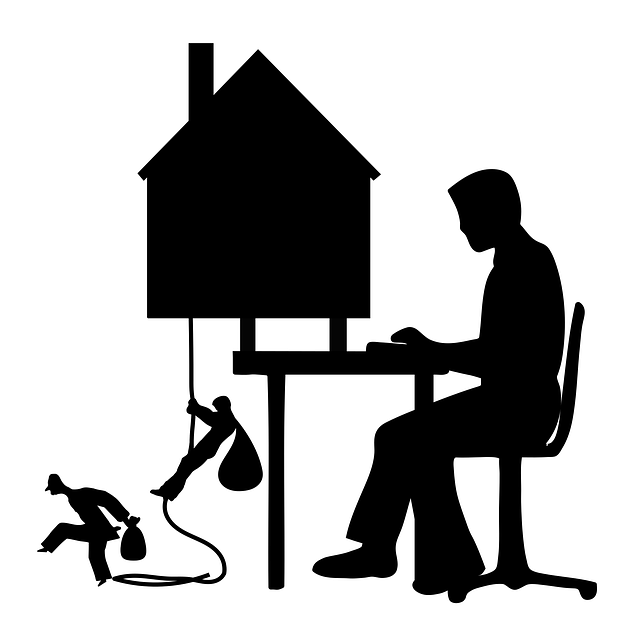

Personal liability insurance stands as a financial safeguard for individuals, offering protection against the unforeseen repercussions of accidental injuries or property damage caused to others. This critical component is often an integral part of comprehensive homeowner or renter insurance policies, providing coverage for third-party liability claims. In today’s litigious society, where legal settlements can escalate rapidly, securing a robust personal umbrella policy extends your homeowner liability coverage, offering an extra layer of security to safeguard your assets. This article delves into the essential aspects of personal liability insurance, exploring its coverage for accidental injury events and property damage incidents. From understanding how it works to recognizing the benefits of a personal umbrella policy, readers will gain clarity on the importance of third-party liability within their insurance portfolios. We’ll also examine why such coverage is indispensable for property owners, ensuring they are prepared should an incident occur. With detailed insights into accidental injury coverage and property damage insurance, this article aims to highlight the significance of adequate liability insurance in maintaining asset protection and financial stability in the face of legal claims.

- Understanding Personal Liability Insurance: A Shield Against Unintended Financial Consequences

- The Role of a Personal Umbrella Policy in Enhancing Homeowner Liability Coverage

- Navigating Third-Party Liability: What It Covers and Why It's Indispensable for Property Owners

- Accidental Injury Coverage: Protecting Yourself and Others from Unexpected Mishaps

- Comprehensive Property Damage Insurance: Beyond the Boundaries of Standard Homeowner Policies

- Asset Protection Through Adequate Liability Insurance: Safeguarding Your Wealth Against Legal Claims

Understanding Personal Liability Insurance: A Shield Against Unintended Financial Consequences

Personal liability insurance serves as a financial safeguard for individuals against the unintended consequences of legal claims resulting from accidental injuries or property damage. This protection is not limited to homeowners; renters can also benefit from this coverage, which is often an add-on to standard renter’s insurance policies. A pivotal aspect of comprehensive coverage, personal umbrella policy extensions provide additional layers of security beyond what a basic homeowner’s or renter’s policy typically offers.

For example, if an unforeseen accident occurs on your property—such as a visitor tripping and falling, resulting in injury—personal liability insurance steps in to cover the ensuing medical expenses, as well as any legal fees that might arise from a lawsuit. This extends to scenarios where your pet causes damage or injury to someone else, or if you are held responsible for libel, slander, or defamation. The scope of third-party liability is broad, ensuring that you are not solely responsible for the financial aftermath of an incident that was not intentional. With the increasing frequency of high-stakes legal settlements, having a robust personal umbrella policy in place can be crucial in mitigating the significant financial risks associated with such unforeseen events. Property damage insurance within this context further complements the coverage by protecting against claims related to damage to others’ property, offering peace of mind for homeowners and renters alike.

The Role of a Personal Umbrella Policy in Enhancing Homeowner Liability Coverage

A personal umbrella policy serves as a critical enhancement to existing homeowner liability coverage, offering expanded protection that goes beyond the limits of standard policies. This additional layer of insurance is designed to kick in once the liability limits of your homeowner’s insurance are exhausted, providing a financial buffer for claims involving accidental injury or property damage for which you are held responsible. For example, if a visitor is seriously injured on your property and seeks compensation beyond what your homeowner’s policy covers, your umbrella policy steps in to cover the remainder of the costs, including legal defense fees. This is particularly important in today’s litigious society where a single incident could lead to substantial financial liability. With a personal umbrella policy, individuals can rest easier knowing they have a robust safety net that addresses third-party liability concerns, ensuring comprehensive accidental injury coverage and property damage insurance, which are essential for safeguarding your assets against unforeseen claims. As such, it’s advisable to evaluate the adequacy of your homeowner liability coverage and consider an umbrella policy as a prudent measure to manage potential financial risks associated with third-party incidents.

