Rental Car Coverage is an essential Auto Insurance Add-on that provides financial protection and a replacement vehicle through Accident Rental Assistance or Post-Accident Rental Coverage when personal vehicles are inaccessible due to accidents. This coverage is particularly beneficial for individuals who rely on their cars daily and lack alternative transportation options, ensuring continued mobility without the high costs typically associated with rental cars after an incident. It's a critical element of a robust auto insurance strategy, offering peace of mind by mitigating travel disruptions and providing Replacement Vehicle Coverage and Coverage for Rental Expenses. This coverage is designed to be both accessible and affordable, making it an ideal solution for those without other means of transportation, alleviating the financial burden and helping maintain normalcy in one's routine after an accident. Insurance for Rental Cars and related coverages are key components that protect against the unexpected and ensure continuity of mobility post-accident, making them a crucial consideration for any driver's auto insurance package.

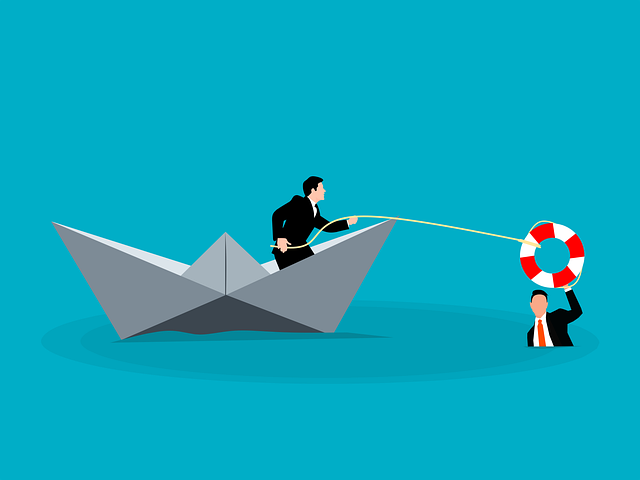

When unexpected vehicle issues arise or an accident occurs, having rental car coverage can be a game-changer. This article delves into the value of rental car coverage as an add-on to your existing auto insurance policy. It highlights the benefits of Rental Car Coverage, particularly for those who lack immediate access to alternative transportation means. We’ll explore how this protection serves as a financial and logistical lifeline, ensuring mobility and mitigating travel disruptions. From understanding the nuances of Accident Rental Assistance to examining the advantages of Auto Insurance Add-ons like Replacement Vehicle Coverage, our comprehensive guide will navigate you through the complexities of Insurance for Rental Cars. We’ll also discuss the critical role of Coverage for Rental Expenses in post-accident scenarios, ensuring you remain mobile and protected.

- Understanding Rental Car Coverage: A Shield Against Unforeseen Travel Disruptions

- The Advantages of Accident Rental Assistance: Ensuring Mobility Post-Collision

- Exploring Auto Insurance Add-ons: Why Replacement Vehicle Coverage is a Must

- Comprehensive Guide to Insurance for Rental Cars: Protecting Your Pocketbook During Car Troubles

- The Role of Coverage for Rental Expenses in Post-Accident Scenarios

Understanding Rental Car Coverage: A Shield Against Unforeseen Travel Disruptions

When unforeseen events such as accidents, car breakdowns, or maintenance checks necessitate alternative transportation, Rental Car Coverage stands as a reliable solution. This valuable add-on to your existing auto insurance policy offers coverage for rental expenses, ensuring that you remain mobile without incurring significant additional costs. It serves as a critical financial safeguard, providing the means to rent a vehicle when your own is indisposed. For those who lack access to alternative transportation methods like public transit or car-sharing services, this coverage becomes even more indispensable. In the event of an accident where your vehicle is damaged and under repair, or if it’s simply time for scheduled maintenance, Rental Car Coverage steps in to offer Accident Rental Assistance, effectively bridging the gap between mobility and immobility. This insurance for rental cars is designed to alleviate the stress and inconvenience that come with unexpected travel disruptions. It ensures that you have a replacement vehicle at your disposal, allowing your journey to continue with minimal interruption. Auto Insurance Add-ons like this are not just about convenience; they’re a prudent choice for comprehensive financial protection, catering to the needs of individuals and families alike who value the assurance of smooth travel experiences, come what may. Replacement Vehicle Coverage and Post-Accident Rental Coverage are essential components of a well-rounded auto insurance package, offering peace of mind with every drive.

The Advantages of Accident Rental Assistance: Ensuring Mobility Post-Collision

When navigating the aftermath of an accident, maintaining mobility becomes a priority. Rental Car Coverage serves as a vital auto insurance add-on that ensures this continuity of transportation. Known more specifically as Accident Rental Assistance or Post-Accident Rental Coverage, this feature offers peace of mind by providing coverage for rental expenses when your primary vehicle is out of commission due to damage from an accident. This means that even if your car is in the shop, you can continue to meet your daily obligations without significant disruption, whether it’s commuting to work or running errands. The financial protection and convenience offered by this coverage extend beyond just the rental cost; it also often includes a replacement vehicle insurance component, ensuring that you have a reliable mode of transport while your vehicle is being repaired.

