When navigating the complexities of rental living, understanding the nuances of tenant liability insurance becomes paramount. This article delves into the intricacies of renter’s insurance, with a spotlight on tenant liability insurance—a critical safeguard against unforeseen financial burdens. It elucidates the scope of coverage, distinguishing it from homeowner liability, and underscores the importance of considering additional protection through a personal umbrella policy for comprehensive peace of mind. Furthermore, it explores third-party liability, property damage insurance, and accidental injury coverage, ensuring that renters are well-informed about their options to secure their financial well-being in the event of accidents or damages.

- Understanding Tenant Liability Insurance: A Key Component of Renter's Insurance

- The Scope of Tenant Liability Insurance: Beyond the Basics

- Tenant vs. Homeowner Liability: Knowing the Differences

- Property Damage Insurance: How It Protects You as a Renter

- Third-Party Liability: What It Means for Renters

- The Role of a Personal Umbrella Policy in Enhancing Tenant Liability Coverage

- Accidental Injury Coverage: Safeguarding Against Unintended Harm to Others

Understanding Tenant Liability Insurance: A Key Component of Renter's Insurance

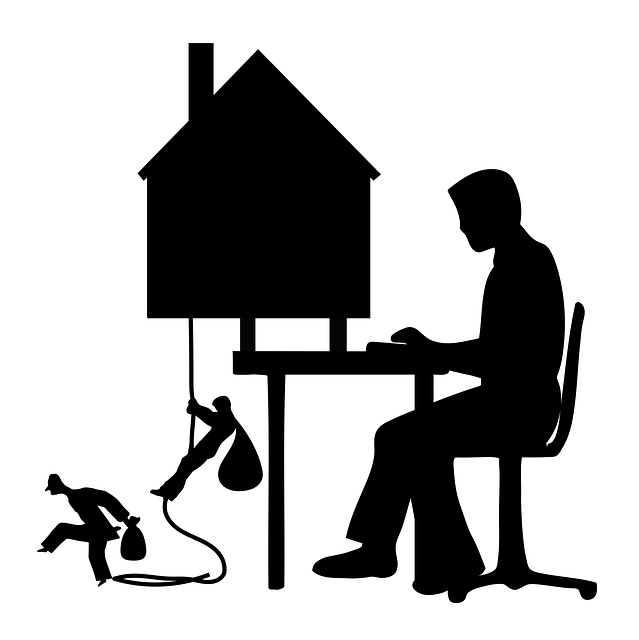

When renting a home or apartment, it’s crucial to comprehend the role tenant liability insurance plays within a broader renter’s insurance policy. This form of coverage is pivotal in safeguarding renters from potentially crippling financial obligations should they be held responsible for property damage or accidental injury occurring within the rental premises. In scenarios where a fire originates from your living space and spreads to adjacent units, tenant liability insurance acts as a protective umbrella, covering the costs associated with repairs and any legal repercussions that may arise. This is particularly important given that landlords’ policies typically only cover their own property up to a certain point; beyond this, you could be held accountable for the remaining damages.

Furthermore, tenant liability insurance extends beyond mere property damage insurance. It also provides coverage for third-party liability claims, which can protect you if someone is injured in your home and decides to sue for negligence or other liabilities. Accidental injury coverage under this umbrella ensures that the well-being of others is not compromised by your circumstances, while also safeguarding your personal assets. A personal umbrella policy can offer additional layers of security beyond the standard renter’s insurance limits, offering peace of mind that your financial stability will remain intact even in the event of a costly incident. Homeowner liability coverage principles are similar, though tailored to those who own their homes rather than renting. Understanding and securing this tenant liability insurance is an essential step for any renter to take, as it provides a safety net that can prevent a single mishap from turning into a long-term financial burden.

