navigating the complexities of commercial auto insurance is a critical task for businesses with fleets. Selecting the best coverage ensures your vehicles are protected against damage and your enterprise is shielded from liability in case of accidents. This article delves into the essentials of securing top-tier commercial auto insurance that aligns with your business’s unique needs, emphasizing the role of comprehensive plans and the importance of affordable options. We will guide you through evaluating market leaders, understanding factors influencing policy costs, and employing strategies to obtain robust liability coverage without overspending. Protecting your assets on the road is not just a legal requirement but a strategic investment in the longevity and financial stability of your business.

- Evaluating Your Business's Unique Needs for Reliable Fleet Auto Insurance

- The Importance of Liability Coverage for Commercial Vehicles in Protecting Your Business

- Assessing the Market: Top Commercial Auto Insurance Providers and Their Offerings

- Factors Influencing the Cost of Affordable Commercial Auto Insurance Policies

- Comparing Comprehensive Commercial Auto Insurance Plans for Optimal Coverage

- Strategies for Selecting the Best Business Auto Insurance without Exceeding Your Budget

Evaluating Your Business's Unique Needs for Reliable Fleet Auto Insurance

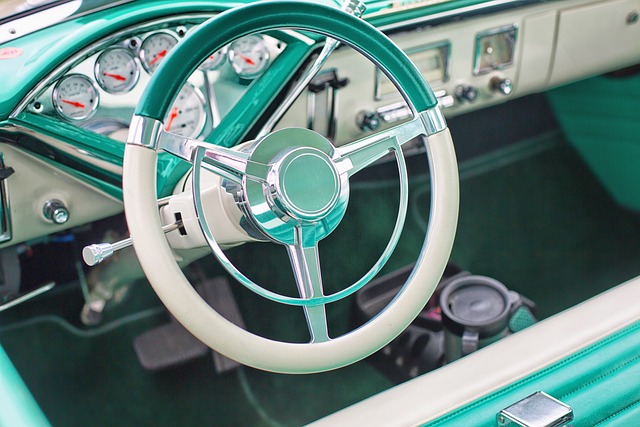

When selecting the top commercial auto insurance for your business, it’s imperative to consider the unique exposures and operational specifics of your fleet. Evaluating your business’s needs begins with understanding the nature of your operations, including the types of vehicles in use, their primary functions, and the routes they travel. For instance, a delivery service with multiple small vans will have different coverage requirements compared to a long-haul trucking operation. The best commercial auto insurance policies are those that offer comprehensive coverage tailored to these specifics. This means not only ensuring that your fleet is protected against physical damage from collisions, theft, or natural disasters but also securing robust liability coverage for commercial vehicles. Such coverage protects your business from third-party claims arising from bodily injury, property damage, or legal costs due to accidents involving your vehicles.

In the pursuit of reliable fleet auto insurance, affordability is a key factor without compromising on essential protections. The most reputable providers in the market offer competitive rates and flexible policy options that align with your business’s budget while providing the level of coverage you need. It’s crucial to assess various quotes and policy details from different insurers to find the best business auto insurance that strikes this balance. A comprehensive policy should cover a wide range of scenarios, including uninsured/underinsured motorist protection, medical payments coverage, and options for additional equipment or cargo. By carefully evaluating your business’s needs and researching providers of affordable commercial auto insurance, you can select a policy that not only safeguards your fleet but also supports the financial health of your business.

The Importance of Liability Coverage for Commercial Vehicles in Protecting Your Business

When your business’ operational backbone is built upon a fleet of commercial vehicles, the importance of robust insurance cannot be overstated. Top Commercial Auto Insurance serves as a financial safeguard against unforeseen events such as accidents, theft, or natural disasters. A key component within this coverage is Liability Coverage for Commercial Vehicles, which shields your business from the repercussions of legal responsibility resulting from vehicle-related damages or injuries to third parties. This coverage is indispensable, as it can protect your assets and your business’s financial stability in the event of a costly liability claim.

In the event of an incident involving your commercial vehicles, having Affordable Commercial Auto Insurance means the difference between maintaining business continuity and facing potential financial hardship. The best Business Auto Insurance policies offer tailored solutions that align with your fleet’s specific needs, ensuring that you are not overpaying for coverage you do not require. With Reliable Fleet Auto Insurance, businesses can opt for Comprehensive Commercial Auto Insurance plans that extend beyond basic liability, providing additional protections such as collision, uninsured motorist coverage, and more. This comprehensive approach to insurance is designed to offer peace of mind, allowing you to focus on your core business activities without the constant worry of what could go wrong on the road. Ensuring that your commercial vehicles are adequately insured with a policy that strikes the right balance between cost and coverage can be one of the most strategic decisions for your business’s long-term success and security.

Assessing the Market: Top Commercial Auto Insurance Providers and Their Offerings

When selecting the top commercial auto insurance, businesses must conduct a thorough assessment of the market to find the most comprehensive and affordable options available. The best business auto insurance policies go beyond mere vehicle damage coverage; they offer robust liability coverage for commercial vehicles, which is indispensable in mitigating financial risks associated with accidents. Companies specializing in reliable fleet auto insurance understand the unique needs of commercial operations and provide tailored solutions that align with budgetary constraints without compromising on essential protections.