Navigating Third-Party Liability: What It Covers and Why It's Indispensable for Property Owners

navaling third-party liability is a critical aspect for any homeowner or renter to understand, particularly when it comes to securing a personal umbrella policy that extends beyond the limits of standard homeowner’s or renter’s insurance. This expansive coverage is designed to shield individuals from financial responsibilities should they inadvertently cause bodily injury or property damage to others. For instance, if a guest were to slip and fall on your property, resulting in injury, third-party liability would typically cover the medical expenses involved, as well as any legal costs that might arise if the injured party seeks compensation. It’s not just about covering the immediate aftermath of an accident; it’s about providing a safeguard against the escalating costs of litigation and settlements in today’s climate. A personal umbrella policy acts as a financial buffer, ensuring that your personal assets remain protected from claims or lawsuits. This is particularly indispensable for property owners who entertain guests regularly or have children and pets at home, increasing the likelihood of accidental occurrences. With liability limits within a standard policy often proving insufficient in serious cases, an umbrella policy offers additional layers of coverage, offering peace of mind that goes beyond the physical walls of your home. It’s an investment in financial security against unforeseen events, ensuring that a single incident doesn’t lead to long-term financial strain or loss. Homeowner liability is a cornerstone of comprehensive protection, and understanding its scope within your insurance portfolio is essential for any property owner.

Accidental Injury Coverage: Protecting Yourself and Others from Unexpected Mishaps

When unforeseen accidents occur on your property, having a robust personal umbrella policy serves as a critical safeguard against potential financial burdens. This policy extends beyond the standard coverage provided by homeowner liability insurance, offering a higher limit of protection for third-party liability claims. It’s not just about protecting your own assets; it’s also about assuming responsibility for the well-being of others when they are on your premises. For example, if a visitor were to slip and fall due to a wet floor that wasn’t clearly marked, accidental injury coverage within your homeowner liability insurance can provide peace of mind by taking care of medical costs and any legal ramifications that may arise from the incident.

Furthermore, property damage insurance is an integral part of this comprehensive coverage. It ensures that if your actions or those of a household member accidentally cause damage to someone else’s property, you are not financially crippled by the cost of repair or replacement. This can range from unintentionally breaking a neighbor’s window to causing significant structural damage during home renovations. With adequate third-party liability coverage, you can navigate such situations with confidence, knowing that your insurance is prepared to handle the financial repercussions on your behalf. As the potential for substantial legal settlements grows, it becomes increasingly important to assess and augment your personal umbrella policy to ensure ample protection against these unpredictable events.

Comprehensive Property Damage Insurance: Beyond the Boundaries of Standard Homeowner Policies

When standard homeowner policies provide a foundational layer of protection against third-party liability claims, there are instances where additional coverage is necessary to fully safeguard against unforeseen events. A personal umbrella policy serves as an invaluable asset beyond the boundaries of typical insurance packages, offering extended limits of liability coverage for both accidental injury coverage and property damage insurance. This supplementary policy kicks in once the limits of your homeowner’s policy are exhausted, ensuring that you have comprehensive protection against claims that could potentially deplete your assets. For example, if an incident at a social gathering hosted in your home results in significant bodily injury or property damage to a third party, the personal umbrella policy can provide an extra layer of financial support to cover costs beyond what your homeowner liability would cover. With the increasing prevalence of costly legal settlements and the potential for substantial damages, securing a personal umbrella policy is a prudent step to fortify your financial well-being against the unpredictability of accidents. It’s advisable to assess your individual risk factors and consider the additional security that a personal umbrella policy can offer, as it can be the difference between financial stability and vulnerability in the event of an unintended incident leading to third-party liability.

Asset Protection Through Adequate Liability Insurance: Safeguarding Your Wealth Against Legal Claims

When considering the broad spectrum of risks that individuals face in today’s litigious environment, it is crucial to recognize the role of a personal umbrella policy in fortifying your financial defense. This type of coverage extends beyond the standard homeowner liability limits and serves as a safety net for unexpected legal claims. It provides comprehensive third-party liability protection, ensuring that accidental injury coverage and property damage insurance are not depleted by a single event. For example, if an unforeseen accident occurs on your property, such as a visitor tripping and injuring themselves, the personal umbrella policy can provide a financial shield against the ensuing medical expenses and legal defense costs. This is particularly important because the compensation demanded in legal settlements has been escalating, making it imperative to secure a robust level of liability coverage. By investing in a personal umbrella policy, homeowner liability concerns are significantly mitigated, allowing you to safeguard your wealth against the potential financial repercussions of unintended incidents. This additional layer of protection can offer peace of mind, knowing that your assets are less exposed to the risks associated with legal claims, thereby protecting not just your present but also your future financial stability.

In conclusion, personal liability insurance serves as a critical financial safeguard for individuals and families against unforeseen legal claims resulting from accidental injuries or property damage. This coverage, often found within homeowner or renter insurance policies, extends to third-party liability, ensuring that medical expenses and legal fees associated with such incidents are managed effectively. A personal umbrella policy can further enhance this protection by providing additional layers of security beyond the standard homeowner liability limits. Accidental injury coverage and comprehensive property damage insurance offer peace of mind, knowing that you are prepared for unexpected mishaps. As the potential costs associated with legal settlements continue to rise, it is prudent to evaluate your current coverage to ensure adequate protection of your assets. Incorporating these elements into your insurance portfolio can be the difference between financial security and vulnerability in the face of liability claims. Therefore, for comprehensive asset protection, it is advisable to review and expand your policy with a focus on homeowner liability and consider the benefits of a personal umbrella policy to stay well-covered in an unpredictable world.