coverage in Car Insurance: A Comprehensive Overview

- Navigating Rental Car Insurance: Does Your Policy Cover More Than Just Personal Vehicles?

- The Role of Commercial Auto Insurance for Business Operations and Fleet Management

- Protecting Your Classic Car with Tailored Classic Car Coverage

- Decoding Car Insurance Deductibles: How They Affect Your Liability Coverage

- Managing High-Risk Driver Coverage: Options and Considerations

- Strategies for Accessing Discounts on Car Insurance Premiums Without Compromising Protection

Understanding Liability Coverage in Car Insurance: A Comprehensive Overview

When navigating the complexities of car insurance, understanding liability coverage is paramount. This type of coverage is designed to offer financial protection for damage or injury that you, as the driver, are legally responsible for causing to others in an accident. It typically encompasses two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical costs, pain and suffering, and legal fees for injuries caused to others, while property damage liability compensates for damages to another person’s vehicle or property.

For those who frequently use rental cars, rent car insurance is an important consideration. It mirrors the coverage of your personal auto policy and can be particularly beneficial for high-risk drivers. Similarly, commercial auto insurance is tailored for businesses that use vehicles for operations, ensuring that their liability exposure is adequately covered. Classic car enthusiasts may also require specialized coverage like classic car coverage, which often includes agreed value and limited mileage options. Car insurance deductibles are a key factor to consider; selecting an appropriate deductible can affect your insurance premiums, with higher deductibles typically leading to lower premiums. It’s crucial for drivers with a history of violations or accidents to secure high-risk driver coverage, as it provides the necessary protection that standard policies might not offer. Discounts on car insurance are available to those who maintain a clean driving record, take defensive driving courses, or opt for higher deductibles, among other qualifications, helping to offset the cost of premiums. Regularly reviewing and updating your liability coverage limits is essential to ensure that you remain protected against unforeseen events and potential financial strain due to accidents. This diligence not only safeguards your assets but also provides a sense of security on the road.

Navigating Rental Car Insurance: Does Your Policy Cover More Than Just Personal Vehicles?

When renting a car, it’s crucial to understand how your existing auto insurance policies interact with rental car insurance. Typical personal car insurance may offer coverage that extends beyond your own vehicle, but the extent of this coverage can vary. Rental Car Insurance is designed to cover losses and damages incurred when driving a rental vehicle. This type of policy often includes a wider range of protection than what you might have for your personal vehicle. It’s important to verify with your insurer whether your current policy, such as those covering Classic Cars or Commercial Vehicles, provides adequate coverage for rentals. Key factors like Car Insurance Deductibles and High-Risk Driver Coverage can influence the level of protection you receive. Additionally, certain situations may necessitate purchasing additional insurance from the rental company to ensure full coverage.

Before renting a car, it’s wise to review your policy to understand what is covered and any potential gaps in coverage that might leave you financially responsible for damage or injury. Discounts on Car Insurance are often available, but they may not apply to rental vehicles unless specifically stated. Insurance Premiums can vary significantly based on a variety of factors, including the type of vehicle you’re renting and your driving history. For those who are High-Risk Drivers, finding affordable coverage that fulfills all legal requirements can be particularly challenging. By proactively consulting with your insurer and carefully reviewing your policy, you can make informed decisions about the rental car insurance you need, ensuring that you’re fully protected without overpaying for unnecessary coverage.

The Role of Commercial Auto Insurance for Business Operations and Fleet Management

Commercial auto insurance plays a crucial role in safeguarding business operations involving vehicles. For companies with fleets or those that regularly use cars, trucks, or vans for work purposes, having robust commercial auto insurance is not just a legal requirement but a strategic investment. This type of coverage extends beyond personal car insurance policies, offering tailored protection that addresses the unique risks associated with business use of vehicles, such as frequent long-distance travel, multiple drivers, and higher liability exposure. It ensures that businesses can manage the costs associated with accidents involving their employees or fleet vehicles without jeopardizing the company’s financial stability.

