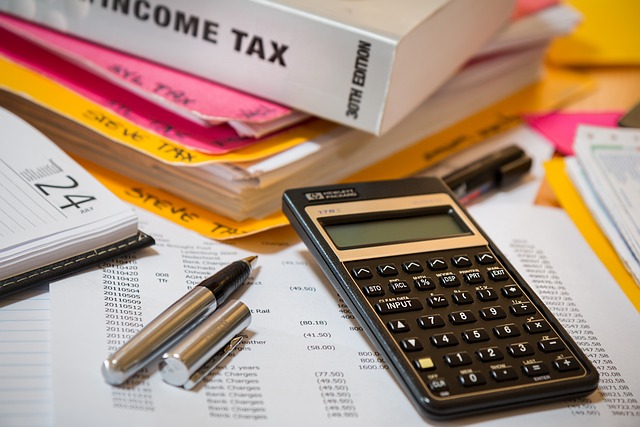

Effective investment tax planning is a cornerstone for enhancing financial growth while navigating the complexities of the tax code. By strategically selecting and timing investments, investors can significantly reduce liabilities and maximize returns. This article delves into the nuances of tax-efficient investment strategies, covering key areas such as Tax Exemption Eligibility as per IRS rules, the advantages of utilizing Roth IRAs and municipal bonds, and proactive measures to avoid IRS Penalties and Interest. It also explores how nonprofit entities can optimize their investment strategies through tax filings and how individuals can leverage changes in the Tax Code to their advantage by adjusting their Filing Status for enhanced tax benefits. Understanding these elements is crucial for any investor looking to align their portfolio with current tax laws, ensuring their financial goals are met with both efficiency and foresight.

- Navigating Tax Exemption Eligibility: Understanding IRS Rules for Tax-Free Income

- Strategic Use of Roth IRAs and Municipal Bonds in Portfolio Diversification

- Mitigating IRS Penalties and Interest through Proactive Tax Planning

- Leveraging Nonprofit Tax Filing Status to Optimize Investment Strategies

- Identifying Tax-efficient Investments Amidst Changing Tax Codes

- Maximizing Returns: Adjusting Filing Status for Optimal Tax Benefits

Navigating Tax Exemption Eligibility: Understanding IRS Rules for Tax-Free Income

Navigating tax exemption eligibility requires a thorough understanding of the Internal Revenue Service (IRS) rules governing tax-free income. Eligible individuals and entities can significantly reduce their tax burden by leveraging specific investment vehicles and nonprofit tax filing statuses that align with the current tax code. For instance, contributing to a Roth IRA allows for after-tax contributions but provides tax-free withdrawals in retirement, assuming eligibility requirements are met. Similarly, municipal bonds often offer tax-exempt income as they are issued by states and local governments to fund public projects. However, it’s crucial to stay updated with tax code changes; these can affect the availability and conditions of tax exemptions. Failure to comply with IRS regulations may result in penalties and interest, further emphasizing the importance of diligent tax planning. Taxpayers should also consider filing status optimization to ensure they are taking advantage of all available legal strategies to minimize their tax liabilities. By evaluating one’s specific financial situation against the backdrop of ever-evolving tax laws, investors can make informed decisions that not only align with their financial goals but also optimize their after-tax returns. Keeping abreast of these rules and adjusting investment strategies accordingly is essential for maintaining tax efficiency and avoiding costly mistakes.

Strategic Use of Roth IRAs and Municipal Bonds in Portfolio Diversification

Mitigating IRS Penalties and Interest through Proactive Tax Planning

Navigating the complexities of the U.S. tax code can be a daunting task for investors, but proactive tax planning is key to mitigating IRS penalties and interest. Understanding one’s eligibility for tax exemption benefits, such as those afforded by nonprofit organizations or Roth IRAs, is crucial. These tax-exempt entities allow for the accumulation of wealth without the erosive effects of annual taxes, which can significantly enhance investment growth over time. For instance, contributions to a Roth IRA are made with after-tax dollars but grow tax-free, providing a substantial advantage during retirement years. Similarly, municipal bonds often offer tax-efficient investments as their income is exempt from federal taxes and, in many cases, state and local taxes as well.

Staying abreast of tax code changes and optimizing filing statuses are strategies that can further reduce tax liabilities. The IRS frequently updates its guidelines, and being proactive ensures that investors do not fall prey to avoidable penalties and interest. By carefully analyzing the potential impact of these changes on investment portfolios, investors can adjust their strategies to remain compliant and tax-efficient. This proactive approach not only safeguards against unexpected financial obligations but also aligns investment decisions with evolving tax laws and personal financial goals. Regularly consulting with a tax professional or financial advisor is essential for maintaining an effective tax planning strategy that adapts to the dynamic nature of the tax code.

