Notary legal protection stands as a critical safeguard in an era where the demand for notarial services is on the rise. As the role of notaries evolves and their responsibilities expand, the risk of liability inherent in their daily operations necessitates robust insurance solutions. This article delves into why notaries, particularly those operating as mobile professionals, must consider affordable Notary Insurance as an indispensable investment. We explore tailored coverage options that offer financial security and risk management strategies to build a fortress of confidence. Understanding the significance of these protections ensures that notaries can navigate their professional landscape with assurance, knowing they are equipped to handle errors or omissions without jeopardizing their livelihood.

- Understanding the Importance of Notary Legal Protection in an Evolving Market

- Cost-Effective Solutions: Finding Affordable Notary Insurance Options

- Tailored Coverage for Mobile Notaries: Ensuring Financial Security on the Go

- Risk Management Strategies and Liability Protection for Notaries: Building a Fortress of Confidence

Understanding the Importance of Notary Legal Protection in an Evolving Market

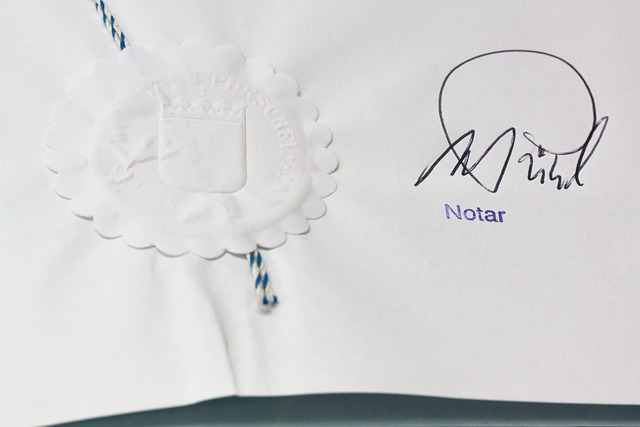

In an era where the notarization landscape is evolving rapidly, Notary Legal Protection emerges as a pivotal aspect of professional responsibility. As the demand for notarial services expands, so too does the potential for exposures that could lead to significant financial repercussions. Mobile notaries, who operate outside traditional office settings and often handle sensitive documents on-the-go, are particularly vulnerable to such risks. Affordable Notary Insurance serves as a safeguard, offering an umbrella of protection against unforeseen errors or omissions that could result in legal action. This coverage is not just a reactive measure but a proactive step towards risk management, ensuring that notaries can navigate their professional responsibilities with confidence and without undue worry about the potential consequences of routine mistakes.

Financial Security for Notaries cannot be overstated, especially when considering the stakes involved in notarial acts. An Insurance Policy for Notaries is designed to provide comprehensive protection, addressing a wide array of potential issues from document fraud to allegations of improper conduct. It’s a testament to the evolving market that such policies are becoming increasingly accessible and tailored to meet the unique needs of notaries operating in various environments. With Notary Risk Management at the forefront, these insurance solutions offer peace of mind, allowing professionals to focus on their duties without the burden of fearing financial ruin due to litigation or reputational harm. It’s a critical component for those committed to maintaining the highest standards of professional integrity in an ever-changing marketplace.

Cost-Effective Solutions: Finding Affordable Notary Insurance Options

In an era where legal vulnerabilities can arise from even the most routine notarial acts, securing notary legal protection is paramount for professionals in this field. Notaries are entrusted with critical documents that require meticulous attention to detail and adherence to legal protocols. As such, the risk of errors or oversights is an inherent aspect of their work. To mitigate these risks, affordable Notary Insurance options are available, providing a safety net against potential claims of negligence or breach of duty. This insurance for mobile notaries, in particular, addresses the unique challenges faced by those who operate outside of a traditional office setting, ensuring that they are not left financially exposed when conducting their services on-the-go.