When considering commercial auto insurance, it’s important to evaluate options that align with the specific needs of the business. This includes assessing rental car insurance needs for when vehicles are out for maintenance, selecting appropriate coverage limits for classic cars in a fleet, and providing high-risk driver coverage for those with less than ideal driving records. Businesses can also explore various discounts on car insurance available to them, which can significantly reduce insurance premiums. These discounts may be based on factors like the number of vehicles insured, drivers’ records, or safety training programs implemented by the company. Regularly reviewing and updating commercial auto insurance policies, including adjusting car insurance deductibles, is essential to ensure that coverage remains adequate as business circumstances evolve. This diligence not only protects the company’s assets but also contributes to a stable and reliable operational framework for the fleet.

Protecting Your Classic Car with Tailored Classic Car Coverage

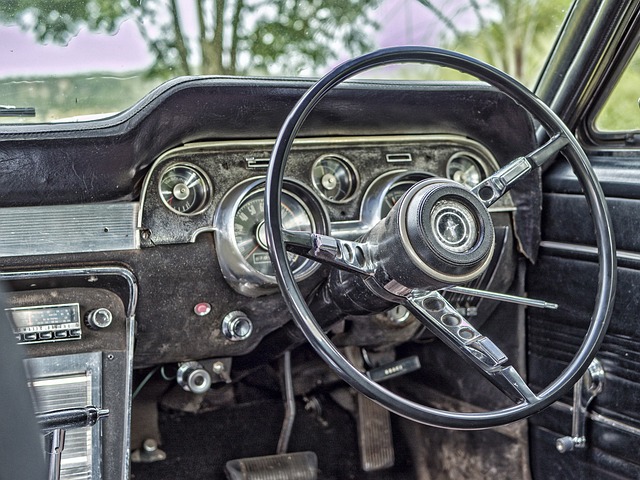

When owning a classic car, standard auto insurance policies may fall short in fully protecting such a unique asset. Classic Car Coverage is specifically designed to address this gap, offering tailored protection that goes beyond what you might find with traditional car insurance. This specialized form of coverage takes into account the distinctive needs of classic cars, which often involve higher values and usage patterns different from daily drivers. It’s crucial for classic car enthusiasts to consider this type of policy to ensure their investment is adequately safeguarded. Unlike Rental Car Insurance or Commercial Auto Insurance, which cater to short-term and business use vehicles respectively, Classic Car Coverage is crafted for the long-term care and occasional use of these cherished automobiles. It typically includes agreed value coverage, which means if your classic car is totaled, you receive the insured amount without the hassle of depreciation assessments. Additionally, this coverage often allows for a limited number of miles per year, reflecting the typical usage patterns of classic cars.

Another aspect to consider when insuring a classic car is the selection of appropriate Car Insurance Deductibles. High-Risk Driver Coverage might be necessary if your driving record isn’t spotless, but for classic car owners, it’s often possible to secure lower insurance premiums due to the limited mileage and careful storage these vehicles usually enjoy. This can lead to significant Discounts on Car Insurance, as insurers recognize that classic cars are less exposed to risks associated with daily commuting. When tailoring your Classic Car Coverage, it’s advisable to work closely with your insurance provider to understand all the options available for discounts, which may include storage conditions, vehicle club memberships, or driver profiles. Regularly reviewing and updating your policy is key, as your classic car coverage should evolve alongside any changes in your car’s value, usage, or personal circumstances to maintain adequate protection.

Decoding Car Insurance Deductibles: How They Affect Your Liability Coverage

When navigating car insurance policies, understanding deductibles is crucial for grasping how they interact with your liability coverage. A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in during a claim. For instance, if you’re involved in an accident and it’s your fault, you will initially cover the deductible on your policy before liability coverage takes effect for the remaining costs associated with bodily injury or property damage. Higher deductibles typically lead to lower insurance premiums, offering a balance between self-insured risk and coverage costs. Conversely, selecting a lower deductible means you’ll pay less out-of-pocket initially but will likely face higher insurance premiums.

Choosing the right deductible can be influenced by various factors including your personal financial situation, the type of car insurance you require—such as Rental Car Insurance, Commercial Auto Insurance, or Classic Car Coverage—and your risk profile. High-Risk Driver Coverage, for example, may come with specific deductible requirements. It’s essential to weigh these against the potential savings from discounts on car insurance, which can be found by maintaining a clean driving record, taking defensive driving courses, or bundling multiple vehicles under one policy. Regularly reviewing your liability coverage and deductibles is prudent, especially as circumstances change, such as when you add a new driver to your policy or after a significant life event. This due diligence ensures that you maintain adequate protection and do not overpay for your Commercial Auto Insurance, Classic Car Coverage, or any other car insurance needs you may have. It’s also important to consider additional coverage options that can complement your liability coverage, like uninsured/underinsured motorist protection, to further safeguard yourself financially.

