Rental Car Coverage, often referred to as Accident Rental Assistance or Replacement Vehicle Coverage under Auto Insurance Add-ons, is an essential component for maintaining mobility after your car is inoperable due to an accident, comprehensive claim, or routine maintenance. This coverage typically offers a daily allowance for rental car expenses, including taxes, fees, and sometimes gas, ensuring that policyholders have access to a vehicle that suits their needs without significant additional cost. It's crucial to understand the specifics of this coverage because it can vary between insurance providers, with some offering comprehensive Rental Car Insurance up to certain limits or durations. This financial support is critical in minimizing disruption to your daily routine or business operations following an unexpected event that renders your vehicle temporarily inoperable. By opting for this add-on, you gain the advantage of having a predefined allowance for rental cars, bridging the gap between vehicle downtime and its restoration. This ensures that you can continue with your activities without major inconvenience, thanks to Insurance for Rental Cars. It's advisable to review your policy in advance to fully comprehend your Coverage for Rental Expenses and Post-Accident Rental Coverage options, ensuring you are prepared and informed when an accident occurs.

When an unforeseen event renders your vehicle inoperable, the need for transportation becomes immediate. This is where incorporating Rental Car Coverage into your auto insurance policy can be a game-changer, offering a safety net against the financial strain of costly repairs and providing you with seamless mobility options. This article delves into the essentials of Rental Car Coverage, highlighting the advantages of adding Accident Rental Assistance to your policy. It also explores valuable Auto Insurance Add-ons, such as Replacement Vehicle Coverage, ensuring you remain mobile without significant inconvenience. We’ll guide you through the various Coverage Options for Rental Cars and offer insights on maximizing Post-Accident Rental Coverage to ensure a smooth transition during vehicle downtime.

- Understanding Rental Car Coverage Within Auto Insurance Policies

- The Advantages of Adding Accident Rental Assistance to Your Policy

- Exploring Auto Insurance Add-ons for Replacement Vehicle Coverage

- Navigating Insurance for Rental Cars: A Comprehensive Guide to Coverage Options

- Maximizing Post-Accident Rental Coverage: Ensuring Seamless Mobility Solutions

Understanding Rental Car Coverage Within Auto Insurance Policies

When considering the implications of an accident or unexpected car repairs, having Rental Car Coverage as part of your auto insurance policy can provide significant peace of mind. This specific add-on to your existing auto insurance policy is designed to offer Accident Rental Assistance, which means that if your vehicle is inoperable due to an accident or undergoing repairs, you are not left without transportation. The coverage typically includes a daily allowance for rental expenses, ensuring that you can maintain your regular activities without significant disruption. This is particularly beneficial when you require a replacement vehicle during the time your car is being fixed.

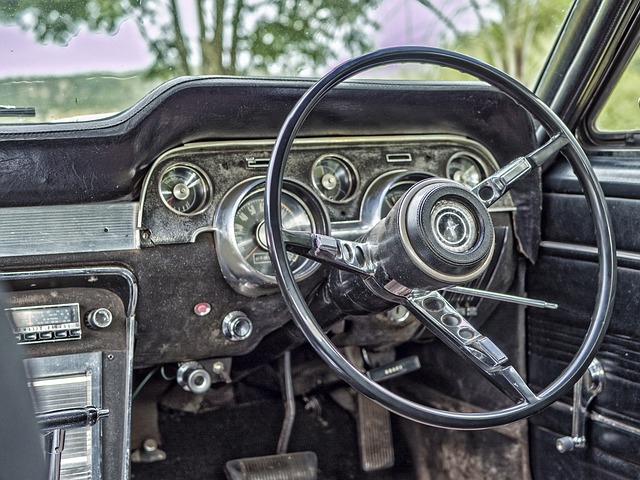

Understanding the nuances of Rental Car Coverage within auto insurance policies is crucial to maximizing its benefits should you ever need it. Insurance for Rental Cars can vary, but generally speaking, it covers the cost of a rental car up to a specified limit or for a certain duration following an insured event like a collision or comprehensive claim. This coverage extends beyond just providing a vehicle; it also offers Coverage for Rental Expenses, which includes not only the rental car itself but also associated costs such as taxes, fees, and sometimes even gas. Post-Accident Rental Coverage is tailored to support you during the critical period immediately following an incident, ensuring that your mobility needs are met while your vehicle is out of commission. With this add-on, you can choose a rental car that suits your needs, providing flexibility and convenience when it matters most.

The Advantages of Adding Accident Rental Assistance to Your Policy

When considering the prudent management of post-accident vehicle downtime, adding Accident Rental Assistance to your auto insurance policy can be a game-changer. This valuable add-on, often categorized as Rental Car Coverage or Insurance for Rental Cars, offers peace of mind that extends beyond mere financial protection. It provides a specified daily allowance for rental expenses, ensuring that you have access to a replacement vehicle without incurring exorbitant costs. This coverage is particularly beneficial in scenarios where your car requires repairs due to an accident, theft, or other unforeseen circumstances. With Auto Insurance Add-ons like this, policyholders can maintain their daily routines and business commitments with minimal disruption.

