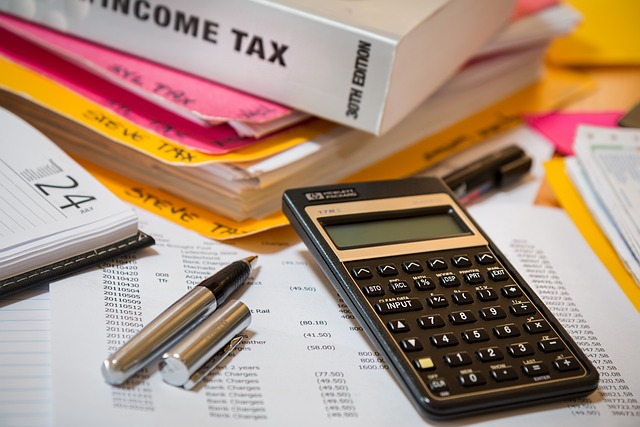

Effective tax planning stands as a cornerstone for individuals and small businesses alike, offering strategies to not only minimize income tax but also maximize savings. By embracing tax-saving tips and judiciously utilizing tax-advantaged accounts such as IRAs and 401(k)s, both current and future financial well-being can be significantly bolstered. As we delve into retirement years, the importance of tax-efficient investments becomes paramount, providing a dual advantage of safeguarding wealth while immediately reducing tax burdens. This article is designed to guide readers through the complexities of tax planning, from the basics of income tax reduction to the sophisticated strategies for high-income earners. We will navigate retirement tax planning, wealth management tax strategies, and small business tax planning considerations, ensuring that readers are well-armed with the knowledge to adapt to changes in tax laws and leverage every available deduction and credit. Join us as we explore a comprehensive approach to optimizing your taxes for a secure financial future.

- Mastering Tax-Saving Tips to Minimize Income Tax and Maximize Savings

- Strategies for Utilizing Tax-Advantaged Accounts like IRAs and 401(k)s

- Navigating Retirement Tax Planning with Tax-Efficient Investments

- Essential Wealth Management Tax Strategies for Long-Term Security

- Advanced Tax Optimization Strategies for High-Income Earners

- Small Business Tax Planning: Key Considerations for Entrepreneurs

- Staying Ahead: Adapting to Changes in Tax Laws and Leveraging Deductions and Credits

Mastering Tax-Saving Tips to Minimize Income Tax and Maximize Savings

Incorporating tax-saving tips into your financial strategy is a pivotal step towards minimizing income tax and maximizing savings. High-income earners, in particular, can benefit from a well-crafted tax optimization plan that takes advantage of the full spectrum of available deductions and credits. By staying abreast of the latest tax laws, these individuals can effectively structure their finances to reduce their taxable income. A key component of this approach is the utilization of tax-efficient investments. These not only contribute to wealth accumulation over time but also offer immediate tax advantages. For instance, contributing to traditional IRAs and 401(k)s can significantly lower adjusted gross income, a direct factor in determining one’s final tax liability. Similarly, for small business owners, understanding the nuances of business-related deductions can lead to substantial savings. The choice between traditional and Roth accounts must be made with an eye on current tax rates versus anticipated future rates. In retirement tax planning, the focus shifts towards drawing down these accounts in a manner that minimizes taxes, often involving strategic decisions about when to take distributions from tax-deferred accounts. Wealth management tax strategies for retirees also involve converting taxable accounts to Roth IRAs if it makes sense from a tax perspective, thus creating a tax-free income stream and further optimizing one’s tax situation in retirement. By meticulously planning and continuously adapting to tax law changes, individuals can effectively manage their taxes throughout different life stages, ensuring that they are not overpaying the IRS and are making the most of their hard-earned money.

