Rental Car Coverage as an add-on to auto insurance, known as Accident Rental Assistance, provides a financial allowance for a rental car when your vehicle is being repaired after an accident or due to other covered issues. This coverage is particularly beneficial for frequent travelers and those who rely on their vehicles daily, ensuring continuous transportation without the added financial strain. It can be customized with Replacement Vehicle Coverage options to match individual needs, whether you require a compact car in the city or an SUV for family trips. This add-on, part of Auto Insurance Add-ons, is a practical solution under Post-Accident Rental Coverage, which safeguards against the inconvenience of vehicle downtime by offering a suitable rental car until your primary vehicle is operational again. It's a critical component that enhances the security and convenience of standard vehicle protection policies, providing peace of mind for policyholders who value continuity in their daily lives post-accident. This comprehensive coverage underscores the evolving nature of modern auto insurance, reflecting an understanding of the diverse transportation needs that arise when your vehicle is out of commission. It's a testament to how Auto Insurance Add-ons like Replacement Vehicle Coverage and Coverage for Rental Expenses are becoming increasingly essential in maintaining mobility and ensuring financial protection during such events.

When an unexpected vehicle repair arises, securing a rental car becomes not just a convenience but a necessity. Rental Car Coverage within auto insurance policies serves as a financial buffer, offering coverage for daily rental expenses and ensuring uninterrupted mobility. This article delves into the practicalities of incorporating this coverage into your existing policy through sections such as “Understanding Rental Car Coverage within Auto Insurance Policies” and “The Advantages of Accident Rental Assistance for Policyholders.” We also explore “Auto Insurance Add-ons: Is Rental Expense Coverage Right for You?” and provide a “Comprehensive Guide to Replacement Vehicle Coverage in Your Policy.” Furthermore, we examine the benefits of “Post-Accident Rental Coverage” as a means to mitigate transportation disruptions, making it an essential aspect of robust auto insurance planning.

- Understanding Rental Car Coverage within Auto Insurance Policies

- The Advantages of Accident Rental Assistance for Policyholders

- Evaluating Auto Insurance Add-ons: Is Rental Expense Coverage Right for You?

- Comprehensive Guide to Replacement Vehicle Coverage in Your Policy

- How Post-Accident Rental Coverage Mitigates Transportation Disruptions

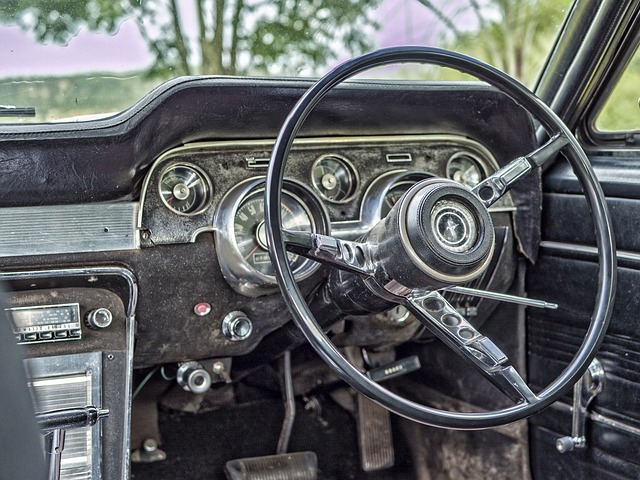

Understanding Rental Car Coverage within Auto Insurance Policies

When considering the implications of an accident or unexpected vehicle repair, having rental car coverage as part of your auto insurance policy can provide significant peace of mind. This particular add-on to your existing policy, often referred to as Accident Rental Assistance, ensures that you are not left scrambling for alternative transportation solutions. It offers Coverage for Rental Expenses, which can be crucial when your vehicle is undergoing repairs due to an accident or other unforeseen issues. This type of coverage typically provides a daily allowance to rent a vehicle, thereby allowing you to maintain your normal routine with minimal disruption. For those who frequently travel or use their car for commuting, this add-on is particularly valuable, as it acts as a safeguard against the unpredictability of vehicle downtime.

Moreover, Insurance for Rental Cars through this coverage extends beyond just a temporary fix; it’s a comprehensive solution that can be tailored to fit your specific needs. It ensures that you have Replacement Vehicle Coverage, which can vary from one policy to another, offering different levels of support depending on the terms agreed upon with your insurance provider. This means that whether you require a compact car for city driving or an SUV for a family road trip, your rental car coverage has got you covered post-accident or during any covered vehicle repairs. By incorporating this add-on into your auto insurance policy, you’re not only safeguarding yourself against the financial strain of unexpected repair bills but also ensuring that you have a reliable means of transportation until your primary vehicle is serviceable once again.

The Advantages of Accident Rental Assistance for Policyholders

In the event of an accident, having Rental Car Coverage as part of your auto insurance policy can significantly alleviate the stress and inconvenience caused by vehicle downtime. This coverage acts as a financial safeguard, providing Policyholders with a daily allowance to cover rental car expenses, ensuring that individuals can continue with their daily routines without significant disruption. For those who opt for Auto Insurance Add-ons like this, the benefits extend beyond mere convenience; it’s a prudent step for financial relief during unexpected repairs. This coverage is not merely a luxury but a practical tool for maintaining mobility post-accident.

