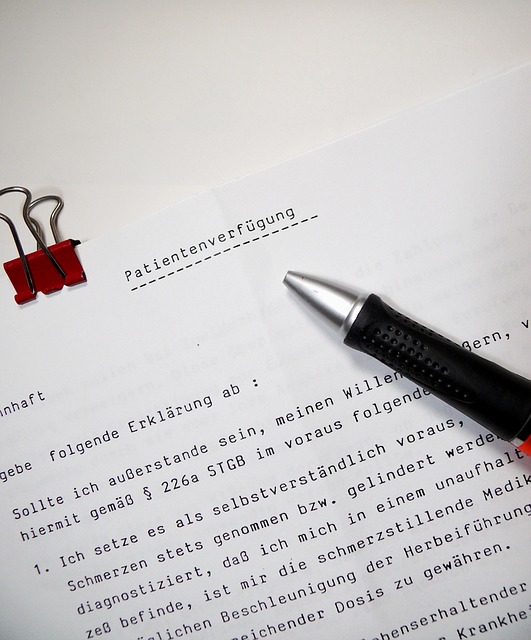

Notary publics serve a critical function in the verification and authentication of documents, yet their role comes with inherent legal liability risks. Understanding the importance of Notary Legal Liability coverage, specifically Errors and Omissions (E&O) insurance, is pivotal for notaries to operate with confidence and protection. This article delves into the essential aspects of E&O insurance, highlighting its role as a safeguard against claims stemming from unintended errors or oversights during notarization activities. From evaluating the Financial Security for Notaries to selecting appropriate coverage limits, we will guide you through the process of choosing the right Notary Public Risk Protection policies and strategies to prevent liability in your day-to-day operations. Ensuring comprehensive Notary Business Insurance is a cornerstone of professional practice, providing peace of mind and maintaining the integrity of notarial acts.

- Understanding Notary Legal Liability: The Role of E&O Insurance

- Key Coverage Aspects of Notary Public Risk Protection Policies

- Evaluating Financial Security for Notaries: Factors Influencing E&O Coverage Limits

- Comprehensive Protection: Choosing the Right Notary Business Insurance

- Strategies for Preventing Notary Liability in Day-to-Day Operations

- Navigating Claims and Legal Defense with Notary E&O Insurance

Understanding Notary Legal Liability: The Role of E&O Insurance

Notary Legal Liability is a critical concept that all notaries public must understand to operate effectively and responsibly within the bounds of their professional duties. The role of E&O insurance, or Errors and Omissions insurance, is pivotal in providing Notary Public Risk Protection. This type of coverage is designed to offer Financial Security for Notaries by mitigating the risks associated with their everyday tasks. It ensures that notaries are not held personally liable should a mistake occur during the notarization process. For example, if a notary mistakenly notarizes a document that leads to a financial loss for a client, E&O insurance steps in to cover legal defense costs and any settlements or judgments against the notary, thereby safeguarding their personal assets and professional reputation.

Given the intricate nature of notarial acts, it’s imperative for notaries to carefully evaluate their exposure to risk. Notary Business Insurance is a strategic investment in their practice. It’s essential for notaries to understand that even with adherence to the highest standards of professional conduct and thorough attention to detail, there is always an inherent risk when dealing with legal documents. E&O insurance acts as a safety net, ensuring that notaries are prepared against claims of negligence or misconduct. By selecting appropriate coverage limits, notaries can rest assured that they have comprehensive protection, allowing them to conduct their business with confidence and peace of mind, knowing that their Financial Security for Notaries is fortified against unforeseen events.

Key Coverage Aspects of Notary Public Risk Protection Policies

Notary Legal Liability coverage, often referred to as Notary Public Risk Protection, is a critical aspect of Financial Security for Notaries. This specialized form of business insurance is tailored to address the unique exposures that notaries public may encounter in their professional practice. It provides a robust shield against claims and lawsuits that can arise from allegations of negligence or errors in the performance of notarial acts. For example, if a notary’s mistake results in a client’s document being rejected by a financial institution due to incorrect information or improper notarization, the Notary Business Insurance policy can offer coverage for both the legal defense and any resulting damages or settlements. This ensures that notaries are not personally liable for such occurrences, which could otherwise have severe financial consequences.

A comprehensive Notary Public Risk Protection policy will typically cover a wide range of potential issues, including but not limited to issues with document authentication, misconduct, breach of duty, and errors in the administration of oaths or affirmations. It is essential for notaries to carefully evaluate their specific operational risks, client interactions, and the types of documents they handle to determine the appropriate level of coverage. This evaluation should be an ongoing process, as the nature of notarization services can evolve over time, potentially introducing new liability exposures. By securing adequate Notary Business Insurance, notaries can operate with greater confidence, knowing that their Financial Security for Notaries is fortified against potential claims and the associated costs, thereby preventing Notary Liability and upholding the integrity of their professional services.

