In today’s litigious climate, understanding your exposure to third-party liability is crucial. Legal liability insurance stands as a shield against the financial weight of lawsuits stemming from negligence or unintentional harm. This article delves into the intricacies of protective measures, focusing on personal umbrella policies, homeowner liability, accidental injury coverage, and property damage insurance. By exploring these key components, you’ll gain insights into why comprehensive liability insurance is indispensable for safeguarding your assets and peace of mind.

- Understanding Your Exposure: When Third-Party Liability Strikes

- The Role of Personal Umbrella Policy in Shielding Your Assets

- Homeowner's Responsibility: Navigating Property Damage and Accidental Injury Coverage

- Unpacking Legal Defense Costs: An Essential Component of Liability Insurance

- Protecting What Matters: Why Comprehensive Liability Insurance is Indispensable

Understanding Your Exposure: When Third-Party Liability Strikes

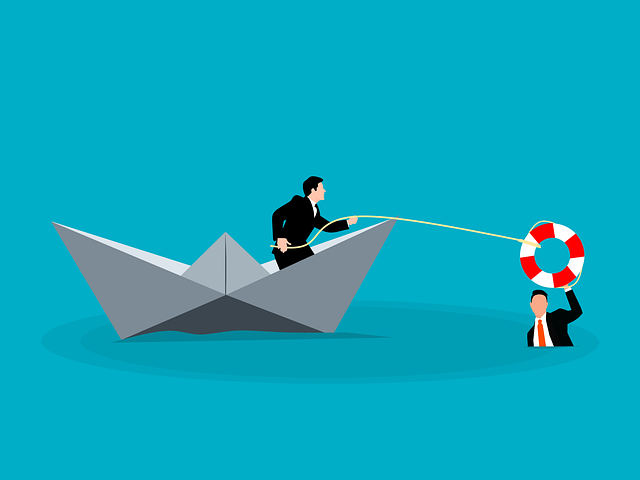

In today’s world, where lawsuits can arise from seemingly minor incidents, understanding your exposure to third-party liability is crucial. Whether it’s a slip and fall on your property, a pet bite, or damage caused by a home improvement project gone awry, unexpected legal claims can quickly spiral into financial ruin. This is where a personal umbrella policy steps in as an essential component of your risk management strategy. It provides additional coverage above and beyond your homeowner liability insurance, protecting your personal assets from lawsuits exceeding the limits of your primary policies.

A personal umbrella policy offers peace of mind by covering legal defense costs, settlement amounts, and judgments up to a specified limit. This additional layer of protection is particularly valuable for those with high net worth, significant assets, or those who are frequently involved in activities that could potentially lead to third-party liability claims, such as hosting events or owning pets known to cause harm. With accidental injury coverage and property damage insurance often included, a personal umbrella policy ensures you’re prepared should the unthinkable happen.

The Role of Personal Umbrella Policy in Shielding Your Assets

In today’s litigious environment, a personal umbrella policy acts as an invaluable extension to your primary home insurance or liability coverage, providing extra protection against significant claims that exceed the limits of your standard policies. This secondary layer of defense is particularly crucial when dealing with third-party liability, which can result from incidents on your property leading to accidental injuries or property damage.

Umbrella policies offer broad coverage, often including compensation for legal defense fees and any damages awarded beyond your original policy’s coverage. For homeowners, this means added peace of mind, knowing that their personal assets are shielded from potential lawsuits arising from accidents involving guests or even unforeseen events on their own property. It’s a proactive step to safeguard one’s financial stability in the face of unexpected legal repercussions.

Homeowner's Responsibility: Navigating Property Damage and Accidental Injury Coverage

In the realm of homeowner’s insurance, understanding one’s responsibilities and the scope of protection is paramount. Homeowners often carry a personal umbrella policy to extend their coverage beyond the standard policy limits. This additional layer safeguards against significant financial losses arising from third-party liability claims. When it comes to property damage insurance, policies typically cover unforeseen events leading to physical harm or destruction of another’s property. However, it is equally crucial to account for accidental injury coverage, which protects against claims related to injuries sustained on the insured’s premises.

Navigating these complexities requires homeowners to be vigilant and informed about their policy details. Accidental injury coverage can extend beyond typical accidents to include incidents involving slippery floors, poorly maintained gardens, or even structural failures. By understanding these parameters, homeowners can ensure they are adequately protected against potential lawsuits, thereby safeguarding their personal assets and financial stability in today’s litigious society.

Unpacking Legal Defense Costs: An Essential Component of Liability Insurance

Legal defense costs are a significant aspect of any liability insurance policy and play a crucial role in protecting individuals from financial strain during legal proceedings. When a lawsuit is filed, these expenses cover the fee for hiring legal representation to defend against the claims. This can include attorney fees, court costs, and other associated legal expenses. Understanding these costs is essential when considering a personal umbrella policy or homeowner liability coverage, as they often provide additional protection beyond standard third-party liability insurance.

Accidental injury coverage and property damage insurance, for instance, may not fully compensate for severe cases of negligence or unintended harm. Here’s where an extended liability coverage comes into play, ensuring individuals are shielded from the financial burden of legal battles and potential settlements or judgments that exceed their primary policy limits.

Protecting What Matters: Why Comprehensive Liability Insurance is Indispensable

In today’s world, where legal battles can be costly and unpredictable, comprehensive legal liability insurance acts as a shield for individuals facing allegations of negligence or unintentional harm. This type of coverage goes beyond basic compensation; it protects personal assets by covering not only legal defense costs but also any settlements or judgments incurred up to the policy limit. A personal umbrella policy, essentially an extension of your existing home or auto insurance, fills the gap between your primary policies and provides additional protection against high-dollar lawsuits.

Consider a scenario where a homeowner faces a third-party liability claim due to accidental property damage. Without adequate coverage, their personal savings and assets could be at risk. However, with a comprehensive personal umbrella policy, they are shielded from financial ruin. This coverage ensures that if settlements or judgments exceed the limits of their primary policies, the umbrella policy kicks in, protecting what matters most – their future financial stability and peace of mind. Similarly, for homeowners dealing with unexpected injury claims, accidental injury coverage within an umbrella policy can be a lifesaver, providing the necessary funds to navigate legal proceedings without compromising their long-term financial security.

In today’s litigious climate, protecting yourself from financial ruin due to unforeseen lawsuits is paramount. By understanding your exposure to third-party liability and investing in comprehensive legal liability insurance, including a personal umbrella policy, you can safeguard your assets and peace of mind. This coverage ensures that legal defense costs and settlements don’t deplete your savings, offering protection against both property damage and accidental injury claims. For homeowners, it’s crucial to review your policy for adequate homeowner liability and accidental injury coverage, ensuring you’re prepared should an incident occur on your premises.