The Scope of Tenant Liability Insurance: Beyond the Basics

Tenant liability insurance serves as a safeguard against unforeseen financial burdens that can arise from property damage or accidental injury caused by renters themselves. While basic policies often cover incidents within the rental unit, extending the scope of tenant liability insurance through a personal umbrella policy offers broader protection beyond these confines. This umbrella policy can kick in when the limits of the underlying renter’s insurance are exceeded, providing a crucial additional layer of coverage. For instance, if a guest slips and falls on an icy walkway leading to your rental property, the personal umbrella policy can offer significant third-party liability coverage to protect against claims or lawsuits resulting from that injury.

Furthermore, homeowner liability standards set higher expectations for coverage than what is typically included in a standard renter’s insurance policy. Tenants should consider this gradient of protection when evaluating their need for more comprehensive coverage. Beyond the basics, tenant liability insurance can also encompass accidental injury coverage, which extends financial support to individuals harmed by the renter, and property damage insurance that covers damages caused to others’ belongings or living spaces. This holistic approach ensures that renters are not only protected within their rented space but also have a measure of security when their actions extend beyond the four walls of their home. It is this all-encompassing coverage that can make the difference between financial stability and vulnerability in the event of an incident. Renters should carefully assess their potential liabilities and the extent of their renter’s insurance policy, considering the peace of mind that a broader tenant liability insurance package can provide.

Tenant vs. Homeowner Liability: Knowing the Differences

Renters and homeowners both have responsibilities when it comes to safeguarding their properties and the people within them. A key distinction lies in their respective liability coverages. Tenant liability insurance is a component often included in renters’ insurance policies, which offers protection against financial losses from property damage or accidental injury that a tenant might cause to others or the rented premises. This contrasts with homeowner liability, where the policyholder is responsible for a broader range of risks on their owned property.

In the event of an incident such as a fire or a slip-and-fall, a renter’s liability coverage can shield individuals from the potentially substantial costs associated with repairs or medical care. This protection extends to situations where the tenant’s actions or inactions lead to third-party liability claims. On the other hand, homeowner liability insurance typically provides more comprehensive coverage, safeguarding against similar incidents that occur on their property. Homeowners may also need a personal umbrella policy for additional layers of protection beyond the limits of their standard homeowner’s insurance. This is particularly important if the incident results in significant property damage or bodily injury to others.

For renters, the tenant liability portion of their renters’ insurance acts as a first line of defense, covering them up to a specified limit. Should the costs exceed this amount, a personal umbrella policy can extend coverage, ensuring that renters are not left financially exposed. It is crucial for both renters and homeowners to understand their respective coverages to ensure they are adequately protected against the risks of accidental injury coverage and property damage insurance. This understanding can prevent financial devastation in the event of unforeseen circumstances.

Property Damage Insurance: How It Protects You as a Renter

When unforeseen events occur within your rented dwelling, such as an accidental fire or water damage, property damage insurance serves as a crucial safeguard for renters. This form of coverage is often included in tenant liability insurance, which is a key component of a comprehensive renter’s insurance policy. It shields you from the financial repercussions of accidental injuries to others or unintended property destruction that extends beyond your own living space. For instance, if a guest slips and falls in your home, leading to injury, this insurance can provide the necessary medical coverage for the injured party. Similarly, if a leak from your apartment spreads to the unit below, causing damage, tenant liability insurance can cover the costs of repairs and any disputes that may arise. A personal umbrella policy can extend this protection further, offering additional layers of security beyond the limits of your renter’s insurance. This is particularly valuable if the damage or injury results in substantial financial loss or legal claims. It’s important to understand that while homeowner liability typically covers the property owner for similar incidents, as a renter, you are not responsible for the structure itself but can still be held liable for your portion of the shared spaces and any third-party liability issues. Therefore, having adequate property damage insurance is essential to ensure that you are not left financially exposed in such scenarios.

Third-Party Liability: What It Means for Renters

When renting a home or apartment, it’s crucial to understand the scope of your responsibility for property and people. Third-party liability is a critical aspect of tenant liability insurance that provides financial protection against claims resulting from accidental injury or property damage caused to others. This means that if your actions—or inactions—lead to another person’s injury or their belongings are damaged while in your care, the landlord’s property insurance may cover the cost of repairs and medical bills, but it’s often the tenant who is held legally responsible.

