Protecting Your Wallet: Navigating Collision Insurance in an Era of Rising Repair Costs

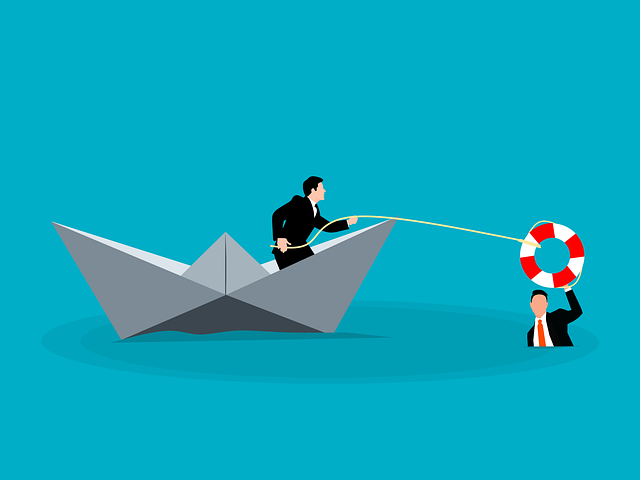

In today’s automotive landscape, where vehicle repairs are becoming increasingly expensive, many drivers are seeking financial safeguards. This article explores the growing importance of collision damage waivers and their role in protecting drivers from hefty repair bills. From understanding deductible factors to comparing insurance rates, we guide you through the process of aligning your policy with your protection needs. By analyzing recent data on collision coverages, we reveal strategies for savvy drivers to ensure financial security behind the wheel, especially as repair markets face unprecedented demands.

- The Rising Costs of Vehicle Repairs: A Modern Concern

- Understanding Collision Damage Waivers and Their Benefits

- Factors Influencing Collision Insurance Deductibles: What You Need to Know

- Comparing Collision Insurance Rates: Strategies for Savvy Drivers

- Aligning Your Policy with Protection Needs in a Repair-Prone Market

- Common Mistakes to Avoid When Considering Collision Coverage

- Ensuring Financial Security: Tips for Proactive Driver Protection

The Rising Costs of Vehicle Repairs: A Modern Concern

The rising costs of vehicle repairs have become a modern concern for many drivers. With the increasing complexity and sophistication of automobiles, the cost of parts and labor has skyrocketed. This trend is further exacerbated by the surge in demand for repair services as more vehicles take to the roads. According to recent data, the average cost of car repairs has been on an upward trajectory, with certain components like engines, transmissions, and body panels becoming increasingly expensive to replace or fix. As a result, drivers are facing significant financial burdens when their vehicles incur damage due to accidents or mechanical failures.

Understanding Collision Damage Waivers and Their Benefits

Collision damage waivers offer significant benefits for drivers facing the financial burden of auto repairs. These waivers typically cover the cost of fixing or replacing your vehicle after a collision, eliminating or reducing the out-of-pocket expense known as a deductible. By waiving this deductible, you can avoid the financial strain associated with unexpected accidents, ensuring that your repair costs do not disrupt your budget.

This type of coverage is especially valuable given the rising costs of vehicle repairs and the increasing demand for auto services due to surge in collisions. With collision damage waivers, drivers can have peace of mind knowing their policy will help shield them from these financial hurdles, allowing them to focus on getting back on the road safely rather than worrying about the financial implications of an accident.

Factors Influencing Collision Insurance Deductibles: What You Need to Know

Collision insurance deductibles are influenced by several factors. One of the primary considerations is your driving history and claims record. A clean driving record with no previous accidents or claims will typically result in lower deductibles. Additionally, the make and model of your vehicle play a role; more expensive cars often come with higher deductibles due to the increased cost of repairs.

Other factors include your age and location. Younger drivers, especially those under 25, might face higher deductibles due to their higher risk profile. Similarly, residing in areas with high crime rates or frequent accidents could also lead to higher deductibles as insurance companies factor in the potential for more claims. Understanding these influences allows you to shop around and compare collision insurance rates effectively.

Comparing Collision Insurance Rates: Strategies for Savvy Drivers

When comparing collision insurance rates, drivers should adopt a strategic approach. Start by understanding your driving history and claims record, as these factors significantly influence premiums. Next, assess the type of vehicle you own; older models or those with high repair costs will generally lead to higher rates. Consider also the level of coverage needed; while liability is essential, comprehensive or collision coverage might be necessary depending on your financial situation and risk tolerance.

Research multiple insurance providers and their policies thoroughly. Compare not only rates but also deductibles and coverage options. Remember that lower premiums may come with higher deductibles, so weigh these considerations carefully. Utilize online tools and quotes to streamline the process, ensuring you have a comprehensive understanding of your choices before making a decision.

Aligning Your Policy with Protection Needs in a Repair-Prone Market

In today’s repair-prone market, aligning your auto insurance policy with your protection needs is more crucial than ever. With rising repair costs and surge in demand for services, drivers must reassess their coverage choices. To safeguard against financial strain from unexpected accidents, consider collision insurance as a strategic investment. Evaluating factors like deductibles and comparing rates ensures you receive tailored protection that aligns with your specific circumstances. By staying informed and proactive, you can navigate this landscape with confidence, ensuring peace of mind behind the wheel.

Common Mistakes to Avoid When Considering Collision Coverage

When considering collision coverage, drivers often make mistakes that can leave them under-protected or paying more than necessary. One common error is assuming that all collision policies are created equal; each policy has its own set of exclusions and deductibles. Failing to read the fine print can result in unexpected out-of-pocket expenses during a claim.

Another mistake is not comparing rates from multiple insurers. Collision insurance rates vary significantly, and shopping around can help drivers secure better coverage at a lower cost. Neglecting to review your policy periodically is also detrimental; circumstances change, and so do your protection needs. Staying informed about market trends and adjusting your coverage accordingly ensures you’re not paying for unnecessary protections or missing out on valuable benefits.

Ensuring Financial Security: Tips for Proactive Driver Protection

To ensure financial security in case of an accident, proactive drivers should consider a few key tips. Firstly, review your auto insurance policy and understand the coverage for collision damage. Many policies include waivers or deductibles that can significantly reduce out-of-pocket expenses during repairs. Compare collision insurance rates from different providers to find the best value for your protection needs.

Secondly, stay informed about rising repair costs and shop around for reputable repair shops. With surge in demand and prices, choosing a reliable and cost-effective mechanic can help maintain your budget. Regularly maintaining your vehicle can also prevent major accidents and costly repairs down the line.

With rising repair costs and surge in demand for services, now is a pivotal time for drivers to reassess their collision insurance policies. By understanding deductibles, comparing rates, and prioritizing financial security, you can ensure your policy adequately protects you from unexpected accident-related expenses. Remember that proactive planning can safeguard your financial well-being and peace of mind.