Notarial acts, requiring meticulous attention to detail, carry significant legal weight. Any negligence can lead to substantial legal liability for notaries. This article explores the crucial role of liability insurance, specifically Errors and Omissions (E&O) insurance, in safeguarding notaries from notary claims. We delve into notary responsibilities and emphasize the importance of document certification in upholding notary law and notary ethics. Additionally, we discuss the protective effect of notary bonds against misconduct. Understanding these aspects is vital for minimizing risks and ensuring ethical practices in notarial duties.

- Understanding Notarial Acts and Their Legal Implications

- The Importance of Liability Insurance for Notaries

- Securing Errors and Omissions (E&O) Insurance

- Notary Bonds: A Financial Safeguard Against Misconduct

- Comprehending the Scope of Notary Responsibilities

- Minimizing Risks Through Ethical Practices and Training

- The Role of Document Certification in Upholding Notary Law and Ethics

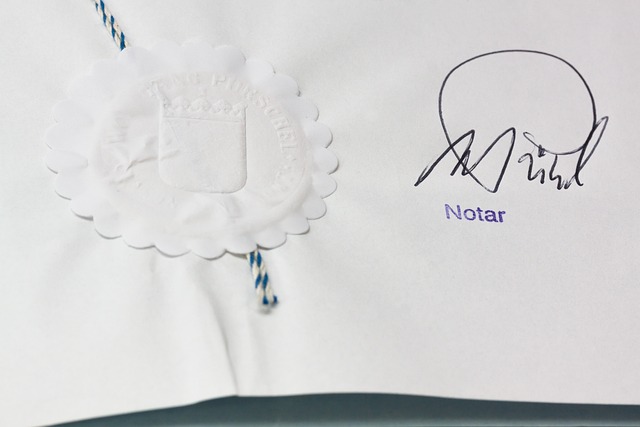

Understanding Notarial Acts and Their Legal Implications

Notarial acts are legal documents that require a notary public to verify and authenticate signatures, ensuring the authenticity and integrity of the signatories. This process is crucial as it impacts various legal proceedings, from real estate transactions to contract executions. Notaries must carefully scrutinize the documentation presented to them, understanding its implications and potential consequences under the law. Any oversight or negligence can lead to significant legal repercussions, including liability for damages, fines, and even criminal charges.

Therefore, it’s imperative for notaries to grasp their duties and responsibilities outlined in notary law. This includes adhering to strict ethical guidelines and ensuring accurate document certification. Liability insurance, such as Errors and Omissions (E&O) coverage, acts as a shield against potential claims arising from notarial misconduct or errors in judgment. By securing this insurance, notaries can protect themselves from financial loss and maintain the public’s trust in their professional services, fostering integrity within the document certification process.

The Importance of Liability Insurance for Notaries

For notaries public, securing liability insurance, particularly Errors and Omissions (E&O) coverage, is a strategic step to safeguard against potential risks associated with their duties. Notarial acts require precise attention to detail due to the legal weight carried by certified documents. Any oversight or error can lead to serious consequences, including legal liability for malpractice claims.

Liability insurance serves as a financial buffer, protecting notaries from substantial monetary losses in the event of notary claims. This coverage compensates individuals or entities harmed by errors, omissions, or negligent acts committed during document certification processes. By ensuring adequate E&O insurance, notaries demonstrate their commitment to upholding notary ethics and adhering to notary law, thereby fostering trust among clients and stakeholders involved in legal transactions.

Securing Errors and Omissions (E&O) Insurance

Securing Errors and Omissions (E&O) Insurance is a strategic step for notaries to safeguard against potential risks associated with their duties. This type of liability insurance is designed to protect notaries from claims arising from errors, omissions, or negligence in performing notarial acts. Given the delicate nature of notarial responsibilities, which involve certifying the authenticity and validity of documents, E&O insurance provides a crucial safety net. It covers legal fees, settlement costs, and damages if a claimant alleges misconduct or malpractice during the document certification process.

