Online tax preparation offers a convenient, secure, and user-friendly alternative to traditional methods. With advanced encryption and certified tax preparers, it simplifies income tax preparation, IRS tax filing, and provides tailored tools for small business tax help and maximizing self-employed tax deductions. Experience efficient tax return assistance, peace of mind, and accurate tax planning strategies from home via comprehensive tax filing services.

Tired of the annual tax season dread? Say goodbye to long hours and headaches with our online tax preparation tools. Our user-friendly platform offers a seamless, secure way to complete your income tax preparation from home—perfect for individuals, businesses, and self-employed folks alike. Eliminate hassle, access expert assistance, and enjoy enhanced security with encrypted data protection. Why wait? Simplify your IRS filing today!

- Benefits of Online Tax Preparation for Effortless Filing

- – Eliminating the hassle and stress of traditional tax preparation

Benefits of Online Tax Preparation for Effortless Filing

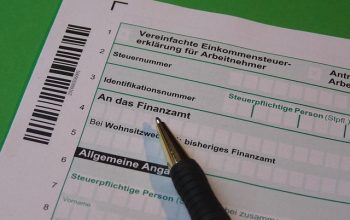

Online tax preparation offers a host of benefits that make the entire process smoother and less stressful for everyone involved. One of the most significant advantages is convenience; individuals and business owners can now file their taxes from the comfort of their homes, eliminating the need to visit a physical location. This accessibility is particularly beneficial for those with busy schedules or those who live in remote areas, ensuring tax filing becomes a hassle-free task.

Moreover, online platforms provide a secure environment for handling sensitive financial information. Advanced encryption and data protection measures are in place, giving users peace of mind. These digital tools often come equipped with user-friendly interfaces, making navigation intuitive and simple. Taxpayers can easily input their financial details, access tax planning strategies, and even explore potential deductions for self-employed individuals. With a certified tax preparer’s assistance, available through many online services, users can ensure accurate filing, reducing the risk of errors or audits.

– Eliminating the hassle and stress of traditional tax preparation

Say goodbye to the tedious and often stressful process of traditional tax preparation. With our online platform, we’ve revolutionized the way individuals and businesses manage their taxes. No more spending countless hours sifting through paperwork or scheduling appointments with a certified tax preparer. Our user-friendly interface streamlines the entire income tax preparation process, making it accessible from the comfort of your home.

By leveraging our online tax filing services, you gain not only convenience but also peace of mind. We ensure secure data transmission and protect your sensitive financial information. Whether you’re a small business owner seeking small business tax help or a self-employed individual looking to maximize deductions, our tools are tailored to meet your specific IRS tax filing needs.

In today’s digital age, navigating tax season no longer has to be a daunting task. By leveraging online tax preparation tools like ours, individuals and small businesses can streamline their IRS tax filing process, saving time and reducing stress. Our user-friendly platform offers secure access to expert tax planning strategies, ensuring accurate returns and maximizing self-employed tax deductions. Don’t let tax season catch you off guard – try our services today for a seamless, efficient experience.