Furthermore, the benefits of such a provision are twofold: it serves as a practical solution for temporary transportation coverage and helps mitigate the inconvenience of being without a vehicle. Coverage for Rental Expenses under Accident Rental Assistance is designed to be comprehensive, often including a range of vehicle types to suit different needs. This means that whether you need a compact car for city driving or an SUV for a family road trip, your policy can accommodate these requirements, alleviating the stress and uncertainty associated with post-accident logistics. Post-Accident Rental Coverage is not just an add-on; it’s an essential component of a well-rounded auto insurance policy that ensures continuity in your life or business operations when the unexpected occurs.

Exploring Auto Insurance Add-ons for Replacement Vehicle Coverage

When an accident occurs, having a reliable auto insurance policy with added coverages can significantly alleviate the stress and inconvenience that follow. Auto insurance add-ons for replacement vehicle coverage, such as Rental Car Coverage, are designed to provide financial assistance for rental car expenses when your primary vehicle is undergoing repairs due to an accident or other unforeseen events. This type of coverage is not just a luxury; it’s a practical measure that ensures you maintain mobility and keep your daily routine intact. With Rental Car Coverage, policyholders can expect a predefined daily allowance to cover the cost of a rental car, which is an essential aspect of accident rental assistance. This means that whether your vehicle is damaged in a collision or needs extensive servicing, you won’t be left without transportation. Insurance for rental cars through this coverage option helps bridge the gap between when your car is inoperable and when it’s ready to hit the road again. It’s a thoughtful addition to any comprehensive auto insurance policy, offering peace of mind that extends beyond just repairing the damaged vehicle—it accounts for the immediate needs that arise post-accident.

Furthermore, seeking out Auto Insurance Add-ons specifically tailored for Rental Car Coverage ensures that you’re fully prepared in the event of a mishap. These add-ons are crafted to provide coverage for rental expenses without the need for extensive paperwork or out-of-pocket payments. The terms and conditions of such coverage vary by provider, so it’s crucial to understand the specifics of your policy. For instance, some policies may offer a flat daily rate, while others might have a maximum allowance for the total rental period. Regardless, the goal is clear: to provide a safety net that covers you against the financial implications of being without your vehicle. With this foresight, policyholders can rest assured knowing they have coverage for rental expenses, mitigating potential disruptions and ensuring continuity in their lives after an accident.

Navigating Insurance for Rental Cars: A Comprehensive Guide to Coverage Options

When faced with an accident or unexpected vehicle repairs, having rental car coverage as part of your auto insurance policy can be a game-changer. This valuable addition to your existing auto insurance serves as accident rental assistance, ensuring that you are not left scrambling for alternative transportation. Rental Car Coverage typically includes a provision that covers a significant portion of your daily rental expenses, which can significantly alleviate the financial strain during an already stressful time. This means that whether your car is in the shop for routine maintenance or due to damage from an accident, you have the means to maintain your routine without significant disruption.

Understanding the various coverage options available under Rental Car Coverage is crucial for drivers to make informed decisions about their auto insurance policies. Auto Insurance Add-ons like Replacement Vehicle Coverage can provide peace of mind knowing that if an incident occurs, you have access to a rental car without incurring substantial out-of-pocket costs. Insurance for Rental Cars is not just about financial relief; it’s also about practicality and convenience. It ensures that whether for personal use or when traveling, you are covered for rental expenses post-accident. This comprehensive guide to Coverage for Rental Expenses is designed to help drivers navigate their options and select the best fit for their needs, ensuring they are prepared in the event of unexpected vehicle downtime.

Maximizing Post-Accident Rental Coverage: Ensuring Seamless Mobility Solutions

When navigating the aftermath of an accident, securing a replacement vehicle is crucial for maintaining your daily routine. Rental Car Coverage, often available as an add-on to your existing auto insurance policy, offers a financial safety net that can significantly alleviate the stress associated with sudden transportation needs. This coverage typically provides a daily allowance to cover rental car expenses, ensuring that you have access to a vehicle while your car undergoes necessary repairs. For those who opt for Accident Rental Assistance, the process is streamlined; the insurance provider can directly arrange and manage the rental, allowing for a seamless transition from your vehicle to a rental car.

Understanding the specifics of your policy’s Replacement Vehicle Coverage is essential for maximizing this benefit post-accident. Insurance for Rental Cars can vary between policies, with some offering comprehensive coverage for all rental expenses and others providing a specified daily limit. It’s important to review your policy details before an incident occurs, so you are fully aware of the coverage for rental expenses that will be available to you. This proactive approach ensures that when the time comes, you can swiftly activate your Post-Accident Rental Coverage without any surprises or delays. With the right insurance add-ons in place, you can enjoy peace of mind knowing that you’re prepared for the unexpected and that your mobility won’t be compromised by an unforeseen event.

In conclusion, integrating rental car coverage into your auto insurance policy is a prudent move that can alleviate significant financial strain and inconvenience should your vehicle require unexpected repairs. With the addition of accident rental assistance as an auto insurance add-on, you gain peace of mind knowing that you have comprehensive coverage for rental expenses post-accident. This ensures that your daily activities remain uninterrupted, as you’ll have access to a replacement vehicle. By exploring and understanding the various options available for coverage for rental cars, you can make an informed decision that suits your needs and budget. Ultimately, with the right policy in place, you can navigate post-accident scenarios with ease, maintaining your mobility without undue stress or expense.