Evaluating Financial Security for Notaries: Factors Influencing E&O Coverage Limits

Notary Legal Liability insurance, commonly referred to as Errors and Omissions (E&O) coverage, is a critical component of Financial Security for Notaries. It provides a safety net for notaries public who are exposed to a variety of risks in the course of their duties. When selecting E&O coverage limits, notaries must carefully evaluate the potential financial impact of claims against them. This includes considering the nature of their notarizations, the volume of their business, and the specific activities they perform that could give rise to a claim. Notary Public Risk Protection is tailored to address these concerns, ensuring that notaries have coverage for various scenarios where their actions—or inactions—could lead to legal challenges or financial losses for clients.

Factors influencing E&O coverage limits are multifaceted and require a thorough understanding of the notary’s business environment and practices. Notaries must consider the jurisdiction’s laws, the types of documents they notarize, and the level of detail required in their notarial acts. Additionally, it’s important for notaries to remain abreast of best practices and any changes in state or federal regulations that could affect their liability exposure. Notary Business Insurance should be comprehensive, covering a wide range of potential errors and omissions without placing undue financial strain on the notary. By obtaining appropriate coverage limits, notaries can safeguard against the costly repercussions of legal actions, ensuring that their professional services are protected against unforeseen circumstances while maintaining Financial Security for Notaries.

Comprehensive Protection: Choosing the Right Notary Business Insurance

Notary legal liability insurance, commonly referred to as Errors and Omissions (E&O) insurance, is a critical component for notaries public seeking comprehensive protection against potential claims. This insurance serves as a financial security net for notaries, providing coverage for unintentional errors or omissions that may occur during the notarization process. It is particularly important for notaries to consider their unique risks and select coverage limits that align with the scope of their business activities. For instance, a notary public risk protection plan can cover legal defense costs and potential settlements if a signer’s identity is misidentified or if a document’s integrity is compromised, which could lead to significant financial loss for clients.

Financial security for notaries extends beyond the immediate transaction; it encompasses long-term stability and trustworthiness in their professional practice. Notary business insurance is not merely about responding to claims after an incident; it is a proactive measure that can prevent notary liability by deterring frivolous lawsuits and providing expert legal defense. This ensures that notaries can operate with confidence, knowing they are prepared for any contingency. It is essential for notaries to regularly review their coverage options and adjust their insurance as necessary, reflecting the evolution of their business and the changing legal landscape. By doing so, they can maintain a high standard of professionalism and protect their reputation and financial well-being.

Strategies for Preventing Notary Liability in Day-to-Day Operations

Notary publics can proactively manage their legal liability by implementing robust strategies within their day-to-day operations. A critical step in preventing notary liability is to maintain a high level of vigilance and attention to detail throughout each notarization process. This includes meticulously reviewing the identity documentation presented by signers, ensuring that all notarial acts are performed in accordance with state laws and the National Notary Association’s best practices. Regularly updating knowledge on notarial law and staying abreast of any changes can also mitigate risks. Additionally, notaries should employ clear communication with clients to establish mutual understanding of the notarization process and its limitations.

Financial security for notaries is paramount, and one of the most effective ways to achieve this is through Notary Business Insurance, which includes coverage for Notary Legal Liability. This insurance serves as a safeguard against claims of negligence, errors, or omissions that may occur despite a notary’s diligence. It is essential for notaries to assess their specific risks and select appropriate coverage limits to ensure comprehensive protection. Notary Public Risk Protection plans often cover a range of scenarios, from alleged mishandling of documents to issues with the notarization’s form or substance. By securing this insurance, notaries can operate with greater confidence, knowing that they have a safety net in place to address any unforeseen liabilities that may arise during their professional duties.

Navigating Claims and Legal Defense with Notary E&O Insurance

Navigating claims and securing legal defense is a critical aspect of a notary’s professional responsibilities, which is where Notary Legal Liability insurance, a component of comprehensive Notary Public Risk Protection, becomes indispensable. This specialized form of Financial Security for Notaries ensures that should an error occur during the notarization process—such as incorrectly witnessing a signature or misinterpreting identification documents—the notary is covered. For example, if a notary inadvertently notarizes a document with incorrect information, which then leads to financial complications for the client, Notary Business Insurance can step in to cover the associated costs of rectifying the error and any potential legal defense fees that may arise from subsequent claims against the notary. This insurance is designed to protect notaries from liability by providing a safety net that allows them to address claims without the immediate financial burden, thereby preserving their reputation and business operations. It is essential for notaries to carefully evaluate their individual risks and select coverage limits that adequately reflect the scope of their activities, ensuring they are prepared for any unforeseen events that could compromise their professional practice.

In conclusion, notary legal liability coverage, or Notary Public Risk Protection as it is formally known, stands as a pivotal safeguard for notaries public. It offers Financial Security for Notaries by providing a defensive umbrella against the unforeseen consequences of human error. With a thorough understanding of one’s risks and careful selection of coverage limits, notaries can procure Notary Business Insurance that aligns with their specific needs. By implementing effective strategies to Preventing Notary Liability within their daily operations, notaries can operate with greater confidence and professionalism. It is advisable for notaries to regularly review their E&O insurance policies to ensure they remain adequate as both their practices and the legal landscape evolve. With these measures in place, notaries can navigate the complexities of their role with a heightened sense of security and an unwavering commitment to uphold the integrity of their services.