The Advantage of Accident Rental Assistance is multifaceted. It ensures that Policyholders are not left stranded as they await repairs to their primary vehicle. With Coverage for Rental Expenses in place, the financial burden associated with rental car costs is mitigated, allowing for a smoother recovery process following an accident. This coverage also removes the need to tap into emergency funds or rely on public transportation, which can be both costly and time-consuming. Insurance for Rental Cars through Post-Accident Rental Coverage is a testament to the comprehensive nature of modern auto insurance policies, offering peace of mind that goes beyond the standard protection against vehicular damage and liability claims. It’s a critical component for anyone who values continuity in their life and work, especially when unforeseen events occur.

Evaluating Auto Insurance Add-ons: Is Rental Expense Coverage Right for You?

When evaluating auto insurance add-ons, considering whether rental car coverage is right for you hinges on your lifestyle and the frequency with which you travel. Rental Car Coverage, often referred to as Accident Rental Assistance or insurance for rental cars, serves as a financial safety net should your vehicle be in the shop due to an accident or repair. This add-on provides coverage for rental expenses, ensuring that your daily commute and personal commitments remain uninterrupted. If you rely heavily on your car for both work and personal errands, this coverage can be particularly beneficial. It acts as a bridge, offering you a replacement vehicle until your own car is repaired or ready for use.

The benefits of such coverage extend beyond mere convenience; they offer peace of mind. In the event of an unexpected collision or mechanical failure that renders your vehicle inoperable, Rental Expense Coverage steps in to alleviate the stress and financial burden associated with securing a temporary mode of transportation. This add-on is especially relevant for those who do not own a second car but cannot afford to be without a vehicle for extended periods. It’s also advantageous for individuals living in areas without reliable public transport. With coverage for rental expenses, policyholders can avoid the hassle and potential additional costs of last-minute car rentals, making Auto Insurance Add-ons like this a prudent investment for comprehensive protection post-accident or during vehicle repairs.

Comprehensive Guide to Replacement Vehicle Coverage in Your Policy

When an accident occurs or your vehicle undergoes unexpected repairs, having rental car coverage as part of your auto insurance policy can be a game-changer. This essential add-on provides post-accident rental coverage, ensuring that you have a mode of transportation while your car is being serviced. It’s not just about immediate relief; it’s about maintaining your daily routine with minimal disruption. The rental car coverage typically includes a daily allowance for rental expenses, which means you can select a vehicle that suits your needs without incurring hefty out-of-pocket costs. This is particularly beneficial if you’re involved in an incident where your car is not drivable and you need to commute to work, pick up children from school, or simply run errands. Insurance for rental cars isn’t a luxury—it’s a practical solution that demonstrates foresight in planning for the unexpected. By incorporating this coverage into your policy, you’re safeguarding yourself against the financial strain that can come with unforeseen vehicle downtime. It’s a proactive step that provides peace of mind, knowing that should an incident occur, you won’t be left scrambling for transportation solutions. With coverage for rental expenses, you can focus on what truly matters without the added stress of mobility concerns.

How Post-Accident Rental Coverage Mitigates Transportation Disruptions

When an accident occurs, the immediate aftermath can be chaotic, with the need for transportation often becoming a pressing concern. Traditional auto insurance policies may not always cover this gap, leaving policyholders to navigate their daily routines without a vehicle. However, by opting for Rental Car Coverage as an add-on to your existing policy, you can significantly mitigate these transportation disruptions post-accident. This coverage serves as a financial safety net by providing allowances for rental car expenses, ensuring that you have a replacement vehicle at your disposal while your car undergoes necessary repairs. With Accident Rental Assistance, drivers can rest assured knowing they won’t be left stranded. The Insurance for Rental Cars aspect of this coverage is designed to cover the costs associated with a rental car after an incident, offering peace of mind and convenience during an already stressful time. It’s a prudent Auto Insurance Add-on that complements your existing policy by addressing the need for temporary transportation solutions. The Coverage for Rental Expenses within Post-Accident Rental Coverage not only facilitates the continuation of your daily activities but also supports your mobility until your vehicle is repaired and ready to hit the road again. This add-on is a testament to the comprehensive nature of modern auto insurance policies, which are increasingly attuned to the diverse needs of drivers in various situations.

When an incident befalls your vehicle, having Rental Car Coverage as part of your auto insurance policy is a strategic move that offers both financial protection and logistical support. This coverage, often providing a daily stipend for rental expenses, serves as a safety net, ensuring that accidental damage doesn’t halt your daily activities. As outlined in our article, which covers various aspects from understanding the policy details to evaluating whether it’s an appropriate Auto Insurance Add-on for you, this coverage is designed to alleviate the stress and inconvenience of unexpected repairs. The inclusion of Replacement Vehicle Coverage within your policy further underscores its value, guaranteeing that you remain mobile post-accident. In light of these advantages, it’s clear that integrating such coverage into your insurance portfolio is a prudent decision for any driver. With Post-Accident Rental Coverage, you can drive forward with confidence, knowing that you’re prepared for the unexpected.