Notary public professionals face unique risks on the job, from document verification to legal authenticity. Protecting against errors and omissions is paramount, making notary insurance an essential tool. This article explores the multifaceted benefits of notary legal protection, including affordable insurance policies tailored for mobile notaries. We delve into financial security measures, risk management strategies, and choosing the right coverage to safeguard your professional journey and reputation in this critical field.

- Understanding Notary Legal Protection: Why It's Crucial for Professionals

- Unveiling the Benefits of Affordable Notary Insurance Policies

- Insuring Mobile Notaries: Coverage on the Go

- Financial Security for Notaries: Protecting Your Assets and Reputation

- Choosing the Right Insurance Policy for Your Notary Practice

- Managing Risks: Effective Notary Risk Management Strategies

- Safeguarding Your Professional Journey with Comprehensive Liability Protection

Understanding Notary Legal Protection: Why It's Crucial for Professionals

For professionals in the notarization field, understanding the importance of notary legal protection is paramount to career success and longevity. While notaries are trusted with vital legal documents, the nature of their work also exposes them to potential risks and liabilities. An affordable notary insurance policy serves as a shield against these risks, providing financial security for notaries and peace of mind in an already stressful profession.

The need for insurance for mobile notaries is often overlooked but crucial. Notaries may encounter a variety of challenges, from document discrepancies to identity fraud. An insurance policy for notaries protects against these issues, ensuring that any errors or omissions are managed professionally and within legal parameters. Effective notary risk management strategies include this coverage, safeguarding both the notary’s financial assets and professional reputation as they navigate complex legal landscapes.

Unveiling the Benefits of Affordable Notary Insurance Policies

For professionals in the notary public field, securing affordable notary insurance policies is a strategic move that brings multiple benefits. This type of insurance offers more than just legal protection; it’s a safety net that provides financial security in an industry where errors and omissions can lead to significant consequences. With coverage for both traditional and mobile notaries, these policies ensure professionals are protected against potential liabilities, offering peace of mind as they serve their clients.

Notary legal protection is particularly crucial when considering the risks involved in verifying documents, witnessing signatures, and ensuring compliance with laws and regulations. Affordable notary insurance allows individuals to manage risk effectively, enhancing their professional image by demonstrating a commitment to service excellence and client protection. It’s an investment in both personal and business stability, providing coverage for potential losses that could arise from unforeseen circumstances.

Insuring Mobile Notaries: Coverage on the Go

Mobile notaries often face unique challenges and risks while providing services on the go. Insuring these mobile professionals is essential for comprehensive notary legal protection. An affordable notary insurance policy tailored for mobile notaries can offer specific coverage options to address these mobility-related concerns. This includes protections against loss or damage to equipment and supplies used during service calls, as well as liability coverage for any incidents that may occur at remote locations.

With an insurance policy designed for mobile notaries, professionals can enjoy enhanced financial security. This coverage ensures that if a client sues over an issue related to a mobile notarization—such as a missing document or equipment malfunction—the notary’s assets are protected. Effective notary risk management starts with the right insurance, providing peace of mind and safeguarding both the professional and their clients.

Financial Security for Notaries: Protecting Your Assets and Reputation

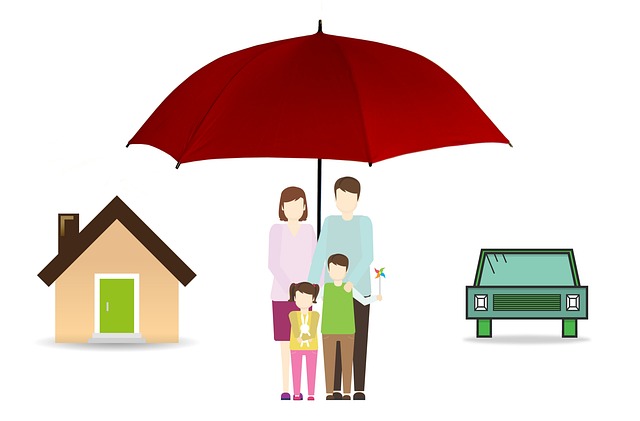

For notaries public, especially those offering mobile services, financial security is paramount to safeguard their assets and hard-earned reputation. Notary Legal Protection, in the form of comprehensive insurance policies, serves as a shield against potential risks and liabilities that could arise during notarization processes. An affordable notary insurance policy can protect notaries from significant financial loss due to errors or omissions, offering peace of mind while they focus on delivering reliable, professional services.

This type of insurance is particularly crucial for mobile notaries who deal with diverse document types and client bases. By ensuring proper coverage, notaries can manage risks effectively, knowing that their business is protected should any unforeseen issues occur. This not only safeguards their personal finances but also reinforces their credibility in the eyes of clients, fostering trust in their services.

Choosing the Right Insurance Policy for Your Notary Practice

When selecting an insurance policy, notaries must consider their specific practice needs and potential risks. Affordable notary insurance options are available that cater to both stationary and mobile notary services, ensuring comprehensive protection for every scenario. Look for policies that offer tailored coverage for error and omission cases, as well as general liability protection against various claims.

Effective notary risk management involves evaluating your practice’s unique exposure to errors and omissions. An ideal insurance policy will provide financial security for notaries, shielding them from the financial burden of unexpected lawsuits or settlements. By prioritizing responsible risk management, notaries can maintain a positive professional reputation while safeguarding their personal and professional assets.

Managing Risks: Effective Notary Risk Management Strategies

Managing Risks: Effective Notary Risk Management Strategies

In the dynamic world of notarization, risks are inherent to the profession. However, with strategic notary risk management, notaries can mitigate potential losses and ensure a robust financial security net. Affordable notary insurance, specifically tailored for mobile notaries, acts as a cornerstone in this risk management strategy. This comprehensive insurance policy for notaries encompasses crucial legal protection against errors and omissions, providing peace of mind and safeguarding their hard-earned assets.

By prioritizing effective notary risk management, professionals can enhance their credibility with clients. The assurance of reliable, professional service instills trust, fostering strong client relationships. Moreover, it enables notaries to focus on delivering accurate services without the constant worry of potential liabilities, ensuring they stay agile and competitive in today’s market.

Safeguarding Your Professional Journey with Comprehensive Liability Protection

In the dynamic landscape of notary services, where every document carries significant weight, protecting your professional journey is paramount. Notary Legal Protection goes beyond basic coverage, offering comprehensive liability protection tailored to meet the unique risks faced by notaries. This includes affordable notary insurance options designed for both stationary and mobile notaries, ensuring financial security regardless of your practice’s footprint.

An Insurance Policy for Notaries isn’t just about mitigating potential losses; it’s a strategic move towards effective notary risk management. By securing thorough notary liability protection, you safeguard your professional reputation and ensure clients trust remains unwavering. This peace of mind allows you to focus on what you do best—notarizing documents with precision and accuracy while navigating the intricate world of legal documentation.

Notary insurance is more than just a safety net; it’s an investment in your professional integrity and stability. By securing adequate coverage, notaries can mitigate risks, protect their financial assets, and maintain client trust. In today’s digital age, where legal documents are more accessible but no less critical, having the right insurance policy acts as a shield against potential errors, omissions, and liabilities. With comprehensive Notary Legal Protection, you can continue your professional journey with confidence, knowing that your practice is shielded from unexpected pitfalls.