When renting a home or apartment, it’s crucial to safeguard your financial well-being against unforeseen events. Tenant liability insurance serves as a vital safeguard for renters, offering robust protection against the financial repercussions of accidental property damage or harm caused to others. This article delves into the nuances of tenant liability insurance, elucidating its role in mitigating risks associated with renting. We’ll explore the scope of coverage, differentiate between tenant and renter’s insurance, and examine additional layers of protection like personal umbrella policies. Understanding the intricacies of third-party liability, homeowner liability, and accidental injury coverage empowers you to make informed decisions about your property damage insurance needs. With a focus on practical implications, real-life case studies, and factors influencing premiums, this guide is designed to ensure you’re adequately protected as a renter.

- Understanding Tenant Liability Insurance: Your Financial Shield as a Renter

- The Scope of Tenant Liability Insurance: More Than Just Accidental Damage

- Tenant vs. Renters' Insurance: Knowing the Difference

- The Importance of Tenant Liability Coverage in Handling Property Damage Incidents

- Personal Umbrella Policy: A Layer of Protection Beyond Tenant Liability

- Navigating Third-Party Liability: How It Differs from Tenant Liability Insurance

- Comparing Tenant Liability to Homeowner Liability: What Sets Them Apart?

Understanding Tenant Liability Insurance: Your Financial Shield as a Renter

When renting a home or an apartment, it’s crucial to recognize the importance of tenant liability insurance as part of your overall protection strategy. This form of coverage acts as a financial shield against unforeseen incidents where you might be held responsible for property damage or accidental injury to others. For instance, if a cooking mishap leads to a fire that spreads beyond your living space, damaging the property of neighbors or common areas, tenant liability insurance can provide the necessary coverage to address these expenses without exposing you to potentially crippling financial obligations. It’s not just about protecting the rental unit you inhabit; it’s about safeguarding your financial well-being from the ramifications of ‘what ifs.’

In the event that someone gets hurt on your rented property and decides to sue, tenant liability insurance steps in to cover legal defense costs. This aspect of the policy is particularly valuable because it complements any existing renter’s insurance by extending protection beyond just your personal belongings. It’s important to understand that while a standard renter’s policy may cover your own possessions against theft or damage, it typically falls short in terms of third-party liability. Therefore, considering a personal umbrella policy or adding an endorsement for additional liability coverage can be a prudent move. This ensures that you are adequately protected not only within the confines of your rented space but also beyond its walls, aligning with the broader scope of homeowner liability that property owners typically have. In essence, tenant liability insurance offers a critical layer of accidental injury coverage and property damage insurance, filling the gaps left by standard policies, and providing peace of mind for renters who want to be thoroughly protected from financial repercussions.

The Scope of Tenant Liability Insurance: More Than Just Accidental Damage

Tenant liability insurance is a critical component for renters, offering robust protection that extends beyond mere accidental damage to a rented dwelling. This form of coverage often acts as a personal umbrella policy, providing an additional layer of security over and above what a standard renter’s insurance policy offers. It ensures that renters are not left financially exposed in the event of third-party liability claims, which can arise from accidents occurring within the rental property that result in bodily injury to others. For instance, if a guest slips and falls on a wet floor in your apartment, sustaining an injury, tenant liability insurance can shield you from the potential medical costs, legal fees, and settlements associated with such incidents.

Furthermore, the scope of tenant liability insurance is comprehensive, covering not only accidental injury coverage but also property damage insurance. This means that if your actions inadvertently lead to damage outside your rental unit—such as a water leak from your apartment that causes damage to the building’s structure or neighboring units—your policy may provide the necessary funds for repairs. It is important for renters to recognize that homeowner liability typically does not apply when you are leasing a property, making tenant liability insurance an indispensable safeguard against unforeseen events that could otherwise result in significant out-of-pocket expenses.

