Navigating the complexities of modern business operations, notary professionals must prioritize robust insurance coverage to safeguard their practice. This article delves into the Types of Notary Insurance available, emphasizing the importance of Affordable Notary Insurance as a shield against the myriad risks faced by notaries today. We explore the comprehensive benefits of a Notary Insurance Policy and elucidate Why Notaries Need Insurance to protect their livelihoods. Ensuring Legal Protection for Notaries is not just about compliance; it’s an essential strategy for sustaining client trust and operational integrity in a litigious landscape.

- Navigating Notary Insurance: Types and Coverage Essentials

- Cost-Effective Options: Finding Affordable Notary Insurance

- The Advantages of a Comprehensive Notary Insurance Policy

- Understanding the Necessity for Legal Protection for Notaries

Navigating Notary Insurance: Types and Coverage Essentials

Navigating the realm of Notary Insurance is a critical task for any notary public looking to safeguard their practice. Among the types of Notary Insurance, Notary Liability Coverage stands out as an indispensable form of protection. This coverage specifically addresses potential claims arising from errors or omissions during notarization processes. It provides a financial safety net against legal challenges, which are increasingly common in today’s litigious society. Additionally, a Notary Public Insurance policy encompasses a broader range of risks, including property damage, personal injury, and loss of documents. These policy benefits are designed to cover the various exposures notaries may face, ensuring that professional responsibilities can be executed without undue concern for personal financial repercussions.

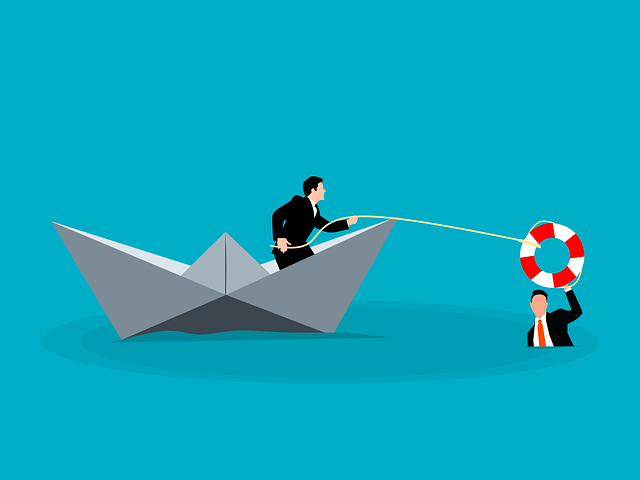

Furthermore, affordability is a key consideration when selecting Notary Insurance. Policies tailored to notary businesses often offer competitive rates while maintaining high coverage limits. It’s imperative for notaries to understand why such insurance is essential—it’s not merely a precaution but a cornerstone of responsible business practice. Legal Protection for Notaries, provided through Notary Business Insurance, ensures that professionals can operate with confidence, knowing they are backed by comprehensive legal support. This protection is vital, as even the most conscientious notary can become embroiled in legal disputes due to circumstances beyond their control. With the right insurance coverage, notaries can navigate their professional responsibilities with greater peace of mind and security.

Cost-Effective Options: Finding Affordable Notary Insurance

When considering the types of notary insurance available, it’s crucial for notaries to evaluate affordable notary insurance options that align with their specific needs and financial considerations. Notary Insurance Policies offer a range of benefits designed to safeguard notaries from potential legal issues and financial repercussions arising from errors or omissions in their professional duties. These policies typically encompass Notary Public Insurance, which provides coverage for the theft of seals or documents, as well as Notary Liability Coverage, which offers protection against claims related to acts of notarization. For instance, if a notary’s negligence leads to a document being improperly notarized, resulting in financial loss for the client, this liability coverage can provide the necessary legal defense and settlement funds, mitigating the impact on the notary’s personal finances.

Navigating the landscape of Notary Insurance Requirements, notaries will find that investing in a Notary Bond and an Errors and Omissions (E&O) Insurance policy can be cost-effective options for maintaining operations with added security. A Notary Bond ensures financial harm caused by the notary’s dishonest or fraudulent acts is covered, offering peace of mind to both the notary and their clients. The E&O Coverage extends further legal protection for notaries by defending against claims related to professional mistakes, including alleged errors in the notarization process or misconduct. By carefully selecting coverage that fits their practice size and risk exposure, notaries can secure comprehensive protection without overextending their budget, thus maintaining a robust defense against potential litigation and upholding the trust clients place in their services.

The Advantages of a Comprehensive Notary Insurance Policy

A comprehensive Notary Insurance policy encompasses various types of coverage tailored to meet the specific risks faced by notaries in their professional capacity. This includes both Notary Public Insurance and Notary Liability Coverage, which together provide a robust shield against potential claims arising from errors or omissions during notarization processes, as well as general legal liabilities. Affordable Notary Insurance options are designed to be accessible to notaries at all stages of their career, offering peace of mind without undue financial strain. The benefits of such a policy extend beyond mere protection; they include the assurance that professional services can be rendered without the specter of unforeseen legal issues disrupting operations or damaging one’s reputation.

For notaries, insurance is not just a precautionary measure but an integral part of maintaining a trustworthy and reliable practice. Legal Protection for Notaries is paramount, as it ensures that in the event of disputes over document authenticity, fraud accusations, or any procedural mishaps, there is a safety net in place to cover legal fees, settlement costs, or judgments against the notary. This protection allows notaries to conduct their duties with confidence, knowing they are equipped to handle potential challenges that may arise during their professional practice. Not only does this reduce the stress associated with the inherent risks of the job, but it also underscores a commitment to professional excellence and client service.

Understanding the Necessity for Legal Protection for Notaries

Notaries public occupy a position of trust within their communities, entrusted with authenticating signatures and documents. As such, they are exposed to potential legal challenges and liability issues that can arise from their professional duties. Understanding the necessity for legal protection is paramount for notaries in today’s litigious society. Types of Notary Insurance are specifically designed to offer a safeguard against these risks. An Affordable Notary Insurance policy can provide comprehensive coverage, including Notary Public Insurance and Notary Liability Coverage, tailored to the unique exposures faced by notaries. This insurance acts as a financial buffer, mitigating the impact of claims related to errors or omissions in notarization processes, as well as protecting against allegations of impropriety. It’s crucial for notaries to recognize why Notaries Need Insurance beyond just the legal aspect; it also ensures business continuity and peace of mind, allowing them to serve clients with confidence, knowing that they are protected against unforeseen events. The benefits of a Notary Insurance Policy extend beyond mere financial protection; they encompass professional credibility and the ability to conduct notarizations without undue concern for personal legal exposure. This coverage is an indispensable tool in navigating the complexities of modern legal practices, ensuring that notaries can operate effectively within their professional scope.

In conclusion, notary businesses must prioritize securing comprehensive types of Notary Insurance to navigate the complexities and risks inherent in their profession. The advantages of an Affordable Notary Insurance policy are manifold, offering Notary Business Insurance that encompasses Notary Public Insurance, Notary Liability Coverage, and additional protections like Notary Bonds and E&O Coverage. Understanding the necessity for Legal Protection for Notaries is paramount in today’s litigious climate, ensuring that notaries can confidently serve their clients without undue financial concern. Embracing a robust Notary Insurance Policy Benefits framework is not merely a good practice but an essential strategy for sustainability and growth within the notarial field.