Online tax preparation has transformed the way individuals tackle their tax obligations. Leveraging tax filing software, you can now file taxes electronically, ensuring accuracy and compliance. These platforms offer features like online tax calculators, digital tax forms, and real-time refund tracking, simplifying a once complex process. By understanding available deductions and embracing e-filing, taxpayers can meet deadlines promptly and maximize refunds. This innovative approach not only saves time but also provides a secure and efficient method to manage taxes, especially beneficial for self-employed individuals seeking convenient tax filing assistance.

- The Rise of Digital Tax Preparation: A Game-Changer for Individuals

- Streamlining Tax Filing: Benefits of Using Online Tax Software

- Calculating Savings: How Online Tools Can Boost Your Refund

- Real-Time Tracking: The Convenience of E-Filing for Tax Refunds

- Security and Peace of Mind: Safeguarding Your Tax Information Online

- Who Can Benefit? Exploring Online Tax Filing for Self-Employed Individuals

The Rise of Digital Tax Preparation: A Game-Changer for Individuals

The digital transformation has brought about a significant shift in how individuals approach their income tax e-filing. Online tax preparation platforms have emerged as game-changers, simplifying the once complex and time-consuming task of filing taxes. These innovative tools empower taxpayers, especially those who are self-employed or require specialized tax filing assistance, to navigate the process with ease. By offering easy tax filing options, these platforms demystify tax laws and regulations, enabling users to understand their tax obligations better.

With intuitive interfaces, online tax forms become accessible, allowing individuals to input their financial information accurately. Advanced features like integrated tax calculators provide immediate feedback on potential refunds or required payments, making tax preparation a breeze. Moreover, the ability to track tax refund status in real-time adds convenience and peace of mind, ensuring taxpayers stay informed throughout the process. This modern approach to tax preparation not only facilitates prompt compliance but also enhances the overall experience, transforming what was once a tedious task into a manageable and efficient procedure.

Streamlining Tax Filing: Benefits of Using Online Tax Software

Online tax software has transformed the once cumbersome task of preparing and filing income tax returns into a streamlined process. By utilizing these platforms, individuals can significantly simplify their tax filing journey. One of the key advantages is the accessibility of online tax forms, eliminating the need for manual searching and sorting through piles of paperwork. This digital approach not only saves time but also reduces the potential for errors often associated with handwritten forms.

Additionally, these software solutions offer easy-to-use tax calculators, enabling taxpayers to quickly estimate their refund or liability. The ability to track tax refund status in real-time further enhances the convenience. For self-employed individuals or those with complex financial situations, online tax filing provides a much-needed solution, ensuring accurate and secure e-filing of taxes. This innovative approach to tax preparation and assistance empowers taxpayers to manage their finances more efficiently.

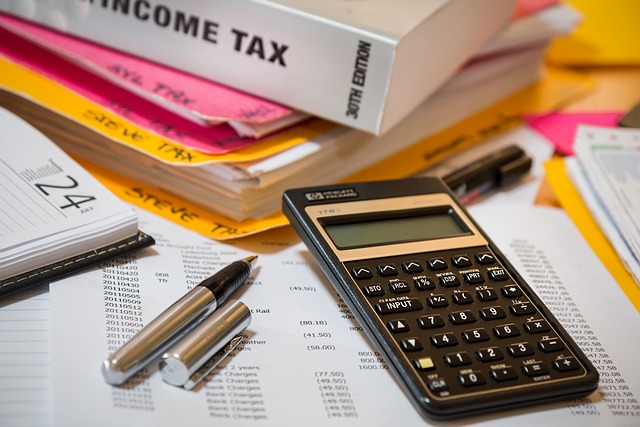

Calculating Savings: How Online Tools Can Boost Your Refund

Online tax preparation software offers significant advantages when it comes to maximizing your tax refund potential. One of the key benefits is the availability of built-in calculators that accurately estimate your refund based on your income, deductions, and credits. These tools make it easy for taxpayers, especially those who are self-employed or have complex financial situations, to calculate their savings in real time. By inputting relevant data into the online tax forms, users can quickly identify areas where they may be eligible for deductions, such as education expenses, charitable donations, or business-related costs.

Furthermore, secure online tax filing platforms provide a convenient way to track your tax refund status. With just a few clicks, taxpayers can access updates on their returns, ensuring transparency and peace of mind. This level of accessibility is particularly beneficial for those who have multiple sources of income or are unaware of specific tax laws, as it offers much-needed assistance in navigating the intricate process of income tax e-filing.

Real-Time Tracking: The Convenience of E-Filing for Tax Refunds

Real-Time Tracking: The Convenience of E-Filing for Tax Refunds

The convenience of e-filing income tax returns offers taxpayers a significant advantage: real-time tracking of their tax refund status. With just a few clicks, individuals can access online platforms that provide up-to-date information on the progress of their tax return. This feature is particularly beneficial for self-employed individuals or those with complex tax situations who require additional tax filing assistance. By eliminating the need for lengthy waiting periods and paperwork, e-filing streamlines the entire process.

Online tax forms and calculators make easy tax filing a reality, ensuring accurate calculations and timely submissions. Taxpayers can bid farewell to the hassle of manual filling and rushing to meet deadlines. Secure online tax filing guarantees that sensitive financial information remains protected, fostering trust in the digital process. This modern approach to managing taxes not only saves time but also empowers individuals to take control of their financial obligations efficiently.

Security and Peace of Mind: Safeguarding Your Tax Information Online

When it comes to online tax preparation, security and peace of mind are paramount. Taxpayers often worry about the safety of their sensitive financial information when filing electronically. However, reputable tax filing software employs robust encryption technologies and secure data storage practices to safeguard personal and income tax e-filing details. These platforms adhere to strict privacy protocols, ensuring that your tax forms, calculations, and refund information remain confidential. With digital tax filing, you can rest easy knowing that your records are protected from unauthorized access, making the process not only easy but also secure.

Many online tax preparation tools offer two-factor authentication, regular security updates, and data backup systems, providing an extra layer of protection for your tax documents. This advanced security infrastructure is particularly beneficial for self-employed individuals who deal with a variety of financial transactions and need reliable tax filing assistance. By choosing a secure platform, you gain access to real-time tax refund tracking capabilities, allowing you to monitor the status of your return conveniently and with peace of mind.

Who Can Benefit? Exploring Online Tax Filing for Self-Employed Individuals

Online tax preparation software offers significant advantages for self-employed individuals navigating complex tax obligations. This demographic often deals with unique financial scenarios, including varying income streams, business expenses, and potential deductions. By utilizing tax filing platforms tailored to their needs, self-employed folks can streamline the process of preparing and submitting their income tax e-filing. These tools provide an easy tax filing experience by offering intuitive interfaces that guide users through relevant forms and calculations.

Self-employed tax filing benefits from the integration of online tax forms, tax calculators, and digital document storage. This accessibility allows entrepreneurs to organize their financial records more efficiently, ensuring they have all necessary information at their fingertips. Furthermore, secure online tax filing platforms offer peace of mind by safeguarding sensitive data. With real-time tax refund tracking, these individuals can stay informed about the status of their returns, promoting timely decision-making and better financial management.

Online tax preparation has not only made navigating complex tax codes more accessible but also empowered individuals to take control of their financial obligations. By embracing digital solutions for income tax e-filing, easy tax filing processes, and secure online tax filing, taxpayers can save time, boost refund potential with calculated deductions, and track progress in real-time. This modern approach, especially beneficial for self-employed individuals seeking reliable tax filing assistance, ensures compliance while simplifying the entire tax preparation journey.