Leveraging Nonprofit Tax Filing Status to Optimize Investment Strategies

Nonprofit organizations have a distinct advantage in the realm of investment strategies due to their tax-exempt status. By leveraging the nonprofit tax filing status, these entities can optimize their investment portfolios to align with their financial goals and mission objectives. The Internal Revenue Service (IRS) provides specific guidelines that define eligibility for tax exemption under section 501(c)(3) of the tax code, which includes a broad range of nonprofits such as charitable, religious, and educational organizations. This status not only exempts them from federal income taxes on certain types of income but also allows them to focus on tax-efficient investments that are beneficial for their long-term financial stability.

Navigating the complexities of the tax code is crucial for nonprofits, as changes in tax laws can significantly impact investment returns and operational budgets. Staying abreast of these changes and understanding how they affect tax exemption eligibility is imperative for maintaining compliance and maximizing returns. Nonprofits must carefully consider their investment choices, timing, and the potential tax implications associated with different asset classes. By doing so, they can effectively manage their endowments and operational funds to avoid IRS penalties and interest that could otherwise erode their financial resources. Strategic planning and regular review of investment strategies in conjunction with the nonprofit’s filing status optimization can ensure that these organizations are poised to fulfill their missions while adhering to the ever-evolving tax landscape.

Identifying Tax-efficient Investments Amidst Changing Tax Codes

navigating the ever-evolving landscape of tax laws requires savvy investors to stay informed about tax-efficient investments and potential changes in the tax code. Understanding one’s eligibility for tax exemption benefits, such as those offered by Roth IRAs or municipal bonds, is crucial. These investment vehicles can offer significant tax advantages, including tax-free income, which is particularly valuable given the IRS’s penalties and interest policies on unpaid taxes. As tax laws are subject to change, investors must regularly assess their portfolios for alignment with current regulations and their filing status optimization. The IRS updates its guidelines periodically, and staying ahead of these changes can mean the difference between maximizing returns and incurring unnecessary taxes. Nonprofit tax filing entities, for instance, must be particularly vigilant, as their tax-exempt status hinges on adherence to stringent reporting requirements. By keeping abreast of tax code changes and actively managing investment choices, including the timing and structure of investments, individuals can strategically minimize liabilities and enhance their overall financial health amidst the shifting sands of tax policy. It’s a proactive approach that demands continuous education and diligent planning to maintain the benefits of tax-efficient investments throughout one’s financial journey.

Maximizing Returns: Adjusting Filing Status for Optimal Tax Benefits

navigating the intricacies of tax law can yield substantial benefits for investors. By carefully selecting and positioning tax-efficient investments within their portfolios, individuals can significantly reduce their tax liabilities. For instance, understanding the eligibility criteria for tax exemption programs like Roth IRAs or the benefits of municipal bonds that are exempt from federal income taxes can be pivotal in tailoring a tax strategy that aligns with one’s financial goals. Moreover, staying abreast of changes in the tax code is crucial as these alterations can affect both the opportunities and limitations for optimizing tax outcomes.

Individuals should also consider the impact of their filing status on their overall tax situation. The IRS provides specific guidelines that determine how marital status can influence tax obligations, and certain filing statuses may offer additional advantages or deductions. For those who are part of a nonprofit tax-filing entity, the nuances of reporting and withholding become even more complex. It is imperative to understand these dynamics to leverage the full scope of legal benefits available. Failure to do so could result in IRS penalties and interest, which can erode investment returns. By regularly reviewing and adjusting investment strategies to reflect one’s current filing status and the latest tax laws, investors can ensure that they are positioned to maximize their returns while minimizing their tax liabilities. This proactive approach not only safeguards against potential penalties but also ensures that an investor’s financial plan remains aligned with their evolving objectives and the ever-shifting landscape of the U.S. tax code.

navating the complexities of investment tax planning is key to optimizing returns and managing liabilities effectively. This article has highlighted critical strategies, such as understanding Tax Exemption Eligibility as per IRS rules, strategically utilizing Roth IRAs and municipal bonds under the Nonprofit Tax Filing umbrella, and proactively planning to avoid IRS Penalties and Interest. As tax codes evolve, identifying Tax-efficient Investments becomes increasingly important. Adjusting your Filing Status Optimization can also yield significant tax benefits. Regularly reviewing and tweaking your investment strategy ensures you remain aligned with current tax laws and your financial goals, positioning you to capitalize on changes in the Tax Code Changes. By staying informed and agile, investors can make informed decisions that contribute to their long-term financial success.