Comprehensive insurance policies now feature rental reimbursement clauses that provide financial support for temporary car rentals when your vehicle is out of commission due to an accident. This is particularly important for individuals who rely on their cars for daily activities, ensuring they can continue with their lives without significant disruption. Insurance providers have expanded these provisions to offer customized coverage options, adapting to a range of needs and situations. Full coverage plans protect against various unforeseen events, including collisions, theft, vandalism, and natural disasters, covering repair or replacement costs regardless of fault. Innovations such as temporary car insurance offer flexible short-term solutions for those needing a rental or borrowed vehicle. The insurance industry has embraced technology to facilitate easy online access to these tailored policies, responding to the demands of contemporary consumers who value adaptability and convenience. This evolution ensures that drivers have appropriate coverage that fits their dynamic lifestyles, whether they are entrepreneurs, experiencing financial fluctuations, or simply need a temporary policy for specific events. The future of vehicle protection is about offering personalized experiences and maintaining mobility, even when facing unexpected setbacks with your primary vehicle.

When navigating the complexities of post-accident travel, rental reimbursement stands as a beacon of relief, ensuring mobility remains unhindered. As we delve into today’s robust vehicle protection plans, full coverage and comprehensive benefits are more versatile than ever, offering a safety net for various unforeseen events. The landscape of temporary car insurance is evolving rapidly, with recent updates reflecting the growing need for adaptable policies. This article will illuminate how these enhancements in vehicle protection can keep you on the move, no matter the challenges life presents. Join us as we explore the dynamic nature of these plans and how they cater to your changing transportation needs, ensuring you stay mobile well into the future.

- Navigating Post-Accident Travel: The Role of Rental Reimbursement

- Full Coverage and Comprehensive Benefits: A Closer Look

- Embracing Flexibility with Temporary Car Insurance Updates

- Customizing Your Policy: Adapting to Changing Needs

- Staying Mobile: The Future of Vehicle Protection Plans

Navigating Post-Accident Travel: The Role of Rental Reimbursement

When an accident occurs, and your vehicle is out of commission, finding alternative transportation becomes a necessity. This is where rental reimbursement provisions in comprehensive insurance policies play a pivotal role. These provisions ensure that policyholders are not left stranded; instead, they receive financial support for a rental car. This allows individuals to maintain their daily routines, including commuting to work, running errands, or fulfilling personal commitments, with minimal disruption. The reimbursement typically covers a portion of the rental car cost for the period during which the primary vehicle is being repaired. This feature is particularly beneficial as it provides immediate solutions without the need for significant out-of-pocket expenses. Insurance companies have recognized the importance of this flexibility and have adapted their policies to offer more comprehensive rental reimbursement options, often with varying levels of coverage depending on the policyholder’s needs and preferences. As a result, even in the face of unforeseen events like accidents, policyholders can navigate their post-accident travel with greater ease and confidence.

Full Coverage and Comprehensive Benefits: A Closer Look

Full coverage and comprehensive benefits within vehicle protection plans offer robust protections that cater to a wide array of unforeseen events. Full coverage typically encompasses collision and comprehensive insurance, providing peace of mind regardless of who is at fault in an accident or for damages from non-collision incidents such as theft, vandalism, or natural disasters. This comprehensive protection ensures that policyholders can repair or replace their vehicles without significant out-of-pocket expenses. Additionally, these plans often include rental reimbursement coverage, which offers financial support towards a rental car while the primary vehicle is being repaired, thus mitigating the inconvenience of being without transportation. This feature exemplifies the evolving nature of insurance policies, which now prioritize adaptability and convenience to keep policyholders mobile and protected under various circumstances. With tailored options like temporary car insurance, individuals can also enjoy short-term coverage solutions that are perfect for those who may need insurance for a limited period, such as when renting a vehicle for an extended trip or borrowing a car from a friend. These innovations underscore the industry’s response to consumer needs for flexibility and comprehensive protection, ensuring drivers remain covered no matter the journey they embark on.

Embracing Flexibility with Temporary Car Insurance Updates

Today’s full coverage and comprehensive insurance plans have evolved to offer exceptional flexibility, catering to a variety of needs. One such innovation is temporary car insurance, which allows policyholders to tailor their coverage duration to match their specific requirements. For instance, if your vehicle is in the shop for repairs following an accident, and you need a rental car for a limited period, temporary insurance can provide the necessary protection during this time without the obligation of a long-term commitment. This adaptability is particularly beneficial for those who may experience fluctuating transportation needs due to unexpected events, such as vacation travel or business trips. With user-friendly online platforms and streamlined processes, obtaining temporary coverage has become swift and straightforward. As a result, drivers have more control over their insurance options, ensuring they remain mobile with the appropriate level of protection suited to their immediate circumstances. The insurance industry’s responsiveness to consumer demands for versatility underscores the importance of staying abreast of these updates, as they can significantly impact your experience on the road and provide peace of mind when navigating through life’s unpredictable moments.