Strategies for Utilizing Tax-Advantaged Accounts like IRAs and 401(k)s

For individuals looking to optimize their income tax reduction, strategic utilization of tax-advantaged accounts like IRAs and 401(k)s is paramount in tax optimization strategies. Contributing to these accounts not only fosters savings for retirement but also offers immediate tax benefits. High-income earners, in particular, can benefit significantly from maximizing contributions to these accounts, as the pre-tax dollars invested can result in a substantial reduction of their taxable income. It’s advisable to contribute as early as possible to take full advantage of compound interest and tax deferral. For those approaching retirement age, transitioning to tax-efficient investments becomes crucial. These investments are designed to minimize taxes on income and capital gains, thereby safeguarding future wealth. Small business owners can also leverage these accounts for themselves and their employees, which can be a powerful tool in their comprehensive tax planning. Wealth management tax strategies often involve a mix of tax-deferred and tax-free accounts, allowing for flexibility and control over the timing and amount of taxes paid. Staying abreast of changing tax laws is essential, as tax deductions and credits can shift, affecting the optimal approach to retirement tax planning. By engaging in proactive tax planning, individuals and small business owners can ensure they are making informed decisions that align with their long-term financial goals.

Navigating Retirement Tax Planning with Tax-Efficient Investments

Engaging in tax optimization strategies is a prudent approach for those approaching retirement, as it allows for the preservation and enhancement of wealth while minimizing the impact of income tax. By carefully selecting tax-efficient investments, retirees can significantly reduce their tax burden. These investments are designed to offer both favorable tax treatment on earnings and the ability to defer taxes until required minimum distributions (RMDs) are mandated. For instance, Roth IRAs and Roth 401(k)s provide after-tax dollars with tax-free growth and withdrawals, which can be particularly advantageous for high-income earners who anticipate being in a higher tax bracket during retirement.

In addition to individual investment choices, small business owners have unique opportunities to engage in tax planning for high-income earners through defined benefit plans or SEP IRAs, which can contribute substantial amounts and offer significant tax deductions. Wealth management tax strategies are not one-size-fits-all; they require a tailored approach that takes into account the individual’s financial situation, investment horizon, and evolving tax laws. Staying abreast of these changes is critical, as tax laws can shift, offering new avenues for income tax reduction or closing loopholes that were previously utilized. By leveraging tax-saving tips and understanding how to allocate assets among various tax-advantaged accounts, retirees can create a more secure financial future and enjoy the fruits of their labor with less tax concern.

Essential Wealth Management Tax Strategies for Long-Term Security

Effective wealth management tax strategies are pivotal for long-term financial security, particularly for high-income earners and small business owners. By employing tax-saving tips tailored to individual circumstances, these strategies can lead to substantial income tax reduction, optimizing one’s after-tax income. For instance, maximizing contributions to tax-advantaged accounts like Individual Retirement Accounts (IRAs) and 401(k)s not only prepares for retirement but also provides immediate tax benefits by reducing taxable income.

Moreover, the selection of tax-efficient investments is a cornerstone of retirement tax planning. These investments are designed to minimize the impact of taxes on investment returns, ensuring that wealth accumulates more effectively and that the burden of tax is deferred until necessary. Staying abreast of the ever-changing tax landscape is crucial for leveraging the full spectrum of deductions and credits available. A proactive approach to tax planning involves a deep understanding of the current tax laws and their implications on one’s financial situation. By implementing a cohesive set of tax optimization strategies, individuals can secure their long-term wealth while navigating the complexities of the tax code, ultimately safeguarding their financial future against the erosive effects of income taxes.

Advanced Tax Optimization Strategies for High-Income Earners

High-income earners have unique opportunities and challenges when it comes to income tax reduction. Advanced tax optimization strategies are critical for these individuals to manage their wealth effectively while complying with tax laws. One effective approach is to diversify income streams, which can include passive income from investments or rental properties, thus spreading out tax liabilities. Utilizing tax-efficient investment vehicles, such as municipal bonds that offer tax-free interest, or specific mutual funds and ETFs known for lower turnover and favorable tax treatments, can also significantly reduce tax burdens.