Managing High-Risk Driver Coverage: Options and Considerations

For high-risk drivers, securing adequate coverage can be a complex task, as it often requires tailored solutions that go beyond standard policies. High-risk driver coverage is designed to address the unique needs of individuals with histories of accidents or violations, which typically lead to higher insurance premiums. To mitigate these increased costs, exploring options such as Rental Car Insurance, which may come with a separate policy or as an add-on to your existing plan, can be beneficial. This ensures that even when driving a rental vehicle, you remain covered and do not face unexpected charges if an incident occurs.

When considering high-risk driver coverage, it’s important to evaluate the type of vehicles you operate. Commercial Auto Insurance is necessary for business-related travel, while Classic Car Coverage caters to the needs of car enthusiasts with antique or collectible vehicles. In both cases, understanding the specific risks and choosing appropriate coverage can help manage insurance premiums. Discounts on Car Insurance may be available for high-risk drivers who complete defensive driving courses or maintain a clean record following their high-risk classification. Adjusting car insurance deductibles is another way to balance cost and coverage; opting for higher deductibles can lower premiums, though it requires more out-of-pocket expense in the event of a claim. Regularly reviewing your policy, especially after significant life changes such as a new job that involves driving or a move to a different state with varying insurance regulations, is crucial. This due diligence ensures that your coverage remains aligned with your current situation and risk profile, providing the necessary protection without unnecessary expense.

Strategies for Accessing Discounts on Car Insurance Premiums Without Compromising Protection

When seeking ways to reduce your car insurance premiums without compromising the quality of your coverage, it’s important to explore various strategies that can lead to discounts. One effective approach is to evaluate whether you truly need Rental Car Insurance as part of your policy. Often, personal auto policies already provide some rental car coverage, so adding a separate plan might be redundant. By reviewing your existing coverage, you can ensure that you’re not overpaying for duplicate protections. Similarly, if your business requires the use of vehicles, Commercial Auto Insurance is a specialized form of coverage designed to address the unique needs of businesses. Ensuring that your policy aligns with your specific commercial auto needs can lead to tailored discounts and more cost-effective insurance premiums.

For car enthusiasts, Classic Car Coverage offers a unique opportunity for discounts. These policies are tailored to the specific needs of classic or collector cars, which often have different values and usage patterns compared to everyday vehicles. By opting for agreed value coverage and maintaining your car in top condition, you can benefit from reduced premiums while still enjoying comprehensive protection. Additionally, if you’re a High-Risk Driver Coverage seeker, it’s crucial to shop around and compare quotes, as insurers may offer different rates based on their risk assessment models. Insurers often provide various discounts for drivers with less-than-ideal driving records, which can significantly lower insurance premiums. Always communicate openly with your insurance provider about your driving history to access these discounts. Lastly, consider adjusting your Car Insurance Deductibles. Opting for a higher deductible can result in substantially lower premiums, but be sure to select a deductible amount that you can comfortably afford in the event of an accident. By carefully considering these strategies and regularly reviewing your policy, you can secure significant discounts on car insurance while maintaining robust protection tailored to your specific needs.

When it comes to car insurance, liability coverage stands as a cornerstone of financial protection. As detailed in this article, understanding the nuances of Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage ensures that whether you’re driving for personal use, managing a business fleet, or cherishing a vintage vehicle, your policy aligns with your specific needs. Similarly, grasping the impact of Car Insurance Deductibles and navigating coverage as a High-Risk Driver can significantly influence your level of security on the road. To conclude, regular review and updates to your liability coverage, along with exploring Discounts on Car Insurance without forfeiting critical protection, are pivotal steps in maintaining robust financial safeguards against unforeseen events. Ensuring your Insurance Premiums reflect these considerations will not only comply with legal requirements but also offer peace of mind, knowing you’re adequately protected and prepared for whatever the journey brings.