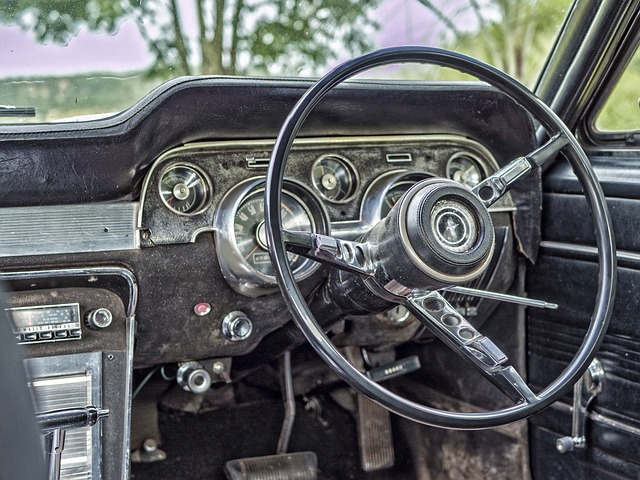

Customizing Your Policy: Adapting to Changing Needs

In today’s dynamic world, the ability to customize insurance policies to meet individual needs is a game-changer. Insurance providers are increasingly offering personalized options that adapt as one’s circumstances evolve. For instance, if you’re temporarily without a vehicle due to repairs or maintenance, you can adjust your policy to reflect this interim period. This flexibility ensures that you’re neither overpaying for coverage you don’t need nor left vulnerable when your situation changes. These tailored solutions are particularly beneficial for those whose lifestyles demand it—like entrepreneurs who use their cars for business and personal errands, or individuals with fluctuating financial situations requiring adjustments to their premiums. The insurance industry’s shift towards customization is a response to the growing consumer demand for more adaptable and responsive policies. By leveraging technology and data analytics, insurers can offer temporary coverage options that align with the specific needs of policyholders, providing peace of mind on the road, no matter what changes in your life. This adaptability is crucial in maintaining the relevance of full coverage and comprehensive plans, ensuring they remain at the forefront of the modern insurance landscape. With these innovative features, drivers can navigate the unexpected with confidence, knowing their vehicle protection plan is as unique as their lifestyle.

Staying Mobile: The Future of Vehicle Protection Plans

In today’s fast-paced world, the ability to maintain mobility is paramount for individuals and families alike. With vehicles being a primary mode of transportation for many, the necessity for comprehensive vehicle protection plans has evolved significantly. Full coverage and comprehensive insurance have traditionally provided robust safeguards against various risks, but the advent of rental reimbursement programs and temporary car insurance options has revolutionized these plans. These innovations ensure that drivers are not left stranded following unexpected events such as accidents or repairs. Rental reimbursement, in particular, acts as a lifeline by offering access to alternative transportation, thereby minimizing the inconvenience and disruption to daily routines. The future of vehicle protection is characterized by its adaptability and responsiveness to consumer needs, with policies designed to accommodate temporary coverage adjustments. This flexibility means that drivers can enjoy peace of mind knowing they have the support they need to stay on the move, regardless of the duration or nature of their vehicle’s unavailability.

The automotive insurance sector is rapidly adapting to the changing demands of consumers, who increasingly value versatility and convenience in their protection plans. The integration of digital technology has facilitated real-time policy adjustments, allowing drivers to adapt their coverage as needed. For instance, app-based platforms enable users to purchase temporary insurance with ease, catering to situations like test driving a new car or borrowing a vehicle for a short period. These technological advancements not only streamline the process but also provide a more personalized and user-friendly experience. As such, the future of vehicle protection is not just about safeguarding your car, but also ensuring that you can maintain your active lifestyle without interruption, come what may on the road ahead.

In the aftermath of an accident, the reliability and adaptability of modern vehicle protection plans are evident. From rental reimbursement ensuring seamless travel to the comprehensive benefits that cater to a wide array of needs, today’s full coverage insurance stands as a testament to innovation in mobility solutions. The recent enhancements to temporary car insurance options underscore an industry commitment to flexibility and responsiveness. These advancements not only provide peace of mind but also enable policyholders to customize their coverage to fit their dynamic lifestyles. As we look to the future, it’s clear that the evolution of vehicle protection plans will continue to offer robust support, keeping drivers like you on the move, regardless of unforeseen circumstances.