Effective income tax reduction is a cornerstone of financial well-being. By adopting strategic tax planning and employing tax-saving tips, individuals can not only enhance their current income but also prepare for a secure financial future. This article delves into the nuances of tax-efficient investments, particularly in retirement tax planning and small business tax planning, offering actionable insights to maximize savings and minimize tax liabilities. Understanding how to leverage tools like IRAs, 401(k)s, and other tax-advantaged accounts is crucial for high-income earners looking to optimize their tax situation. Moreover, staying abreast of changing tax laws ensures that every deduction and credit is utilized to its full potential, safeguarding personal wealth over the long term through comprehensive wealth management tax strategies.

- Maximizing Income and Minimizing Tax Burdens with Strategic Tax Planning

- Leveraging Tax-Saving Tips for Immediate and Future Financial Health

- Navigating Retirement Tax Planning: Prioritizing Tax-Efficient Investments

- Effective Tax Optimization Strategies for High-Income Earners

- Small Business Tax Planning: Streamlining Operations for Tax Efficiency

- Wealth Management Tax Strategies for Long-Term Financial Security

Maximizing Income and Minimizing Tax Burdens with Strategic Tax Planning

Engaging in strategic tax planning is a pivotal step for individuals and small businesses aiming to maximize income while minimizing tax burdens. By adopting tax-saving tips, such as timing the recognition of income and deductible expenses to align with lower tax brackets, taxpayers can effectively reduce their income tax liabilities. Utilizing tax-efficient investments is another cornerstone of tax optimization; these investments offer both potential growth and tax advantages, such as tax-deferred or tax-exempt status, which can be particularly beneficial within tax-advantaged accounts like IRAs and 401(k)s. For high-income earners, it’s crucial to explore a range of wealth management tax strategies that go beyond the basics, including maximizing contributions to retirement accounts, where earnings often grow tax-free until withdrawal, and employing advanced techniques like trusts or estate planning to further mitigate taxes.

Furthermore, for those nearing retirement, tax planning becomes even more nuanced. The shift from accumulating wealth to distributing it necessitates a reevaluation of investment choices with an eye toward tax efficiency. This includes selecting investments that are favorable within one’s retirement accounts and understanding how required minimum distributions (RMDs) will impact taxable income. Additionally, retirees must consider the tax implications of various income streams, such as Social Security benefits, pensions, and taxable accounts, to ensure a tax-wise approach to their retirement income. Staying abreast of changes in tax laws is indispensable for anyone looking to optimize their tax situation, as new legislation can introduce fresh opportunities for tax savings or close previously available loopholes. By staying informed and making strategic decisions, individuals can effectively manage their taxes throughout their earning years and into retirement, safeguarding their wealth and enhancing their financial security.

Leveraging Tax-Saving Tips for Immediate and Future Financial Health

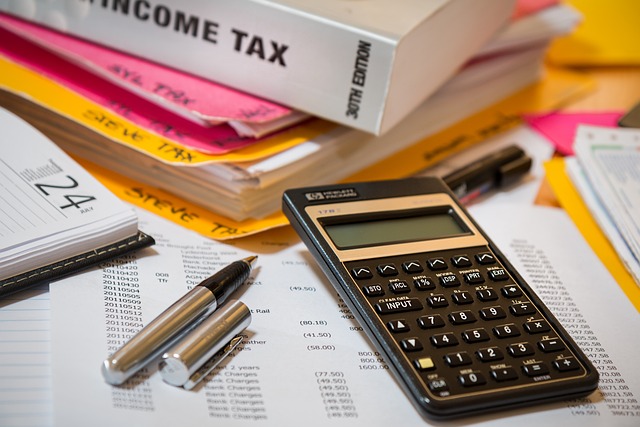

Utilizing tax-saving tips is a pivotal strategy for both small business owners and high-income earners aiming to reduce their income tax. Tax optimization requires a proactive approach, where understanding allowable deductions, credits, and the nuances of the tax code can lead to significant savings. For instance, investing in tax-efficient investments not only aligns with one’s financial goals but also offers immediate tax benefits. These investments, often including bonds and certain types of funds, are designed to minimize tax liabilities while still generating returns. By carefully selecting a portfolio that maximizes these advantages, individuals can enhance their current financial health while simultaneously laying the groundwork for a more secure future. In addition to immediate gains, long-term wealth management tax strategies must be considered. This involves planning for retirement with tax-advantaged accounts like IRAs and 401(k)s, which provide substantial tax deferrals. For those in their peak earning years, maximizing contributions to these accounts can lead to a considerable reduction in taxable income. Furthermore, understanding the intricacies of tax planning, such as the timing of income and deductions, is crucial for optimizing one’s tax situation. High-income earners, in particular, may benefit from specialized tax planning services that take into account their unique financial circumstances, ensuring they navigate the complexities of tax laws to their advantage. By integrating these tax optimization strategies into one’s overall financial plan, individuals can effectively reduce their tax burdens and enhance both their current and future financial health. Staying abreast of changes in tax laws is a continuous task that requires diligence and expertise, ensuring that every possible deduction and credit is utilized to its fullest potential.

Navigating Retirement Tax Planning: Prioritizing Tax-Efficient Investments

As individuals approach retirement, the focus of their financial strategy often shifts to preserving and managing their wealth effectively. A crucial aspect of this process is incorporating tax-efficient investments into one’s portfolio. By selecting investment vehicles that offer favorable tax treatments, retirees can not only safeguard their savings but also potentially reduce their tax burden, thereby increasing their net income during a period when stable cash flow is particularly important.

