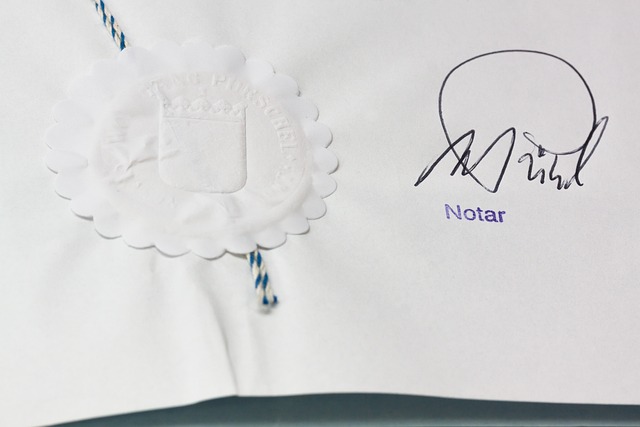

Notaries public are pivotal in the legal system, verifying the authenticity of documents to uphold lawful practices and safeguard against fraudulent activities. As gatekeepers of official documents, their role demands precise attention to detail and adherence to notary responsibilities. In an era where legal liabilities can arise from seemingly minor oversights, understanding the risks associated with notarial acts is paramount. This article delves into the importance of liability insurance for notaries, highlighting how it serves as a safeguard against potential financial losses due to errors in document certification. We will explore the essentials of notary law, the ethical standards required in notarization, and the steps notaries must take to ensure their practices are protected from notary claims through a robust notary bond. With insights into best practices for accuracy and compliance, notaries can conduct their duties with assurance and professionalism, underscoring the significance of liability insurance in navigating the complexities of their role.

- Understanding Notaries Public and Their Indispensable Role in Legal Document Authentication

- Navigating Notarial Acts: A Guide to Proper Document Certification

- The Risks of Notary Misconduct: Potential for Legal Liability and Financial Loss

- Shielding Against Claims: The Necessity of Professional Liability Insurance for Notaries

- Deciphering Notary Law: Legal Obligations and Ethical Standards in Notarization

- The Anatomy of a Notary Bond: Protecting Your Practice from Notary Claims

- Best Practices for Notaries: Ensuring Accuracy and Compliance in Notarial Acts

Understanding Notaries Public and Their Indispensable Role in Legal Document Authentication

Navigating Notarial Acts: A Guide to Proper Document Certification

Navigating notarial acts requires a deep understanding of notary responsibilities and the legal framework that governs document certification. Notaries public are tasked with ensuring the authenticity and integrity of documents, which is critical in various legal and commercial transactions. The process of notarization involves verifying the identity of the signer, administering oaths or affirmations, and witnessing the signing of the document. This meticulous attention to detail is essential to prevent fraud and uphold the sanctity of legal agreements. However, the complexity of notarial acts makes them susceptible to errors, which can lead to significant legal liability. Notaries must be aware that even a minor oversight can result in claims against them, potentially causing financial distress. This is where liability insurance, specifically Errors and Omissions (E&O) insurance, becomes indispensable. E&O insurance is designed to offer protection for notary claims arising from alleged or actual notarial misconduct or negligence. It serves as a safeguard against the costs associated with legal defense and any damages that may be awarded. Additionally, maintaining a notary bond is another layer of security that notaries can utilize to mitigate the risks of potential claims. By understanding their role and responsibilities under notary law and securing appropriate liability insurance, notaries can perform their duties with confidence, upholding the highest standards of notary ethics and ensuring the proper certification of documents. This proactive approach not only safeguards their professional reputation but also contributes to the overall integrity of the legal system.

The Risks of Notary Misconduct: Potential for Legal Liability and Financial Loss

Notaries public are entrusted with the critical task of document certification, a process that requires strict adherence to notary law and ethical standards. The accuracy and integrity of their notarial acts are paramount, as any misconduct or negligence can result in significant legal liability for both the individual notary and their clients. In the event of errors or omissions during the notarization process, notaries may face claims alleging fraud or improper conduct. These claims can lead to costly legal battles and financial losses, undermining the trust placed in the notary’s professional capabilities. To mitigate these risks, obtaining liability insurance, specifically Errors and Omissions (E&O) insurance, is a prudent step for any notary public. This type of coverage is designed to protect against claims arising from alleged or actual notarial misconduct, providing a financial safety net that can cover legal defense costs, settlements, and judgments. Furthermore, maintaining a notary bond complements the E&O insurance by offering additional protection against potential claims, ensuring that notaries have a robust layer of security to rely on in the face of unforeseen incidents. By understanding their responsibilities and securing appropriate liability insurance, notaries can conduct their duties with confidence, upholding the integrity of the notarization process and safeguarding both their professional reputation and financial well-being.