By availing of this insurance, notaries can ensure that their professional commitments are financially secured, even in unforeseen circumstances. This is particularly important as notarial errors can lead to significant legal consequences and financial burdens. E&O insurance demonstrates a notary’s commitment to upholding notary laws and ethics, fostering public trust in the document certification process.

Notary Bonds: A Financial Safeguard Against Misconduct

Notary Bonds serve as a financial safeguard against potential misconduct or negligence on the part of notaries public. These bonds are essentially agreements between the notary, the principal (usually a state or government agency), and a surety company. The bond guarantees that the notary will fulfill their duties honestly, competently, and in accordance with notary law and ethics. If a notary fails to meet these standards, resulting in legal liability due to notary claims, the bond acts as financial protection, covering the cost of legal defense and any damages awarded.

By requiring notaries to maintain a notary bond, state laws ensure that notarial acts are carried out with integrity and responsibility. This financial safeguard encourages notaries to prioritize their duties, understand their notary responsibilities, and take necessary precautions to avoid errors or omissions during document certification processes. Ultimately, the bond protects both the public and the notary, fostering trust in the notarial system.

Comprehending the Scope of Notary Responsibilities

Comprehending the Scope of Notary Responsibilities

Notaries play a crucial role in legal and document certification processes by ensuring the authenticity and integrity of signatures. Their responsibilities encompass a wide range, from verifying personal identities to attesting to the accuracy of documents. As part of their duties, notaries must adhere strictly to notary laws and ethics, which vary by jurisdiction. Failure to do so can lead to severe consequences, including legal liability and notary claims.

Liability insurance, commonly known as Errors and Omissions (E&O) insurance, acts as a shield against potential notary claims. This insurance protects notaries from financial loss in case of mistakes or omissions that result in legal disputes. Additionally, maintaining a notary bond is an ethical requirement that provides a financial guarantee of the notary’s commitment to integrity and accuracy in document certification processes, further minimizing risks associated with notarial acts.

Minimizing Risks Through Ethical Practices and Training

Minimizing risks through ethical practices and training is paramount for notaries to uphold their duties effectively while mitigating potential notary claims. Adhering strictly to notary responsibilities, as outlined by notary law, is non-negotiable. Notaries must remain vigilant against human error, oversight, or intentional misconduct that could compromise the integrity of document certification processes. Regular, comprehensive training on notary ethics and best practices ensures notaries are well-versed in their duties, the latest regulatory changes, and risk management strategies.

This proactive approach not only bolsters individual professionalism but also serves as a shield against legal liability. By embracing a culture of ethical conduct and continuous learning, notaries can minimize the likelihood of notary claims stemming from errors or omissions in notarial acts, thereby safeguarding their reputations and ensuring the public trust in document certification processes.

The Role of Document Certification in Upholding Notary Law and Ethics

Document certification plays a pivotal role in upholding notary law and ethics. As notaries public, individuals entrusted with official duties, their primary responsibility is to ensure the authenticity and legality of documents presented to them for certification. This process involves meticulous scrutiny of various aspects, including identity verification, document validity, and adherence to legal requirements. Any oversight during this critical stage could potentially lead to severe consequences, such as voided documents, legal disputes, and even liability claims against the notary.

Liability insurance, like Errors and Omissions (E&O) coverage, acts as a shield against potential notary claims. It compensates for financial losses stemming from errors or omissions in document certification, protecting notaries from the financial burden of legal actions. Additionally, maintaining a notary bond underscores the notary’s commitment to ethical practices, providing an extra layer of security and assurance to document signers and users. By prioritizing these measures, notaries can effectively manage risks associated with their duties, ensuring compliance with notary laws and upholding professional ethics.

In conclusion, the meticulous nature of notarial acts demands a robust risk management strategy. By securing professional liability insurance, such as Errors and Omissions (E&O) coverage, and maintaining a notary bond, notaries can safeguard against potential claims and ensure compliance with notary responsibilities and legal requirements. Understanding the scope of their duties, adhering to ethical practices, and staying informed about notary law and ethics are essential components in minimizing risks associated with document certification processes, thereby upholding the integrity of their professional role.