Drivers face rising auto repair costs due to complex vehicles and chip shortages, impacting older or high-mileage cars. Collision damage waivers offer financial protection against major accidents, easing the burden on drivers with limited flexibility. Understanding insurance deductibles—the out-of-pocket amount for repairs—is key. Higher deductibles lower premiums but require savings; lower deductibles cost more in premiums but provide better protection. Factors like vehicle make, driving history, coverage extent, and deductible amount influence collision insurance rates. By balancing costs and protection through informed decisions, drivers can safeguard both their vehicles and financial security.

In today’s world, unexpected accidents can lead to substantial financial strain, especially with the escalating costs of vehicle repairs. As a proactive measure, an increasing number of drivers are turning towards auto collision protection, recognizing its importance in safeguarding their finances. This article delves into the growing trend of collision damage waivers and explores various facets of collision insurance. We examine rising repair expenses, dissect the role of deductibles, analyze rate-determining factors, guide readers through coverage comparisons, and emphasize the significance of aligning policies with changing market demands to ensure adequate protection.

- Rising Auto Repair Costs: A Growing Concern

- Collision Protection: Safeguarding Your Finances

- Understanding Insurance Deductibles

- Factors Influencing Collision Insurance Rates

- Comparing Coverage Options for Better Protection

- Ensuring Your Policy Meets Your Needs in a Changing Market

Rising Auto Repair Costs: A Growing Concern

In recent years, the escalating costs of auto repairs have become a significant worry for many drivers. The complexity and sophistication of modern vehicles mean that even minor accidents can result in substantial repair bills. According to industry reports, the average cost of car repairs has increased by nearly 10% over the past decade, outpacing inflation rates. This trend is further exacerbated by the global chip shortage, which has led to longer wait times and higher costs for both new vehicles and their repairs. As a result, drivers are increasingly seeking ways to safeguard themselves from these financial burdens.

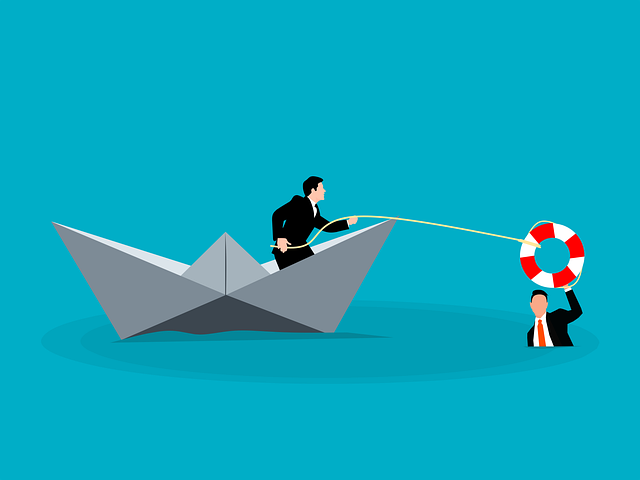

The rising repair costs pose a particular challenge for those with older or high-mileage vehicles, as well as for individuals who may not have the financial flexibility to cover unexpected expenses. Collision damage waivers and similar coverages offer a much-needed safety net, ensuring that drivers are not left with hefty out-of-pocket expenses in the event of an accident. By understanding how these factors influence your insurance premium, you can make informed decisions to better protect yourself and your vehicle’s financial value.

Collision Protection: Safeguarding Your Finances

Collision protection is designed to shield individuals from the significant financial burden that often accompanies auto accidents. When your vehicle suffers damage, whether due to a fender bender or a more severe collision, the costs can mount quickly. Repair shops charge varying rates for parts and labor, and these expenses are not always covered by standard insurance policies. Collision protection fills this gap, ensuring that policyholders are not left with a substantial deductible or unexpected out-of-pocket expenses when their vehicle needs repair.

By opting for collision coverage, drivers can rest assured that their finances will be better protected in the event of an accident. This is especially crucial given the rising costs of vehicle repairs and maintenance. With collision protection, policyholders can focus on recovering from the incident rather than worrying about how to cover the financial hit. It’s a proactive step towards securing peace of mind and ensuring that any unforeseen automotive events don’t leave a lasting impact on one’s financial stability.

Understanding Insurance Deductibles

Insurance deductibles are an important aspect to consider when evaluating your auto collision protection. A deductible is a specified amount, usually in dollars, that you agree to pay out-of-pocket for repairs following an accident. The higher your deductible, the lower your premium, as insurance companies aim to incentivize drivers to take on more financial responsibility. However, this also means you’ll be responsible for covering the initial repair costs up to that deductible threshold.

Understanding deductibles is crucial because it directly affects your out-of-pocket expenses in the event of a collision. Opting for a higher deductible can significantly reduce your monthly premiums, but ensure you have sufficient savings or access to funds to cover potential repairs when needed. Conversely, choosing a lower deductible means a larger premium but provides better financial protection during accidents.

Factors Influencing Collision Insurance Rates

Collision insurance rates are influenced by several key factors, each playing a significant role in determining your premium. The first and perhaps most obvious factor is your vehicle’s make and model. Older or high-performance vehicles often come with higher repair costs, leading to increased insurance rates. Additionally, your driving history plays a crucial part; a clean record typically results in lower premiums, while accidents or moving violations can dramatically raise your rates.

Another critical aspect is the extent of coverage you choose. Comprehensive and collision coverages protect against various incidents, from theft to natural disasters, but they also carry different cost implications. Furthermore, your deductible, the amount you agree to pay out-of-pocket before insurance kicks in, significantly impacts your premium. Opting for a higher deductible can reduce costs, but it means you’ll need to cover more of the repair expenses initially.

Comparing Coverage Options for Better Protection

When comparing coverage options, it’s crucial to understand the extent of protection each provides. Collision insurance, for instance, covers repairs stemming from accidents, while comprehensive insurance steps in for damage caused by events like theft, vandalism, or natural disasters. Deductibles, the amount you pay out-of-pocket before insurance kicks in, can vary significantly between policies. Lower deductibles mean higher premiums, but they also provide peace of mind knowing that your financial burden is lighter in case of an accident.

Taking the time to research and compare different coverage options allows drivers to make informed decisions tailored to their needs. It’s about balancing the potential cost of repairs with the comfort of knowing you’re protected financially should an unexpected event occur.

Ensuring Your Policy Meets Your Needs in a Changing Market

In today’s rapidly evolving market, where vehicle repair costs are on the rise and demand for skilled labor is high, it’s crucial to ensure your auto insurance policy keeps up with these changes. As a driver, staying proactive in managing your financial security is essential. One way to do this is by reviewing your collision coverage and understanding how it adapts to the market conditions.

When considering collision insurance deductibles, it’s important to find that sweet spot between cost and protection. With repair costs increasing, choosing a higher deductible can lower your premium, but it also means you’ll bear more of the financial burden in case of an accident. Conversely, maintaining a lower deductible provides peace of mind but may result in slightly higher monthly payments. Staying informed about these dynamics allows you to make an educated decision that aligns with your financial goals and drives your policy’s effectiveness in protecting you from unexpected repairs.

In today’s world, where auto repair costs are on the rise, securing financial protection through collision insurance is more crucial than ever. By understanding deductibles, rate influencers, and coverage options, drivers can make informed decisions to safeguard their wallets. With growing popularity in collision waivers, it’s evident that prioritizing financial security is a smart move for any driver. Ensure your policy keeps pace with these changing times to avoid unexpected financial burdens from vehicle accidents.