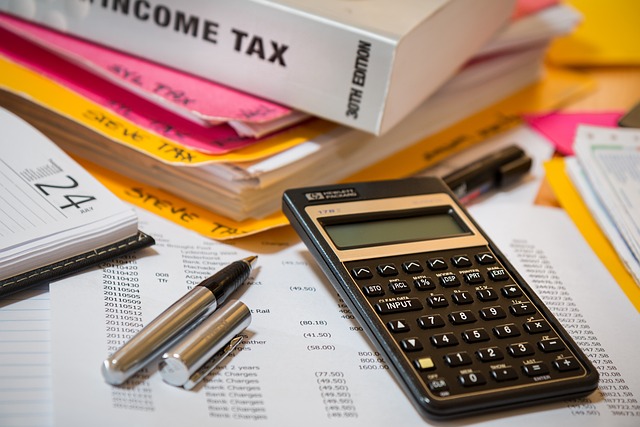

navigator through the complexities of investment tax planning is crucial for enhancing returns and mitigating liabilities. Strategic tax planning not only optimizes your financial portfolio but also ensures alignment with ever-evolving tax laws. This article delves into the nuances of tax exemption eligibility, IRS penalties and interest associated with nonprofit tax filings, and the benefits of leveraging tax-efficient investments such as Roth IRAs and municipal bonds. It also highlights the importance of optimizing your filing status and managing taxable income through savvy investment choices and precise timing to maximize your gains. By staying abreast of tax code changes, you can effectively adapt your strategy for long-term financial success.

- Maximizing Tax Exemption Eligibility: Strategies for Investment Tax Planning

- Navigating IRS Penalties and Interest: The Importance of Timely Nonprofit Tax Filing

- Leveraging Tax-efficient Investments and Adapting to Tax Code Changes for Financial Goals

Maximizing Tax Exemption Eligibility: Strategies for Investment Tax Planning

Navigating the intricacies of investment tax planning is pivotal for investors aiming to maximize their returns while mitigating tax liabilities. A key strategy involves understanding and leveraging tax exemption eligibility, which can be a significant advantage when managing one’s financial portfolio. Tax-efficient investments such as Roth IRAs or municipal bonds often provide tax-free income streams, making them attractive options for investors who wish to minimize their tax burden. To remain eligible for these benefits, it is crucial to adhere to IRS regulations and guidelines.

For instance, contributions to a Roth IRA must be made with after-tax dollars, but withdrawals during retirement are tax-free, provided certain conditions are met. Similarly, municipal bonds often offer tax-exempt income on the interest earned, which is particularly advantageous in high-tax states. To further optimize one’s investment strategy, staying abreast of changes to the tax code and utilizing tools like the IRS Tax Explanation (IRS Pub. 550) is essential. Additionally, selecting the appropriate filing status can yield additional tax savings. Nonprofit tax filing entities should ensure they are in compliance with the latest tax laws to maintain their exempt status and avoid potential IRS penalties and interest. Regularly reviewing and adjusting one’s investment approach in light of these factors can lead to a more tax-efficient portfolio, ultimately aligning with an investor’s financial goals and ensuring they reap the full benefits of available tax exemptions. Nonprofit organizations must also file their taxes appropriately to maintain their nonprofit status and avoid any penalties or interest that may arise from missteps in their filings. By strategically planning investments with an eye on the evolving tax landscape, investors can effectively shield their earnings from unnecessary taxation.

Navigating IRS Penalties and Interest: The Importance of Timely Nonprofit Tax Filing

Navigating the complexities of IRS regulations is critical for nonprofit organizations to maintain their tax-exempt status and avoid costly penalties and interest. The eligibility for Tax Exemption Eligibility hinges on meticulous compliance with the IRS requirements, which includes timely filing of the appropriate Nonprofit Tax Filing forms, such as the Form 990 series. Delays in these submissions can result in the imposition of IRS Penalties and Interest, which can erode the financial resources of even the most well-intentioned nonprofits. To mitigate this risk, organizations must stay abreast of Tax Code Changes, ensuring that their filings are accurate and completed within the prescribed timeframes. This proactive approach not only safeguards against penalties but also reinforces the organization’s credibility with donors, stakeholders, and the public at large.

Moreover, beyond the realm of Nonprofit Tax Filing, individuals and entities alike can benefit from leveraging Tax-efficient Investments. These investments are specifically designed to minimize the impact of taxes, offering a more favorable financial outcome. For instance, Roth IRAs and municipal bonds are commonly used tools for generating tax-free income. Additionally, understanding and optimizing one’s Filing Status Optimization can lead to further tax savings. As Tax Code Changes evolve, staying informed and adjusting investment strategies accordingly is essential to ensure that one’s portfolio remains aligned with current tax laws and financial objectives. This strategic approach to tax planning is indispensable for maximizing returns and minimizing liabilities in an ever-shifting regulatory landscape.

Leveraging Tax-efficient Investments and Adapting to Tax Code Changes for Financial Goals

Investors looking to maximize their returns and minimize tax liabilities should seriously consider the eligibility for tax exemption on certain investments, a key aspect of tax-efficient investment strategies. Roth IRAs and municipal bonds are often highlighted due to their potential to offer tax-free income. These tax-exempt vehicles can play a pivotal role in an investor’s portfolio, especially when planning for long-term financial goals. The Internal Revenue Service (IRS) sets strict guidelines for eligibility, and understanding these can help investors avoid costly IRS penalties and interest. For instance, contributing to a Roth IRA requires adherence to income limits, and early withdrawals from these accounts typically incur taxes and fees. Therefore, it’s crucial to align contributions with financial goals while staying within the established parameters set by the IRS.

Staying ahead of tax code changes is equally important for maintaining a tax-efficient investment approach. The tax landscape can shift dramatically, necessitating adjustments to investment strategies and filing status optimization. Nonprofit tax filing entities, for example, must be vigilant about updates that could affect their tax-exempt status or the deductions they can claim. Similarly, individual investors should monitor how new legislation might impact their tax liabilities, especially as it pertains to capital gains, dividends, and other investment income. By proactively adapting to these changes and continuously reviewing one’s investment strategy, investors can ensure that their portfolios remain aligned with current tax laws and contribute positively to achieving their financial objectives. Regular consultation with a tax professional is advisable, given the complexity of tax codes and the potential for significant tax savings through strategic investment decisions.

In conclusion, effective investment tax planning is a cornerstone of a robust financial strategy. By leveraging tax exemption eligibility, such as through Roth IRAs or municipal bonds, investors can significantly enhance their after-tax returns. Staying abreast of tax-efficient investments and adapting to tax code changes ensures that your portfolio not only meets your financial goals but also remains tax compliant. Moreover, optimizing your filing status and diligently avoiding IRS penalties and interest associated with nonprofit tax filings are critical steps in maintaining a healthy financial standing. As the tax landscape evolves, so too must your investment approach; regular strategy reviews and adjustments are essential to navigate these changes effectively. With careful planning and strategic forethought, investors can secure their financial future while mitigating tax liabilities.