To mitigate this risk, many renters opt for a personal umbrella policy, which extends beyond the standard coverage limits of their renter’s insurance. This policy acts as an additional layer of third-party liability coverage, offering higher liability limits and broader protection. It can provide peace of mind knowing that in the event of a catastrophic incident, such as a guest slipping and falling in your home or a fire starting from your kitchen that spreads to neighboring units, you have adequate financial safeguards. Accidental injury coverage and property damage insurance within a tenant liability insurance policy are designed to protect renters from the potentially significant costs associated with such incidents, ensuring that they are not left in a financially precarious position due to unforeseen events.

The Role of a Personal Umbrella Policy in Enhancing Tenant Liability Coverage

When it comes to comprehensive protection against liability, a personal umbrella policy serves as an invaluable addition to tenant liability insurance. This supplementary coverage steps in where standard renter’s insurance might fall short, offering higher limits of liability to provide extensive financial security. In the unfortunate event that a renter is held responsible for third-party liability claims, such as accidental injury coverage to someone who is not a member of their household, the personal umbrella policy can shield them from the potential burden of excessive costs. It extends beyond the typical coverage limits, ensuring that renters are not personally liable for damages or legal expenses that exceed their tenant liability insurance coverage.

Furthermore, a personal umbrella policy is particularly beneficial for renters who may be at higher risk of claims due to their activities or lifestyle. For instance, if a renter frequently hosts social gatherings and someone gets injured, the umbrella policy can offer additional layers of protection for both property damage insurance and bodily injury liability. This means that whether it’s an expensive claim for damages to a neighboring property or significant medical costs from an accidental injury, a personal umbrella policy can provide the extra coverage needed to avoid financial repercussions. It is a prudent measure for renters who understand the importance of safeguarding their assets and financial well-being against unforeseen events. Homeowner liability insurance may cover similar scenarios for homeowners, but for renters, the personal umbrella policy is the key to a robust defense against potential claims that could otherwise jeopardize their financial stability.

Accidental Injury Coverage: Safeguarding Against Unintended Harm to Others

When unforeseen events occur, such as an accident within your rental home that results in injury to another person, having accidental injury coverage is invaluable. This aspect of a tenant liability insurance policy, often extendable through a personal umbrella policy, provides a safety net for renters who might otherwise be held financially responsible for medical expenses and legal liabilities arising from such incidents. It’s crucial to understand that this coverage extends beyond the confines of your lease; it safeguards you against unintended harm caused to third parties.

In the event that property damage extends beyond the limits of your renter’s insurance policy, a personal umbrella policy can offer additional layers of protection. This is particularly important because accidents happen, and when they do, the costs can be substantial. For instance, if a guest slips and falls in your home, resulting in injury, the expenses associated with their medical care, as well as any legal consequences if they sue for damages, could be significant. A robust personal umbrella policy complements your existing coverage by providing a financial shield against these potential liabilities, ensuring that you are not left financially exposed. Homeowner liability and tenant liability insurance share the common purpose of protecting homeowners and renters alike from the risks of causing unintended harm or property damage. This comprehensive protection ensures peace of mind, allowing you to live and entertain in your rental home without undue worry about the financial implications of an accident.

In conclusion, tenant liability insurance serves as a critical safeguard for renters, offering comprehensive protection against financial loss from property damage and third-party liability claims. As detailed throughout this article, understanding the nuances of tenant liability insurance is essential for anyone renting a home. From the basic coverage to the more expansive protections provided by a personal umbrella policy, renters can significantly mitigate their risk exposure. Homeowner liability differs in many respects, underscoring the importance of tailored insurance to one’s specific living situation. By opting for robust property damage insurance and securing accidental injury coverage, renters can ensure peace of mind, knowing they are well-prepared should unforeseen incidents occur. It is advisable for renters to carefully evaluate their insurance needs and consider the additional benefits of a personal umbrella policy to enhance their tenant liability coverage. Doing so will safeguard not only their assets but also their financial security in the event of costly claims or lawsuits.