When your business encompasses a fleet of vehicles, securing robust and comprehensive insurance is non-negotiable. Opting for top-tier commercial auto insurance not only simplifies your operations with a unified policy but also offers cost-effective solutions that protect your investment. In this article, we explore the significance of the best business auto insurance for fleets, emphasizing how it can mitigate risks and streamline management. Whether you run a delivery service, a construction company, or any other operation relying on multiple vehicles, understanding the nuances of comprehensive coverage and liability protection is key to ensuring your fleet’s smooth operation and peace of mind. We delve into the essential aspects of choosing the right insurance, helping you navigate the market for affordable yet reliable fleet auto insurance options that align with your business needs.

- Maximizing Protection with Top Commercial Auto Insurance for Fleets

- Cost-Effective Solutions: Finding Affordable Commercial Auto Insurance

- Navigating the Market: Choosing the Best Business Auto Insurance for Your Needs

- The Importance of Reliable Fleet Auto Insurance in Fleet Operations

- Understanding Comprehensive Commercial Auto Insurance Coverage Options

- Ensuring Peace of Mind with Liability Coverage for Commercial Vehicles

Maximizing Protection with Top Commercial Auto Insurance for Fleets

When it comes to safeguarding your business’s fleet, opting for the top commercial auto insurance is a strategic move that can significantly enhance your operational resilience. The best business auto insurance policies, which are among the affordable commercial auto insurance options available, are designed with the needs of fleet operators in mind. They offer comprehensive coverage tailored to address the unique risks associated with multiple vehicles on the road. These policies go beyond basic liability coverage for commercial vehicles by providing a robust suite of protections that can include collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. This ensures that in the event of an accident, your fleet’s operations can continue with minimal disruption, as repair costs and potential legal liabilities are covered.

Moreover, the most reliable fleet auto insurance packages are crafted to adapt to the fluctuating demands of your business. They offer flexible options that allow you to customize your policy based on the size and nature of your fleet, the types of vehicles you operate, and the specific risks inherent to your industry. This bespoke approach to coverage not only helps in maximizing protection but also ensures that you are not overpaying for insurance that does not align with your actual needs. With comprehensive commercial auto insurance, businesses can breathe easier knowing that their assets are protected, their employees are secure, and their clients’ trust is maintained. This level of coverage and care is indispensable for delivery services, construction firms, and any other operations that rely heavily on fleet vehicles to conduct business.

Cost-Effective Solutions: Finding Affordable Commercial Auto Insurance

When scouting for top-tier commercial auto insurance that won’t strain your budget, it’s imperative to explore options that offer both affordability and comprehensive coverage. Affordable Commercial Auto Insurance is a cost-effective solution that doesn’t compromise on the quality of protection. Businesses with multiple vehicles can significantly reduce their overhead by opting for a single policy that encompasses all their assets under Best Business Auto Insurance umbrellas. This approach not only simplifies insurance management but also minimizes administrative costs and potential headaches associated with managing multiple policies.

In the market for Commercial Fleet Auto Insurance, the key is to find a balance between cost and coverage. Opting for Reliable Fleet Auto Insurance that includes Comprehensive Commercial Auto Insurance ensures that your vehicles are adequately protected against a wide range of risks. Liability Coverage for Commercial Vehicles is a critical component of any fleet policy, safeguarding your business from financial repercussions should an accident occur. By carefully evaluating different insurers and their offerings, you can secure the most affordable yet robust insurance package that aligns with your company’s specific needs, thereby ensuring smooth operations for your team on the road.

Navigating the Market: Choosing the Best Business Auto Insurance for Your Needs

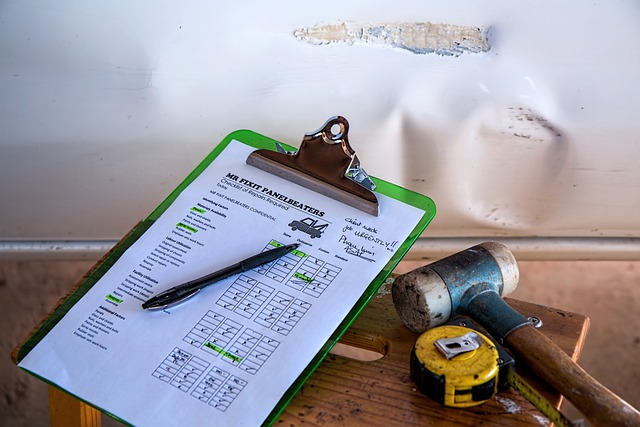

When your business relies on a fleet of vehicles, securing the best commercial auto insurance is paramount to safeguard your operations from unexpected events. Top Commercial Auto Insurance providers offer tailored policies that address the unique needs of your business, ensuring that you have coverage that aligns with the specific risks associated with your fleet’s activities. In the market for Affordable Commercial Auto Insurance, it’s crucial to balance cost and protection; opting for the Best Business Auto Insurance doesn’t necessarily mean breaking the bank. Instead, look for comprehensive policies that offer robust Liability Coverage for Commercial Vehicles, which can protect your business against claims or lawsuits arising from accidents involving your fleet.