For high-income earners, particularly those with businesses, small business tax planning is a cornerstone of comprehensive tax optimization strategies. It involves careful consideration of business structures, timing of income and deductions, and strategic use of tax credits and incentives. In this realm, leveraging retirement tax planning through defined benefit plans or SEP IRAs can offer substantial tax deferrals. Additionally, wealth management tax strategies often involve charitable contributions or the establishment of trusts to minimize estate taxes and transfer wealth efficiently. By staying abreast of changes in tax laws and utilizing a team of experienced financial advisors and tax professionals, high-income earners can implement sophisticated tax planning tactics tailored to their individual circumstances, thereby safeguarding their current income and future wealth.

Small Business Tax Planning: Key Considerations for Entrepreneurs

For entrepreneurs, small business tax planning is a critical component of overall financial management. Crafting effective tax-saving tips is an ongoing process that requires a keen understanding of the current tax code and how it affects your business’s bottom line. By carefully categorizing expenses, such as home office deductions or equipment depreciation, businesses can significantly reduce their income tax. Entrepreneurs should leverage tax-efficient investments to not only lower their immediate tax burdens but also to lay the groundwork for a secure financial future. These investments are often part of broader tax optimization strategies that consider the timing and structure of income and deductions to minimize tax liabilities.

Moreover, small business owners must stay abreast of changing tax laws to take full advantage of available deductions and credits. This proactive approach is particularly important for high-income earners who face more scrutiny and potentially higher tax rates. Incorporating tax planning into retirement tax planning is a strategic move that can lead to substantial wealth management tax strategies. By prioritizing tax-advantaged accounts and considering the tax implications of different business structures, small business owners can protect their earnings and ensure a comfortable retirement, all while keeping their tax burden as low as possible. Engaging with a knowledgeable tax professional to navigate these complexities is often an essential step in achieving long-term financial success.

Staying Ahead: Adapting to Changes in Tax Laws and Leveraging Deductions and Credits

stay ahead in the ever-evolving landscape of taxation, individuals and businesses must be proactive in understanding and adapting to changes in tax laws. Tax-saving tips that are effective today may not yield the same benefits tomorrow, as tax regulations can shift with new legislation or economic conditions. Therefore, it is crucial for taxpayers to stay informed about updates and to utilize these changes to their advantage. By keeping abreast of the latest developments in tax laws, high-income earners, as well as small business owners, can strategically plan their financial activities to maximize income tax reduction throughout the year. This includes identifying opportunities for tax-efficient investments that not only benefit future wealth but also offer immediate tax savings.

For those planning for retirement, tax optimization strategies should be a cornerstone of wealth management tax strategies. Retirement tax planning is particularly sensitive to the tax implications of various investment vehicles and retirement accounts, such as IRAs and 401(k)s. These tax-advantaged accounts are designed to lower taxable income now while providing tax benefits during retirement. By carefully selecting investment products that align with one’s retirement goals and tax situation, individuals can create a tax-efficient portfolio that minimizes current and future tax burdens. This prudent approach to tax planning ensures that retirees can enjoy the fruits of their labor without unnecessary tax encumbrances.

Effective tax planning is a pivotal component in optimizing one’s financial well-being. By implementing strategic tax-saving tips and capitalizing on the benefits of tax-advantaged accounts such as IRAs and 401(k)s, individuals can substantially reduce their income tax burdens. This proactive approach not only offers immediate tax relief but also contributes to long-term wealth preservation, particularly for those preparing for retirement. The intricacies of tax-efficient investments are crucial for safeguarding future earnings and ensuring that hard-earned savings are protected. Moreover, staying abreast of the evolving tax landscape is vital for seizing every possible deduction and credit. For small business owners and high-income earners, sophisticated tax optimization strategies are indispensable tools in their wealth management arsenal. Embracing these practices underscores a commitment to financial responsibility and fiscal acumen. As the tax environment continues to shift, adaptability and informed decision-making remain key to leveraging tax planning for maximum benefit.