- Income Tax E-Filing: Unlocking Efficiency and Security

- Why Easy Tax Filing Matters for Every Individual

- Online Tax Forms: Streamlining the Collection of Data

- Tax Refund Tracking: Real-Time Updates at Your Fingertips

- The Benefits of Secure Online Tax Filing for Sensitive Information

- Navigating Self-Employed Tax Filing with Digital Assistance

- Empowering Taxpayers: Key Features of Modern Online Services

Income Tax E-Filing: Unlocking Efficiency and Security

Income Tax e-filing has emerged as a game-changer for individuals and self-employed taxpayers, offering unprecedented efficiency and security in managing their tax obligations. By utilizing specialized online tax software, filers can effortlessly navigate through complex tax forms, ensuring accuracy from the comfort of their homes. This digital approach streamlines the entire process, from inputting personal information to calculating taxable income and deductions using readily available online tax calculators.

One of the key advantages is the ability to access and complete tax forms digitally, eliminating the hassle of collecting and organizing paper documents. Taxpayers can simply log in to their chosen platform, fill out the required fields, and even scan or upload necessary supporting documents, making the entire experience incredibly user-friendly. Additionally, real-time tax refund tracking features provide transparency and peace of mind, allowing individuals to monitor their progress and stay informed about any updates or changes. This modern approach to income tax e-filing ensures a secure online transaction, safeguarding sensitive financial data while enabling quick and efficient tax filing assistance.

Why Easy Tax Filing Matters for Every Individual

For every individual, easy tax filing is a crucial aspect of managing personal finances. The traditional paper-based tax filing process can be cumbersome and time-consuming, often requiring extensive record-keeping and manual calculations. With the advent of online tax preparation software, this landscape has drastically changed. Income tax e-filing offers a streamlined approach, allowing taxpayers to complete their returns with minimal effort. By simply providing necessary information and accessing digital tax forms, individuals can ensure accurate reporting, thereby reducing the risk of errors that may lead to audits or penalties.

Moreover, online tax filing platforms provide immediate benefits like real-time tax refund tracking. This feature empowers taxpayers, especially those who are self-employed or have complex financial situations, by offering transparency and control over their finances. Easy tax filing also saves valuable time, which can be better utilized for other important aspects of life. With the help of integrated tax calculators, individuals can understand their tax potential and explore various deductions, potentially increasing their refunds. In essence, embracing secure online tax filing methods ensures compliance, convenience, and peace of mind for every taxpayer.

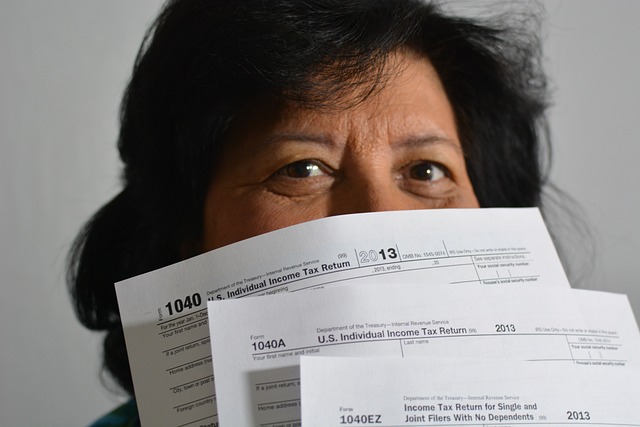

Online Tax Forms: Streamlining the Collection of Data

Online tax forms have transformed the way individuals gather and submit their income tax data. These digital platforms offer a streamlined approach by consolidating various tax forms into one convenient location, simplifying the process for both employees and self-employed individuals. With just a few clicks, users can access and fill out required tax forms, eliminating the need for manual paper work and reducing errors caused by illegible handwriting or missing information.

By utilizing online tax forms, taxpayers can ensure accurate reporting of their income, deductions, and credits. The platforms often feature intuitive design elements, making it easy to navigate through different sections and accurately input financial data. Moreover, many e-filing software providers offer real-time validation checks, alerting users to any potential discrepancies or missing fields before submitting their taxes, thus enhancing the overall accuracy of the process. This not only facilitates efficient tax preparation but also contributes to a smoother experience for both taxpayers and tax professionals, ensuring timely filing and easy tracking of tax refunds.

