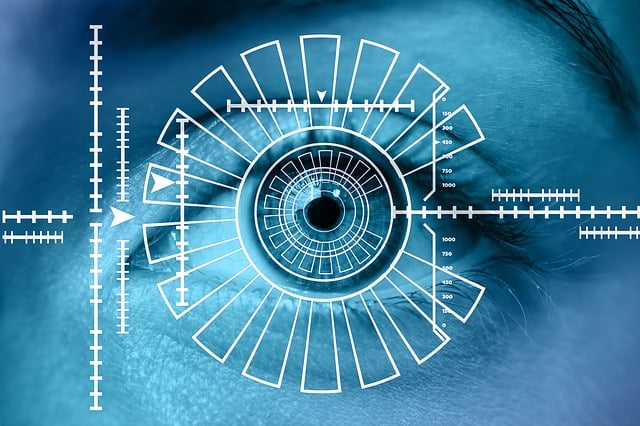

In a rapidly evolving digital landscape, businesses face escalating fraud risks. To combat this, identity proofing through customer due diligence and risk assessment automation is transforming operations. Secure identity verification employs instant verification solutions, like automated document verification and biometric authentication, to streamline customer onboarding. This multi-faceted approach not only bolsters security but also enhances customer trust by enabling automated compliance checks, ensuring strict adherence to regulations in the digital era.

In today’s digital economy, protecting your business from fraud and ensuring compliance is more crucial than ever. As the landscape of business security evolves, identity proofing stands out as a game-changer. This comprehensive approach integrates automated tools for customer due diligence and risk assessment, leveraging advanced technologies like document verification and biometric authentication. By implementing secure identity verification, businesses can streamline compliance checks and customer onboarding processes, fostering trust while maintaining a robust security environment through instant verification solutions.

- Understanding the Evolving Landscape of Business Security: The Rise of Identity Proofing

- Automated Tools for Enhanced Customer Due Diligence and Risk Assessment

- Implementing Secure Identity Verification: Streamlining Compliance Checks and Onboarding Processes with Instant Solutions

Understanding the Evolving Landscape of Business Security: The Rise of Identity Proofing

In today’s digital economy, the landscape of business security is constantly evolving, with new threats emerging and technologies advancing rapidly. As fraud becomes increasingly sophisticated, businesses must adapt their strategies to protect against ever-inventive con artists. This shift has led to a growing emphasis on identity proofing as a robust defense mechanism. Customer due diligence and risk assessment automation are at the forefront of this transformation, empowering companies to mitigate risks efficiently.

Secure identity verification goes beyond basic authentication by incorporating instant verification solutions that include automated document verification and biometric authentication. This multifaceted approach streamlines customer onboarding automation, ensuring that businesses can welcome new clients while maintaining strict security protocols. By leveraging these automated compliance checks, companies can safeguard their operations, build trust with customers, and foster a culture of integrity in the digital realm.

Automated Tools for Enhanced Customer Due Diligence and Risk Assessment

In today’s digital landscape, businesses face heightened risks from fraud and non-compliance. Automated tools have emerged as a game-changer in this regard, significantly enhancing Customer Due Diligence (CDD) and Risk Assessment processes. By leveraging advanced algorithms and machine learning, these tools streamline identity proofing, enabling instant verification solutions that reduce manual effort and potential human errors.

Identity proofing becomes more robust with automated compliance checks, ensuring accurate and efficient document verification against global databases. This not only speeds up the customer onboarding process but also fortifies security measures. Risk assessment automation, integrated into these systems, allows businesses to identify suspicious patterns or anomalies in real-time, proactively mitigating potential threats.

Implementing Secure Identity Verification: Streamlining Compliance Checks and Onboarding Processes with Instant Solutions

Implementing Secure Identity Verification is a game-changer for businesses aiming to streamline their compliance checks and onboarding processes. By adopting instant verification solutions, companies can revolutionize their customer due diligence procedures. This technology automates risk assessment by meticulously scrutinizing documents and biometric data during the onboarding stage.

For instance, automated identity proofing ensures that every customer’s identity is verified accurately and instantly, reducing the time spent on manual checks. Instant verification solutions also enhance data security by employing advanced encryption methods to safeguard sensitive information. Moreover, they simplify the entire process, making it more efficient for both businesses and customers while maintaining a robust security framework.

In today’s digital economy, protecting businesses from fraud and ensuring compliance are paramount. By integrating comprehensive identity verification services, including automated identity checks, document verification, and biometric authentication, companies can adopt a holistic approach to security. This enables them to accurately and efficiently verify customer identities, build trust, streamline onboarding processes, and maintain secure operational environments through advanced customer due diligence and risk assessment automation. Instant verification solutions play a crucial role in this transformation, making it possible to conduct automated compliance checks and enhance overall business security.