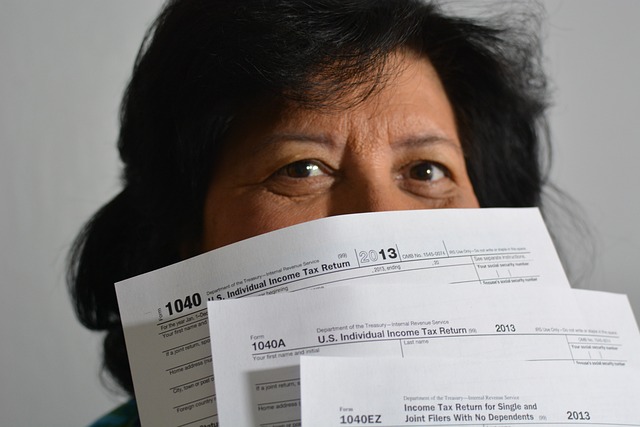

Navigating the complexities of tax season can be a formidable task, but with the advent of online tax filing solutions, the process is streamlined for ease and efficiency. This article serves as your comprehensive guide to mastering income tax e-filing through user-friendly online tools. Whether you’re self-employed or an individual taxpayer, the digital realm offers a suite of resources to simplify your tax return experience. With easy tax filing options and free online tax forms at your disposal, you can accurately complete your returns without the traditional headaches. Additionally, these platforms enhance security, allowing for confident e-filing. Discover how online tax calculators provide insight into your liabilities and potential refunds, aiding in effective financial planning. As we delve into the nuances of secure online tax filing and tax refund tracking, you’ll find that this modern approach to tax preparation is not only time-saving but also offers robust tax filing assistance to ensure you make the most informed decisions come tax season.

- Mastering Income Tax E-Filing: A Guide to Easy Tax Filing with Online Tools

- Streamlining Your Tax Return with User-Friendly Online Tax Forms and Free Filing Options

- Enhancing Security and Efficiency in Self-Employed Tax Filing and Tracking Tax Refunds

Mastering Income Tax E-Filing: A Guide to Easy Tax Filing with Online Tools

Embarking on the process of income tax e-filing can be seamless and straightforward with the plethora of online tools available today. These digital platforms are designed to simplify the complexities of tax season, offering easy tax filing for individuals and self-employed taxpayers alike. By leveraging user-friendly online tax forms, filers can input their financial data accurately and efficiently. The intuitive design of these software programs guides users through each necessary step, ensuring that all required information is correctly reported. For those concerned with security, rest assured that secure online tax filing is a priority for these services, employing robust encryption and privacy protocols to protect sensitive personal and fiscal information.

Furthermore, the ease of e-filing extends beyond the initial submission; it also encompasses tax refund tracking and financial management. Many online tax filing platforms provide real-time updates on the status of your tax return, allowing for transparency and peace of mind throughout the process. Additionally, taxpayers can utilize online tax calculators to estimate their liabilities or anticipate potential tax refunds, aiding in better financial planning. For those who require assistance, help is readily available through virtual support services, ensuring that you are never alone in navigating the complexities of income tax e-filing. With these online tools, tax season becomes less daunting and more manageable, transforming what was once a source of stress into a process that can be completed with confidence and ease.

Streamlining Your Tax Return with User-Friendly Online Tax Forms and Free Filing Options

Each year, tax season arrives with its complex forms and strict deadlines, often leaving individuals and self-employed taxpayers searching for efficient ways to navigate the process. The advent of income tax e-filing has revolutionized this annual tradition by offering an array of easy tax filing options online. These user-friendly online tax forms are designed to simplify the process, allowing individuals to seamlessly input their financial data into a digital format that is both intuitive and comprehensive. The online tax forms guide users through each necessary step, from deductions and credits to ensuring all relevant information is accurately reported. Moreover, for those concerned about security, secure online tax filing options are available, employing state-of-the-art encryption technology to protect sensitive personal and financial data throughout the e-filing process.

The benefits of utilizing online tax forms extend beyond simplicity and security; they also provide accessibility in the form of free filing options for various income brackets. Many reputable services offer free online tax filing, making it an affordable choice for a wide range of taxpayers. These platforms not only help individuals avoid common errors but also enable them to track their tax refunds with ease. The integrated tax refund tracking feature provides real-time updates on the status of one’s return, offering peace of mind and reducing the anxiety typically associated with waiting for a refund. For those who may need additional assistance or have more complex tax situations, such as self-employed individuals, these online tools often come with tax filing assistance, ensuring that even the most intricate returns can be prepared accurately and on time. The shift towards digital tax preparation is not only a boon for convenience but also a significant step forward in making tax season less daunting and more manageable for all filers.

Enhancing Security and Efficiency in Self-Employed Tax Filing and Tracking Tax Refunds

Self-employment necessitates a meticulous approach to managing finances, and income tax e-filing plays a pivotal role in this endeavor. The transition from traditional paper-based filings to online tax forms has revolutionized how self-employed individuals handle their taxes. With the advent of secure online tax filing platforms, the process is not only streamlined but also fortified with robust security measures to protect sensitive financial data. These platforms employ advanced encryption and authentication protocols to safeguard personal and business information throughout the tax filing process. Self-employed filers can breathe easier knowing their tax submissions are encrypted, reducing the risk of fraud and identity theft.

Furthermore, the ease of accessing Easy tax filing resources online means self-employed individuals can file at their convenience, from any location with internet connectivity. The user interface of these platforms is designed to be intuitive, guiding users through each step of the self-employment tax return process. Whether it’s recording income, deducting business expenses, or claiming allowable credits, taxpayers can navigate the complexities of their tax obligations with confidence. Additionally, online tax forms are updated regularly to comply with the latest tax laws and regulations, ensuring that filers remain in good standing with the tax authorities.

For those who have submitted their taxes, Tax refund tracking services are available online, allowing for real-time monitoring of one’s refund status. This feature provides a level of transparency and convenience previously unattainable, as taxpayers can check the progress of their refund without having to contact the tax authority directly. The process is straightforward; simply enter your Social Security number, filing status, and the amount anticipated for a swift update on your refund’s status. This tool not only saves time but also reduces the uncertainty that often accompanies waiting for a tax refund.

Incorporating Tax filing assistance through these online platforms means self-employed individuals no longer have to navigate the complexities of tax season alone. With resources such as online tax calculators, filers can estimate their liabilities and potential refunds before finalizing their returns. This planning tool is invaluable for financial forecasting and budgeting, helping users understand their fiscal responsibilities and plan accordingly. The integration of Tax filing assistance with secure online tax filing systems provides a comprehensive solution that enhances both the security and efficiency of self-employed tax filing and tracking tax refunds.

navigating income tax e-filing no longer has to be a source of stress. With the advent of user-friendly online tax filing solutions, even those who consider easy tax filing a complex task can manage their returns with confidence and ease. The digital transformation in self-employed tax filing, complete with secure online tax filing options and tax refund tracking tools, empowers individuals to approach tax season with a sense of control and efficiency. By leveraging the accessible nature of free online tax filing services, coupled with the accurate and timely e-filing capabilities, taxpayers can streamline their processes and focus on what truly matters. Embrace the convenience and assistance provided by these platforms, making this year’s tax return a testament to the strides made in simplifying financial obligations.