Tenant vs. Renters' Insurance: Knowing the Difference

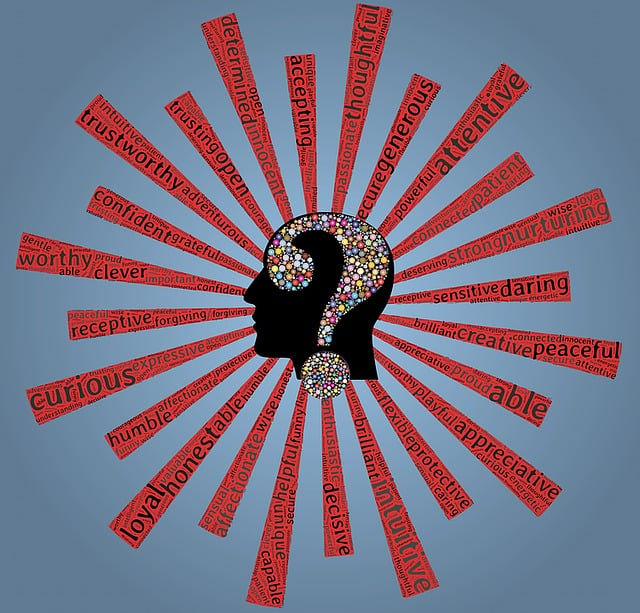

When considering protection for your personal assets and wellbeing while renting a property, understanding the nuances between tenant and renter’s insurance is crucial. Both types of policies offer different layers of coverage that cater to distinct needs. Renter’s insurance, which often includes tenant liability insurance, safeguards individuals from financial burdens should they inadvertently cause damage to rented premises or unintentionally injure others. This coverage extends beyond the confines of your rental unit, providing peace of mind for instances such as a kitchen fire that could spread to neighboring apartments, potentially destroying their contents and causing harm. In such scenarios, renter’s insurance can cover the cost of repairs and the legal expenses that may arise from claims by the property owner or affected third parties.

On the other hand, tenant insurance typically focuses on protecting your personal belongings against perils like theft, vandalism, or natural disasters. It may offer limited liability coverage, but it does not usually extend to incidents where you are held responsible for third-party injury or property damage beyond the rental space. For comprehensive protection, a personal umbrella policy can be an invaluable addition to your insurance portfolio. This type of policy acts as an extra layer of liability coverage on top of your existing tenant or renter’s insurance, ensuring that you are not held personally responsible for claims exceeding your renter’s policy limits, or for incidents that your tenant insurance does not cover. It is important to assess your individual circumstances and consider the scope of coverage you require. For instance, if you have significant assets or engage in activities that increase the risk of liability claims, a personal umbrella policy becomes even more imperative. Furthermore, accidental injury coverage and property damage insurance within these policies are tailored to provide robust defense against unforeseen events, ensuring that renters are not left financially exposed.

The Importance of Tenant Liability Coverage in Handling Property Damage Incidents

When unforeseen events like fires, floods, or accidents occur in a rented dwelling, tenant liability insurance serves as a critical financial safeguard. This coverage is not merely an optional add-on but a prudent measure for renters to protect themselves from the financial repercussions of property damage incidents. In the event that accidental damage extends beyond one’s own rental unit and affects neighboring properties or common areas, tenant liability insurance can provide the necessary funds for repairs. This is particularly important because landlords may pursue legal action to recover costs, and the renter’s personal assets could be at risk without adequate coverage.

Moreover, tenant liability insurance extends beyond mere property damage; it often includes provisions for third-party liability, which shields renters from claims resulting in accidental injury or harm to others. For instance, if a guest slips and falls in the hallway due to your neglect, you could be held responsible. A robust personal umbrella policy can offer additional layers of protection beyond what a standard renter’s insurance might cover. This ensures that renters are not solely liable for medical bills or legal fees associated with such incidents. Similarly, a homeowner liability clause, which might be included in a broader renter’s policy or as an endorsement, can also safeguard renters against claims of negligence. Accidental injury coverage and property damage insurance are integral to these policies, providing peace of mind that renters will not face financial ruin after an incident.

Personal Umbrella Policy: A Layer of Protection Beyond Tenant Liability

When considering your liabilities as a tenant, it’s crucial to understand the extent of protection provided by your renter’s insurance policy, particularly concerning tenant liability insurance. This coverage typically safeguards you against the financial consequences of accidental property damage or injury to others within your rented dwelling. However, there may be instances where additional security is necessary. Enter the personal umbrella policy, a critical layer of protection that extends far beyond the confines of standard tenant liability insurance. This policy kicks in once the limits of your primary renter’s insurance are exhausted, offering substantial coverage for third-party liability claims.