For high-income earners, in particular, the implementation of robust tax optimization strategies becomes even more imperative. These individuals often face higher rates on both ordinary income and investments. To mitigate this, small business owners and self-employed individuals must leverage tax-saving tips that are tailored to their unique financial situation. This includes contributing to tax-advantaged accounts such as IRAs and 401(k)s to the fullest extent possible, utilizing Roth options where available, and considering the tax implications of different asset allocations. Additionally, staying abreast of changes in tax laws is essential, as these can offer new opportunities for income tax reduction. By engaging in proactive retirement tax planning and aligning investments with personalized wealth management tax strategies, individuals can significantly enhance their financial security while optimizing their tax liabilities throughout retirement. Engaging a tax professional to navigate these complexities can provide clarity and ensure that one’s portfolio is as tax-efficient as possible, thereby contributing to a more secure and enjoyable retirement.

Effective Tax Optimization Strategies for High-Income Earners

High-income earners have unique challenges when it comes to tax optimization. Effective tax-saving tips for this demographic involve strategic planning to reduce income tax while maximizing investment growth. One pivotal approach is to engage in tax-efficient investments, which are designed to minimize the impact of taxes on investment returns. These may include municipal bonds that offer tax-free interest or carefully selected mutual funds and exchange-traded funds (ETFs) with lower turnover rates to avoid capital gains taxes. Additionally, high earners should consider the tax implications of their charitable contributions, as these can provide significant deductions if structured correctly.

For small business owners among the high-income bracket, careful small business tax planning is essential. Utilizing deductions for business expenses, health insurance premiums, and retirement contributions can significantly reduce taxable income. It’s also advantageous to consider the different structures of businesses, such as S corporations or limited liability companies (LLCs), which may offer favorable tax treatments. Furthermore, high-income individuals should employ wealth management tax strategies that encompass both current and future income streams. This includes maximizing contributions to tax-advantaged accounts like IRAs and 401(k)s, as well as exploring Roth options for a more favorable tax treatment in retirement. Staying abreast of changing tax laws is crucial, as they can offer new opportunities for tax optimization strategies. By leveraging these tactics, high-income earners can not only reduce their current tax burdens but also set the stage for tax efficiency in their retirement years.

Small Business Tax Planning: Streamlining Operations for Tax Efficiency

For small businesses, effective tax planning is a cornerstone of financial health, enabling entrepreneurs to navigate the complexities of income tax reduction and capitalize on tax-efficient investments. By implementing strategic tax optimization strategies, small business owners can streamline operations for enhanced tax efficiency. A critical component of this involves understanding the nuances of the tax code as it pertains to businesses, including qualifying for various deductions and credits that can significantly reduce tax liabilities. For instance, careful planning around inventory management and timing of expenditures can yield immediate tax benefits while laying a foundation for long-term financial success. Additionally, small business owners should explore retirement tax planning options early on, such as setting up SEP IRAs or solo 401(k)s, which not only secure their future but also offer substantial income tax reduction opportunities now. Wealth management tax strategies should be tailored to the individual’s situation, with high-income earners paying particular attention to the implications of passive income and the best structures for their investments. By staying ahead of the curve with respect to changing tax laws and utilizing professional guidance, small businesses can ensure they are maximizing their tax-saving tips potential throughout the year, thereby safeguarding their financial interests and enhancing their bottom line.

Wealth Management Tax Strategies for Long-Term Financial Security

Effective tax planning is a cornerstone of long-term financial security, particularly for high-income earners who stand to benefit significantly from strategic tax-saving tips and income tax reduction strategies. Wealth management tax strategies encompass a range of tactics designed to optimize an individual’s or business’s tax position, ensuring compliance with current laws while maximizing savings. By carefully selecting tax-efficient investments, individuals can not only protect their wealth but also enjoy immediate tax benefits, which are crucial for those approaching retirement age. These investments often include traditional and Roth IRAs, 401(k)s, and other retirement accounts that offer tax advantages both now and in the future.

For small business owners, tax planning is an ongoing process that requires a deep understanding of the unique deductions and credits available to them. It’s about more than just reducing the current year’s tax burden; it’s about setting up structures that will benefit the business for years to come. This includes leveraging retirement plans tailored for small businesses, such as SEP IRAs or Solo 401(k)s, and employing advanced strategies like entity structuring and cost segregation for real estate ventures. By integrating these tax optimization strategies into their overall financial plan, business owners can ensure they are not only compliant but also positioned to thrive in a changing economic landscape.

In conclusion, strategic tax planning is a cornerstone for individuals and businesses alike to enhance income and mitigate tax liabilities. By implementing tax-saving tips and capitalizing on tax-advantaged accounts such as IRAs and 401(k)s, one’s taxable income can be substantially reduced. Retirement planning with tax-efficient investments offers a dual advantage: protecting future wealth while enjoying immediate tax savings. High-income earners stand to benefit from tailored tax optimization strategies that consider their unique financial situations. Small business owners can streamline operations for enhanced tax efficiency, ensuring they remain competitive and fiscally sound. Moreover, wealth management tax strategies are pivotal for long-term financial security, allowing individuals to navigate the complexities of tax laws with confidence and clarity. Staying abreast of these ever-evolving tax laws is crucial for maximizing every available deduction and credit, thereby optimizing one’s overall tax position.