Small and medium-sized enterprises (SMEs) are demanding flexible auto insurance policies tailored to their unique operational challenges. This shift is driven by modern entrepreneurs and fleet managers who recognize that one-size-fits-all commercial auto insurance may not be sufficient. Insurers are responding with customizable policies that cater to specific business needs, such as fleet management and specialized equipment protection. By adopting these flexible policies, businesses gain comprehensive coverage options, reducing potential financial setbacks and ensuring operational continuity in an evolving market.

Commercial auto coverage is transforming the way businesses protect their assets on the road. Designed for fleet vehicles and delivery vans, this specialized insurance goes beyond standard policies by offering tailored protections for unique business needs. Recent market insights highlight a growing demand for flexible, business-focused solutions, signaling a shift towards more adaptable insurance models. By understanding the distinct benefits of commercial auto coverage—from custom parts and equipment protection to streamlined claims processes—business owners can enhance operational continuity and mitigate risks effectively. This article guides you through these essential aspects, helping you make an informed decision that supports your business’s growth.

- Understanding Commercial Auto Coverage: What Sets It Apart?

- Benefits for Fleet Vehicles and Delivery Vans

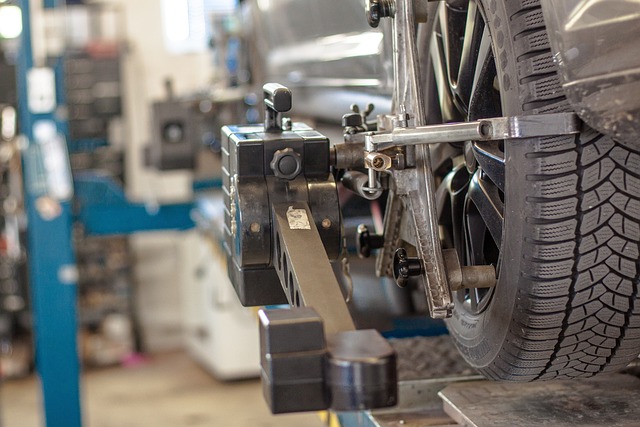

- Custom Parts and Equipment Protection

- Market Trends: The Growing Demand for Flexible Policies

- Why Upgrading Your Auto Insurance is a Smart Business Move

- Key Considerations for Choosing the Right Coverage

Understanding Commercial Auto Coverage: What Sets It Apart?

Benefits for Fleet Vehicles and Delivery Vans

Custom Parts and Equipment Protection

Market Trends: The Growing Demand for Flexible Policies

The recent market trends reveal a noticeable shift in demand for flexible and tailored auto insurance policies among businesses. This surge can be attributed to the evolving needs of modern entrepreneurs and fleet managers who require coverage that adapts to their unique operational challenges. With an increasing number of small and medium-sized enterprises (SMEs) taking to the road, there is a growing recognition that one-size-fits-all commercial auto insurance may not provide the necessary protection for specialized vehicles and equipment.

As such, insurers are responding by offering more customizable policies that cater to specific business requirements. This trend reflects a forward-thinking approach in the industry, aligning with the dynamic nature of small businesses and their diverse needs on the road. By embracing flexibility, insurance providers can better serve their clients, ensuring peace of mind and operational continuity for businesses navigating today’s competitive landscape.

Why Upgrading Your Auto Insurance is a Smart Business Move

Upgrading your auto insurance policy can be a strategic business move for several reasons. Firstly, commercial auto coverage offers tailored protection for diverse business needs, from fleet management to specialized equipment. This ensures that your unique operational risks are addressed with precision. With the current market trend showing increased demand for flexible policies, now is an opportune time to reassess and optimize your insurance strategy.

By upgrading, you gain access to comprehensive coverage options, including custom parts and equipment protection, which can significantly mitigate potential financial setbacks. This proactive approach allows business owners to focus on growth and efficiency, knowing their assets and operations are safeguarded against unforeseen circumstances. Embracing this change ensures your business remains agile and resilient in an ever-evolving market.

Key Considerations for Choosing the Right Coverage

When choosing the right commercial auto coverage, consider these key factors:

1. Your Business Needs: Evaluate your specific business activities and fleet requirements. Different vehicles require distinct coverage levels; for instance, delivery vans may need more liability protection than a single fleet car. Understanding your unique operational needs ensures you’re not over- or underinsured.

2. Risk Assessment: Analyze potential risks associated with your operations. This includes driving conditions, vehicle age and condition, and the nature of cargo carried. For example, if your business involves transporting valuable goods, consider additional coverage for cargo protection against theft or damage. Assessing these risks allows you to tailor a policy that addresses your most pressing concerns.

Commercial auto coverage is not just a necessity; it’s an investment in your business’s smooth and secure operation on the road. With a growing market demand for flexible policies, now is the opportune time to review and upgrade your insurance plan. By understanding what sets commercial coverage apart—from custom parts protection to fleet management—you can choose the right policy to keep your business humming along without unexpected speed bumps.