In the current market, a handful of providers stand out for their comprehensive coverage and competitive pricing. These top commercial auto insurance providers offer a suite of options designed to safeguard a variety of fleet sizes and types, from small businesses with a few vehicles to large enterprises with extensive fleets. When comparing these providers, it’s crucial to consider the specific needs of your business, such as the type of vehicles used, the nature of your operations, and any additional coverage options you may require, like hired and non-owned auto insurance or on-hook towing and rental reimbursement. By carefully evaluating each provider’s offerings, businesses can select a commercial auto insurance policy that not only meets their current needs but also adapts to future growth and changes in the industry.

Factors Influencing the Cost of Affordable Commercial Auto Insurance Policies

When considering the cost of affordable commercial auto insurance policies, several factors come into play that can influence premium rates. The type and number of vehicles in your fleet are primary considerations. Operators with a larger or diverse fleet may see higher costs due to the increased exposure. The drivers’ records and experience levels also significantly impact pricing; insurers typically offer lower rates for fleets with drivers who have clean driving records and extensive training. Location is another critical factor, as vehicles operated in high-traffic areas or regions with higher accident rates will generally cost more to insure. The type of cargo being transported can also affect rates, with goods that are more susceptible to damage or theft potentially leading to higher insurance premiums.

Coverage limits and options you choose further shape the cost of your policy. Opting for comprehensive commercial auto insurance provides broader protection against a wide range of risks, which can be more expensive than basic liability coverage but is often essential for robust protection. The level of liability coverage for commercial vehicles is particularly important to ensure financial stability in the event of an at-fault accident. Businesses must weigh their specific needs against their budget constraints when selecting coverage limits. Lastly, discounts and additional services offered by insurers can also affect affordability. For instance, installing GPS tracking devices or implementing fleet management programs may lower premiums by enhancing vehicle security and operational efficiency. By carefully evaluating these factors and comparing policies from the top commercial auto insurance providers, businesses can find reliable fleet auto insurance that balances comprehensive coverage with budgetary considerations.

Comparing Comprehensive Commercial Auto Insurance Plans for Optimal Coverage

When your business operates a fleet of vehicles, securing the top commercial auto insurance is paramount to safeguarding your assets. Among the plethora of available policies, Comprehensive Commercial Auto Insurance stands out for its robust coverage options. This type of policy not only shields your vehicles from physical damage but also offers extensive liability coverage for when commercial vehicles are involved in accidents. It’s crucial to compare these plans to find the most comprehensive and affordable option for your business’s unique needs. The best providers tailor their policies to provide reliable fleet auto insurance that strikes a balance between thorough protection and cost-effectiveness. This ensures that your operation can continue smoothly, even in the face of unexpected events on the road. When evaluating commercial auto insurance providers, consider those that specialize in providing affordable Commercial Auto Insurance without compromising on the quality of coverage. The goal is to secure the best business auto insurance that covers all bases, from liability claims to repair costs, at a price point that supports your business’s financial health. By carefully analyzing and comparing these policies, you can select a Comprehensive Commercial Auto Insurance plan that offers optimal coverage for your fleet, providing peace of mind and allowing you to focus on what you do best: running your business.

Strategies for Selecting the Best Business Auto Insurance without Exceeding Your Budget

When in the market for the top commercial auto insurance, it’s essential to balance comprehensive coverage with affordability. The best business auto insurance policies are those that offer robust protection while remaining within your budgetary constraints. To select the most suitable policy, begin by assessing the specific needs of your fleet. Consider the types and numbers of vehicles, their usage frequency, and the risks associated with each vehicle’s purpose. This will help tailor your coverage to your operations, ensuring that you’re not overpaying for unnecessary extras.

Shop around to compare quotes from providers offering affordable commercial auto insurance. Look for carriers that specialize in reliable fleet auto insurance, as they often have the expertise to offer competitive rates without compromising on essentials like comprehensive coverage and liability protection for commercial vehicles. Evaluate each policy’s terms regarding liability limits, deductibles, and coverage exclusions. A policy with higher deductibles might be less expensive monthly but could leave you financially vulnerable in the event of a claim. Ensure that the chosen policy provides adequate liability coverage to protect your business from costly accidents and the associated legal liabilities. By carefully considering your options and prioritizing both coverage and cost, you can secure a reliable and affordable commercial auto insurance policy that safeguards your business’s assets on the road.

In conclusion, securing the top commercial auto insurance is an indispensable move for businesses with fleets on the road. A robust policy not only ensures that your vehicles are covered against damages and losses but also offers critical liability coverage essential for commercial use. The market’s leading providers of such insurance tailor their offerings to meet diverse business requirements, ensuring comprehensive protection at an affordable rate. By carefully evaluating your business’s unique needs and comparing plans, you can select the best business auto insurance without overextending your budget. Investing in reliable fleet auto insurance is a strategic decision that protects your assets and maintains the integrity of your operations, allowing you to navigate the demands of the road with confidence.