Shielding Against Claims: The Necessity of Professional Liability Insurance for Notaries

Notaries public are entrusted with the critical task of authenticating legal documents, a duty that hinges on precision and adherence to notary laws. In the course of their duties, notaries must navigate complex legal landscapes, ensuring document certification is conducted with utmost accuracy to prevent legal liability. Given the potential for human error, it is imperative for notaries to shield themselves against claims that may arise from alleged notarial misconduct or negligence. Professional Liability Insurance, colloquially known as Errors and Omissions (E&O) insurance, stands as a cornerstone in this protection, offering financial coverage for errors or omissions during the notarization process. This insurance is a safeguard that addresses the legal liability inherent in notarial acts, providing a critical layer of defense against unfounded allegations or genuine mistakes. It ensures that notaries can fulfill their responsibilities without undue anxiety over the financial repercussions of potential claims.

Furthermore, maintaining a notary bond complements the protective measures afforded by E&O insurance. The bond serves as an additional security blanket against claims, reinforcing the notary’s commitment to upholding notary ethics and fulfilling their duties with integrity. This combination of professional liability insurance and a notary bond is essential for notaries who wish to operate with confidence in their expertise and dedication to legal accuracy. It is a testament to their professionalism and a clear signal to the public that they are prepared to handle the weight of their responsibilities responsibly, from document certification to safeguarding against notary claims.

Deciphering Notary Law: Legal Obligations and Ethical Standards in Notarization

The Anatomy of a Notary Bond: Protecting Your Practice from Notary Claims

Notaries public are entrusted with the critical task of document certification, which hinges on their adherence to notary law and ethical standards. A fundamental component in safeguarding a notary’s practice is the notary bond, an integral part of a comprehensive liability insurance policy. This bond serves as a financial guarantee that compensates individuals harmed by a notary’s negligence or error during notarial acts. It ensures that should a claim arise due to a breach of duty or failure to comply with state notary regulations, the bond can cover the cost of damages up to its limit. For instance, if a notary fails to properly verify the identity of a signer or incorrectly witnesses a signature, leading to legal liability, the notary bond can provide protection against potential financial losses. This financial safety net allows notaries to navigate their responsibilities with greater confidence and assurance, knowing that their practice is fortified against the uncertainties inherent in notarial services.

In addition to the notary bond, professional liability insurance, or E&O insurance, complements this protection by addressing specific liabilities arising from notarial acts. It covers claims of negligence or breach of duty that result in a financial loss for clients. Notaries must be acutely aware of their duties and the potential risks involved in document certification. By securing both a notary bond and E&O insurance, notaries demonstrate a commitment to upholding the highest standards of professional conduct and due diligence. This dual protection is essential for maintaining the integrity of the notarization process and ensuring that notaries can operate within the bounds of the law while serving the public with trust and competence.

Best Practices for Notaries: Ensuring Accuracy and Compliance in Notarial Acts

Notaries public are entrusted with the critical task of authenticating legal documents, a role that hinges on precision and adherence to notary laws. To ensure accuracy and compliance in notarial acts, notaries must be well-versed in their responsibilities as outlined by their jurisdiction’s notary law. This includes a thorough understanding of the document certification process, which is pivotal in preventing legal liability. Notary ethics demand meticulous attention to detail; each notarial act must be executed with integrity and due diligence. Notaries should always verify the identity of the signers, assess their willingness to sign voluntarily, and ensure that all information is accurately recorded.

In the event of errors or omissions during these processes, notaries may face notary claims alleging negligence or misconduct, which can lead to substantial financial repercussions. To mitigate such risks, it is imperative for notaries to secure professional liability insurance, commonly known as Errors and Omissions (E&O) insurance. This coverage safeguards against the financial impact of claims arising from alleged mishandling of notarial duties. Additionally, maintaining a notary bond complements this protection by providing an extra layer of security. Together, these measures offer a robust defense against potential legal liability, allowing notaries to conduct their professional activities with confidence and assurance. Understanding the importance of these protective measures and implementing best practices will enable notaries to uphold the highest standards of their profession and maintain the public’s trust in their critical role within the legal system.