A critical aspect of selecting the right policy is understanding the different levels of coverage available. Reliable Fleet Auto Insurance typically includes various components such as bodily injury liability, property damage liability, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. These elements work together to provide a shield for your fleet, ensuring that each vehicle is adequately protected. By carefully evaluating the offerings from leading providers of Comprehensive Commercial Auto Insurance, you can make an informed decision that aligns with your business’s risk profile, budget, and specific operational requirements. This meticulous approach to selecting the best policy not only secures your fleet but also contributes to the long-term financial health and reliability of your business operations.

The Importance of Reliable Fleet Auto Insurance in Fleet Operations

When managing a fleet of vehicles, securing comprehensive commercial auto insurance is paramount. Top Commercial Auto Insurance policies are designed to address the unique needs of businesses with multiple vehicles on the road. These policies not only provide the Best Business Auto Insurance but also ensure that each asset is adequately protected under one umbrella. This integration is crucial for streamlining operations, as it allows for Affordable Commercial Auto Insurance solutions that cover all your bases without breaking the bank. With Reliable Fleet Auto Insurance, businesses can mitigate risks associated with accidents, theft, or natural disasters, which are common concerns for delivery services and construction firms that rely heavily on their vehicles. This type of insurance is a safeguard that enables operations to continue smoothly in the event of unforeseen circumstances, thanks to robust Liability Coverage for Commercial Vehicles that offers financial protection against third-party claims. By choosing a policy that aligns with your fleet’s specific needs, you can drive with confidence, knowing that comprehensive coverage is in place to safeguard your business and keep your operations moving forward.

Understanding Comprehensive Commercial Auto Insurance Coverage Options

When exploring top-tier commercial auto insurance options, it’s crucial to delve into the various coverage levels available under Comprehensive Commercial Auto Insurance. This encompassing policy can be tailored to fit the specific needs of your fleet, offering a robust shield against potential risks. The best business auto insurance packages often include Liability Coverage for Commercial Vehicles, which is designed to safeguard your company from financial repercussions arising from accidents caused by your vehicles. This critical coverage typically includes both bodily injury and property damage liability, ensuring that medical costs and repairs for third-party damages are managed effectively.

Moreover, a comprehensive policy can extend to provide additional protection such as collision coverage, which pays for vehicle repairs after an accident, regardless of fault; and comprehensive coverage, which addresses non-collision related damages like theft, vandalism, or natural disasters. Adequate Uninsured/Underinsured Motorist Coverage is also a prudent addition to your policy, offering protection when other drivers who lack sufficient insurance cause damage to your fleet vehicles. By opting for Affordable Commercial Auto Insurance that doesn’t compromise on coverage quality, you can rest assured that your investment in your fleet remains protected, allowing your business operations to run smoothly without the burden of unexpected costs. Choosing the right blend of coverage options from the Top Commercial Auto Insurance providers will not only demonstrate due diligence but also ensure that your fleet is prepared for a wide array of scenarios. This meticulous approach to insurance management can be the foundation of a reliable fleet auto insurance strategy, integral to the continued success and stability of your business.

Ensuring Peace of Mind with Liability Coverage for Commercial Vehicles

When your business relies on a fleet of commercial vehicles, it’s imperative to secure comprehensive coverage that includes robust liability protection. Top Commercial Auto Insurance policies are designed to offer affordable options for businesses seeking reliable fleet auto insurance solutions. These policies ensure that in the event of an accident or incident involving one of your vehicles, the liability coverage component steps in to safeguard your company against third-party claims and damages. This financial security not only protects your business’s assets but also provides peace of mind, allowing you to focus on your core operations without the added stress of potential legal and financial repercussions.

The Best Business Auto Insurance packages go beyond mere compliance, offering comprehensive coverage that addresses a wide range of exposures inherent in fleet management. A key aspect of these packages is the liability coverage for commercial vehicles, which typically includes bodily injury and property damage liability. This coverage is tailored to meet the specific needs of your business, ensuring that you are protected against claims arising from accidents caused by your drivers. With the Best Business Auto Insurance, you can rest assured that your fleet operations are safeguarded, enabling a smooth and efficient workflow for your team while mitigating the risks associated with commercial driving.

In conclusion, managing a fleet of vehicles necessitates robust insurance solutions to safeguard your investment and operations. Opting for top-tier commercial auto insurance from the plethora of available policies is not just about finding the most affordable option; it’s about selecting the best business auto insurance that provides reliable protection tailored to your specific fleet needs. With comprehensive coverage options and liability protection for commercial vehicles, businesses can navigate the roads with confidence, knowing they are well-prepared for any eventualities. By integrating an understanding of the market and a commitment to cost-effectiveness, businesses can ensure peace of mind and seamless operations, making the best choice in commercial auto insurance for their fleet.