Imagine an incident where an unexpected accident leads to bodily injury or property damage that exceeds the coverage limits of your tenant liability insurance. In such scenarios, a personal umbrella policy serves as a financial safety net, ensuring that you’re not burdened with out-of-pocket expenses that could potentially drain your savings. It provides coverage for situations where you are held responsible for accidents that occur outside your home as well, offering peace of mind that goes beyond the confines of your rented space. This policy is particularly beneficial for those who face higher risks due to their activities or lifestyle, offering additional protection against claims related to homeowner liability in social settings, such as during gatherings at your residence. With accidental injury coverage and robust property damage insurance, a personal umbrella policy stands as a robust defense against the unpredictable nature of liability claims. It’s an investment in your financial security, complementing your renter’s insurance to offer comprehensive protection that adapts to your needs.

Navigating Third-Party Liability: How It Differs from Tenant Liability Insurance

When considering the scope of financial protection against property damage or accidental injury, it’s crucial to understand the distinctions between third-party liability and tenant liability insurance. Third-party liability typically covers you for bodily injury or property damage that you unintentionally cause to others, going beyond the limits of your renter’s policy. For instance, if a guest slips and falls in your rental home due to your negligence, third-party liability would address the medical costs and legal liabilities associated with this incident. In contrast, tenant liability insurance is designed specifically for renters and protects them from financial responsibility should they accidentally cause damage to the rented property. This means that if a fire originates from within your unit, tenant liability insurance can cover the cost of repairing the damages not only to your own dwelling but also to neighboring units.

A personal umbrella policy serves as an additional layer of coverage that complements both homeowner and tenant liability insurance. It extends beyond the standard limits of these policies, offering higher financial protection against claims for bodily injury, property damage, or personal injury like slander, libel, or invasion of privacy. This extra security is particularly beneficial if you’re found liable for such claims and the costs exceed your existing policy limits. Accidental injury coverage within a tenant liability insurance policy can provide peace of mind by covering medical expenses for others injured in your rented space, while property damage insurance ensures that landlords are compensated for any accidental harm done to their property by you or someone for whom you’re responsible. With the right combination of these coverages, renters can safeguard themselves from the financial repercussions of unforeseen events, ensuring they are not held personally responsible for damages beyond their control.

Comparing Tenant Liability to Homeowner Liability: What Sets Them Apart?

When considering financial protection for their homes and belongings, both renters and homeowners have options tailored to their unique living situations. Tenant liability insurance, a component often included in a renter’s insurance policy, serves as a safety net against unintended property damage or accidental injury inflicted upon others while residing in a rented dwelling. This coverage is distinct from a homeowner’s insurance policy, which offers broader protection for both the structure and its contents, including coverage for personal umbrella policy options that extend beyond the standard limits.

In contrast to tenant liability, which primarily addresses third-party liability concerns within the confines of a rented space, homeowner liability extends to a wider scope. It encompasses the responsibility of the property owner for any accidental harm or damage occurring on their premises. This includes not only liability for injuries to guests but also for damage to the dwelling itself, which is typically more extensive than what tenant liability covers. For instance, if a homeowner’s dog bites a visitor or if a fire originates from the home and spreads to neighboring properties, a homeowner liability policy would provide coverage that extends beyond the renter’s policy, offering a more comprehensive level of accidental injury coverage and property damage insurance for both the owned property and any third-party claims arising from such events.

In conclusion, tenant liability insurance serves as a critical financial safeguard for renters, offering comprehensive protection against the unforeseen. By understanding the scope of this coverage—which extends beyond mere accidental damage to include personal umbrella policy options and third-party liability considerations—renters can navigate property damage incidents with confidence. This insurance not only shields against financial burdens resulting from accidental injury or property damage but also distinguishes itself from homeowner liability through its tailored provisions for renters. It is an essential aspect of a well-rounded renter’s insurance policy, ensuring that the unexpected does not lead to unnecessary financial strain. Renters are advised to carefully evaluate their coverage needs, considering both tenant liability and personal umbrella policy options to ensure optimal protection.