Furthermore, Insurance for Rental Cars is designed to be accessible and affordable, making it an excellent option for those without alternative transportation solutions. It’s particularly beneficial for individuals who rely on their personal vehicles for everyday activities and cannot afford the potential downtime that comes with auto body repairs. With this coverage, policyholders can avoid the stress and expense of securing a rental car on their own, which typically involves hefty daily rates and strict terms. By incorporating Rental Car Coverage into your existing auto insurance policy, you’re not only safeguarding yourself against the unexpected but also ensuring that life can go on as normally as possible after an accident.

Exploring Auto Insurance Add-ons: Why Replacement Vehicle Coverage is a Must

When an accident occurs and your vehicle is out of commission, having a reliable means of transportation becomes crucial. This is where Rental Car Coverage stands out as an essential auto insurance add-on. It ensures that you have access to a rental vehicle post-accident, alleviating the stress and inconvenience that come with sudden mobility loss. Unlike some policies that offer limited coverage, comprehensive Rental Car Coverage, such as Accident Rental Assistance, goes beyond the basics by providing full or partial reimbursement for your rental car expenses. This coverage is designed to integrate seamlessly into your existing auto insurance policy, offering a robust layer of protection without significantly driving up costs.

In the event of an accident or vehicle breakdown, the implications extend beyond the immediate damage to your car. The ripple effects can disrupt your daily life and routines, making the Coverage for Rental Expenses not just a value-added feature but a necessity. Insurance for Rental Cars through your policy means that you won’t be left stranded, financially or logistically. It provides a safety net that allows you to maintain your schedule without the added pressure of substantial out-of-pocket expenses. This post-accident rental coverage is particularly beneficial for those who lack alternative transportation options, such as public transit or a personal second vehicle. By safeguarding against the uncertainty of vehicular downtime, this add-on to your auto insurance policy not only offers convenience but also peace of mind, ensuring that your mobility and financial stability are protected during unexpected events.

Comprehensive Guide to Insurance for Rental Cars: Protecting Your Pocketbook During Car Troubles

When encountering car troubles or during an accident where your vehicle is inoperable, rental car coverage serves as a critical lifeline. This form of auto insurance add-on ensures that you have access to a replacement vehicle, allowing you to maintain your daily activities without significant disruption. Rental Car Coverage typically includes coverage for rental expenses, providing financial assistance when you’re unexpectedly in the market for a temporary vehicle. It’s a savvy choice for drivers who lack alternative transportation means, offering both practical convenience and protection against costly rental fees that can accumulate rapidly during an emergency.

Accident Rental Assistance is a component of comprehensive insurance plans designed to offer support post-accident. This coverage not only facilitates the acquisition of a rental car but also integrates into your existing auto insurance policy, ensuring continuity in your coverage without the need for separate policies or additional paperwork hassles. Insurance for Rental Cars is an essential consideration for any driver, as it can significantly mitigate the stress and financial strain associated with being without a vehicle. It’s a prudent step to enhance your auto insurance package, safeguarding against unforeseen events that could leave you stranded. With Post-Accident Rental Coverage, you can rest assured knowing that your transportation needs are addressed, allowing you to focus on what truly matters during challenging times.

The Role of Coverage for Rental Expenses in Post-Accident Scenarios

In post-accident scenarios, having rental car coverage can be a game-changer. When an insured vehicle is taken out of commission due to an incident, this coverage steps in to provide a replacement vehicle. This ensures that individuals maintain their mobility and continue with their daily lives without significant disruption. The role of accident rental assistance becomes apparent when considering the logistical challenges that arise after an accident. Without access to transportation, tasks as simple as commuting to work or performing errands can become insurmountable obstacles. Auto insurance add-ons like this one offer peace of mind, knowing that even if your primary vehicle is inaccessible, you won’t be left stranded. Rental car coverage acts as a bridge, offering a temporary solution until repairs are completed or a new vehicle is acquired. It’s an essential component for those who lack alternative transportation options, making it a prudent add-on to any comprehensive auto insurance policy.

Furthermore, insurance for rental cars provides not just a vehicular substitute but also financial protection. Coverage for rental expenses safeguards against the costs associated with renting a car post-accident. This can be particularly valuable as rental prices can vary greatly depending on location and demand. By including this coverage in your policy, you’re ensuring that you won’t face unexpected financial strain during an already stressful time. Post-accident rental coverage is designed to complement your existing auto insurance, offering a robust safety net that addresses the specific needs that arise following an incident. This add-on is not just a convenience but a strategic choice for drivers who wish to avoid potential financial hardships and maintain their independence after an accident.

When navigating the unpredictable nature of travel and vehicle issues, securing rental car coverage through your auto insurance policy is a wise decision. As detailed in the article, rental car coverage—a key auto insurance add-on known as replacement vehicle coverage—acts as a comprehensive shield, offering both immediate mobility solutions and financial protection in post-accident scenarios. This coverage, which falls under insurance for rental cars, is particularly beneficial for those without access to alternative transportation. Its affordability belies the significant value it provides, ensuring that unexpected events such as accidents or vehicle repairs do not disrupt your life or finances. In light of these advantages and the peace of mind it offers, incorporating this coverage into your auto insurance plan is a prudent move for any driver.