Tax Refund Tracking: Real-Time Updates at Your Fingertips

Taxpayers can bid farewell to the tedious process of waiting for their tax refunds with tax refund tracking features offered by online tax preparation software. These tools empower individuals to monitor the status of their returns in real-time, providing peace of mind and eliminating the need for frequent follow-ups with tax authorities. By simply logging into their account, users can access up-to-date information about their refund’s progress, from submission to approval. This level of transparency is particularly beneficial for those who rely on accurate income tax e-filing to receive their hard-earned money promptly.

The convenience extends beyond tracking; many platforms offer seamless integration with banking systems, enabling direct deposit of refunds. For self-employed individuals or those with complex tax situations, this modern approach to easy tax filing simplifies a once-daunting task. Online tax forms are readily available, and some software even provides dedicated assistance for specific tax scenarios, ensuring that users receive the most accurate returns possible while navigating the intricacies of self-employed tax filing.

The Benefits of Secure Online Tax Filing for Sensitive Information

Online tax preparation offers a secure and convenient way to handle sensitive income tax information. When using reputable tax filing software, your data is encrypted and protected, ensuring privacy during the entire process. This is especially beneficial for self-employed individuals who often deal with complex tax scenarios and multiple revenue streams. With online tax forms readily available, you can input your financial details accurately and efficiently, reducing the risk of human error.

The ease of secure online tax filing allows taxpayers to avoid the hassle of visiting physical locations or employing traditional paper-based methods. Tax refund tracking becomes a seamless experience, as these platforms provide real-time updates, keeping you informed about the status of your return. This transparency empowers individuals to stay on top of their finances and make informed decisions regarding their tax obligations.

Navigating Self-Employed Tax Filing with Digital Assistance

For self-employed individuals, navigating income tax e-filing can be a complex task due to the unique nature of their income streams and deductions. However, digital assistance has transformed this process into an easier, more manageable one. Online tax forms are designed to accommodate the specific needs of freelancers, allowing them to input detailed information about their business expenses, revenue, and various deductions. This streamlined approach ensures accurate reporting while simplifying the task of compiling necessary documents.

The benefits extend beyond ease of use; online tax filing platforms offer robust tax refund tracking features. Taxpayers can monitor their refund status in real-time, enhancing transparency and peace of mind. Moreover, secure online tax filing guarantees the safety of sensitive financial data, a crucial aspect for self-employed individuals who handle various transactions throughout the year. This combination of accessibility and security makes digital assistance an attractive and effective solution for managing self-employed tax filing obligations.

Empowering Taxpayers: Key Features of Modern Online Services

Modern online tax preparation services have transformed the way individuals interact with their tax obligations, empowering them in several significant ways. One of the key features is the ease of income tax e-filing. Taxpayers can now submit their returns electronically, eliminating the need for paper forms and manual filing. This process not only saves time but also reduces errors commonly associated with handwritten documents. Online platforms often include intuitive online tax forms that guide users through the step-by-step process, ensuring even those without a tax background can navigate it successfully.

Additionally, these services offer valuable tools like tax refund tracking, allowing taxpayers to monitor the status of their returns in real-time. This transparency is particularly beneficial for individuals seeking self-employed tax filing assistance, as they can stay updated on potential delays or adjustments. Many platforms also incorporate easy tax filing calculators, providing instant insights into possible refunds or additional deductions, which can further optimize tax returns. With data security a paramount concern, modern online services employ robust encryption to safeguard sensitive financial information, ensuring a secure online tax filing experience.

Online tax preparation has not only transformed the way individuals manage their taxes but also empowered them with efficiency and convenience. By leveraging technology, taxpayers can streamline income tax e-filing, access easy tax filing solutions, and take advantage of online tax forms for a seamless experience. Tax refund tracking becomes effortless with real-time updates, while secure online tax filing protects sensitive information. Moreover, digital assistance aids self-employed individuals in navigating complex tax obligations. Embracing these modern online services not only saves time but also ensures accurate tax compliance, making it an indispensable tool for efficient tax management.