Financial security for notaries is not a luxury but a necessity, especially as demand for their services continues to expand. An Insurance Policy for Notaries tailored to the specific risks involved in notarization safeguards against costly legal disputes and reputational harm. It’s essential for notaries to consider Notary Risk Management solutions that offer comprehensive coverage without breaking the bank. These policies are designed to be cost-effective, allowing notaries to focus on their professional duties with the assurance of liability protection. This financial security is critical in maintaining a successful and sustainable notarization practice, as it protects both the notary’s livelihood and the trust clients place in their services.

Tailored Coverage for Mobile Notaries: Ensuring Financial Security on the Go

Notary legal protection is paramount in today’s litigious environment, where a single error can lead to significant financial repercussions. Mobile notaries, who often work away from a fixed office location, face unique challenges that necessitate tailored coverage. Affordable Notary Insurance policies designed for mobile practitioners provide comprehensive legal protection, ensuring that whether they are in a client’s home, a coffee shop, or on the road, their professional activities are safeguarded against unforeseen claims of errors and omissions. These insurance plans are meticulously crafted to address the specific risks inherent to the mobile notary’s practice, offering robust financial security for notaries on the move.

Investing in an Insurance for Mobile Notaries policy is a strategic step in notary risk management, aligning with the growing demand for their services. It is an essential component of a notary’s professional toolkit, offering peace of mind that comes from knowing that any potential legal battles or reputational damage caused by mistakes can be managed without the threat of personal financial ruin. A well-structured Insurance Policy for Notaries will cover a wide range of liabilities, including document fraud or mishandling, ensuring that notaries can operate with confidence and maintain their reputation for integrity and professionalism. This level of coverage is not just about responding to claims—it’s about proactive risk management and a commitment to excellence in the notarization process.

Risk Management Strategies and Liability Protection for Notaries: Building a Fortress of Confidence

In an era where legal repercussions can arise from even the most unintentional errors, notaries must prioritize notary legal protection as a cornerstone of their professional practice. Risk management strategies are essential for notaries to operate with confidence and trust, knowing they have a safety net in place. A robust risk management strategy encompasses a comprehensive approach, including adherence to all relevant laws, maintaining meticulous records, and providing exceptional service. This proactive stance helps mitigate the likelihood of claims against them. However, even with stringent risk management measures, unforeseen circumstances can still occur. This is where an Insurance Policy for Notaries becomes indispensable, offering affordable notary insurance options that cater specifically to the mobile notary’s unique needs. Such a policy serves as a financial security blanket, ensuring that notaries are not left vulnerable should they face a lawsuit or claim due to alleged errors or omissions. It covers legal defense costs and any resulting damages, allowing notaries to focus on their professional duties without undue anxiety about the potential financial impact of litigation. With the demand for notarial services ever-increasing, the importance of notary liability protection cannot be overstated. It is a critical component in the overall well-being and longevity of a notary’s career. By securing an Insurance for Mobile Notaries, notaries can build a fortress of confidence, knowing they are safeguarded against the unpredictable nature of their profession. This fortress not only protects their personal finances but also preserves their reputation in the community, which is paramount for ongoing trust and client satisfaction. In essence, notary legal protection is a strategic investment in professional security, ensuring that even the most unexpected of challenges can be managed with the utmost grace and financial prudence.

In conclusion, notaries play a pivotal role in the official process, and with the increasing demand for their services, the risks they face also grow. It is imperative for notaries to recognize the importance of securing Notary Legal Protection as part of their professional practice. With options for Affordable Notary Insurance tailored specifically for mobile notaries, obtaining an Insurance Policy for Notaries becomes a straightforward and economical decision. This coverage serves as a safeguard against potential errors or omissions, providing Financial Security for Notaries that is both comprehensive and responsive to their unique needs. By implementing Notary Risk Management strategies alongside Liability Protection, notaries can build a fortress of confidence, ensuring their reputation and finances remain secure. In an ever-evolving market, investing in Notary Legal Protection is not just a wise choice but a cornerstone of professional responsibility and peace of mind.