Car insurance has evolved with specialized options for classic cars and teen drivers, ensuring tailored protection at competitive rates. Classic car policies cater to vintage enthusiasts, covering restoration costs and unique risks, while teen driver insurance addresses higher accident rates with incentives for safe behavior. Understanding influencing factors like driving history, vehicle specifics, location, and industry trends is key to choosing the right coverage. Regular policy reviews and taking advantage of discounts enable informed decisions, optimizing protection while managing costs effectively.

Exploring Specialized Car Insurance Options: A Guide to Savvy Protection

The recent surge in car insurance costs has prompted drivers to reassess their coverage choices, prompting a closer look at specialized options. This shift is driven by the need for tailored protection that caters to diverse vehicle types and driver demographics. From classic cars requiring meticulous care to teen drivers navigating the roads for the first time, specific insurance categories offer benefits suited to these unique situations. By delving into these specialties, this article aims to empower drivers to make informed decisions, ensuring they secure adequate coverage while managing costs effectively.

- Understanding Car Insurance Specializations

- Classic Cars vs. Teen Driver Policies

- Navigating Rate Factors and Discounts

- Staying Informed for Optimal Coverage

Understanding Car Insurance Specializations

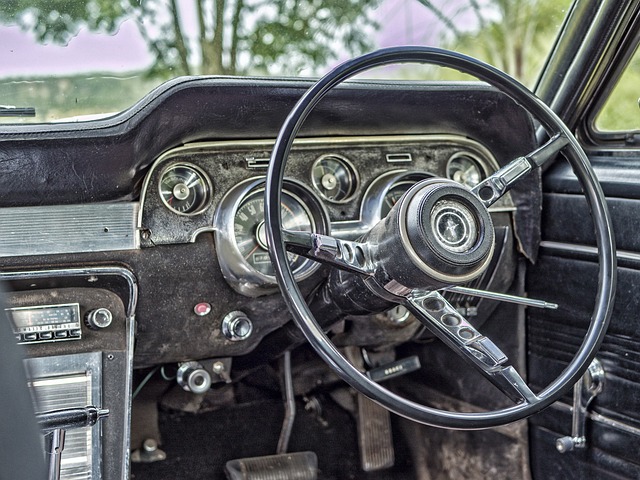

Car insurance has evolved to cater to diverse vehicle types and driver needs, resulting in specialized coverage options. Two notable examples are classic car insurance and teen driver insurance. Classic car insurance is designed for vintage enthusiasts, offering tailored protection for vehicles with historical or sentimental value. Policies typically consider factors like the car’s make, model, age, and condition, often providing more competitive rates than standard insurance due to reduced risk profiles.

Teen driver insurance, on the other hand, addresses the unique challenges faced by young drivers, who statistically have higher accident rates and less driving experience. These policies are crafted to balance affordability with comprehensive coverage, incorporating features that encourage safe driving behaviors, such as good student discounts or completion of defensive driving courses. Understanding these specializations allows drivers to choose the most suitable insurance for their needs, ensuring they receive adequate protection while avoiding unnecessary expenses.

Classic Cars vs. Teen Driver Policies

Classic car insurance and teen driver insurance serve distinct purposes, catering to different demographics with unique risk factors. For vintage vehicle enthusiasts, classic car policies offer specialized coverage tailored to the needs of owning and maintaining a cherished, often high-value, timeless ride. These policies may include provisions for specific restoration or customization expenses, as well as comprehensive or collision coverage options that recognize the unique nature and potential vulnerabilities of these vehicles.

In contrast, teen driver insurance is designed to address the heightened risk profiles associated with young and inexperienced drivers. These policies often incorporate features such as driving history monitoring, parental consent clauses, and strict usage guidelines. They may also offer perks like good student discounts or safe-driving incentives, encouraging responsible behavior behind the wheel. While classic car and teen driver policies share the common goal of providing adequate protection, they do so with distinct approaches, catering to the unique needs and circumstances of their respective target groups.

Navigating Rate Factors and Discounts

Navigating the complex world of car insurance rates requires a deeper understanding of the factors influencing premiums. Several key considerations come into play, including your driving history, vehicle make and model, age and location. For classic cars, insurers often factor in restoration quality, rarity, and the car’s historical significance. Teen drivers, on the other hand, face higher rates due to their lack of driving experience, but policies can be tailored with parental involvement and safe-driver incentives.

Discounts play a significant role in mitigating these costs. Common discounts include good student, safe driver, bundle (combining multiple policies), and multi-car discounts. Staying informed about industry trends and regularly reviewing your policy can help you secure the best rates possible. By understanding how these factors interact, drivers can make more informed decisions when choosing their car insurance coverage.

Staying Informed for Optimal Coverage

Staying up-to-date with industry trends is vital for drivers to make informed decisions about their car insurance. The market is constantly evolving, with new discounts and coverage options emerging regularly. For instance, safe driving apps that track habits can offer incentives like rate reductions from some providers. Additionally, understanding the specific needs of your vehicle—be it a classic or a teen’s first car—is key to finding suitable coverage. By keeping abreast of these changes, you can adjust your policy accordingly and avoid unnecessary expenses.

Regularly reviewing your insurance needs ensures you’re not overpaying for coverage that might not fully protect you. It also allows you to take advantage of new opportunities in the market, such as bundle discounts when combining car and home insurance policies. Staying informed empowers drivers to make strategic choices, ultimately optimizing their coverage while keeping costs manageable.

In response to rising car insurance costs, drivers are increasingly turning to specialized coverage options like classic car insurance and teen driver policies. These tailored solutions not only provide necessary protection but also offer competitive rates by addressing specific risk factors. By understanding the nuances of these policies, comparing quotes, and staying informed about industry trends and discounts, you can secure adequate coverage without unnecessary expenses.