navigating the complexities of investment tax planning is a pivotal strategy for enhancing financial growth while safeguarding against unnecessary liabilities. As investors strive to maximize returns, understanding how investments are taxed becomes paramount. This article delves into the nuances of tax-efficient investments like Roth IRAs and municipal bonds, which can offer tax-free income streams. It also guides readers through the intricacies of tax exemption eligibility and the implications of IRS penalties and interest, ensuring investors make informed decisions. Staying abreast of tax code changes is crucial, as these can significantly impact investment strategies and financial objectives. Additionally, optimizing filing status to enhance tax efficiency within investment portfolios and understanding the role of nonprofit tax filing in investment strategy are essential components for a robust tax planning approach. By integrating these elements, investors can position themselves favorably in the ever-evolving landscape of tax laws and financial management.

- Maximizing Returns through Strategic Investment Tax Planning

- Leveraging Tax-efficient Investments for Enhanced Financial Growth

- Navigating Tax Exemption Eligibility and IRS Penalties

- Understanding Tax Code Changes and Their Impact on Investments

- Optimizing Filing Status for Tax Efficiency in Investment Portfolios

- The Role of Nonprofit Tax Filing in Investment Strategy and Tax Planning

Maximizing Returns through Strategic Investment Tax Planning

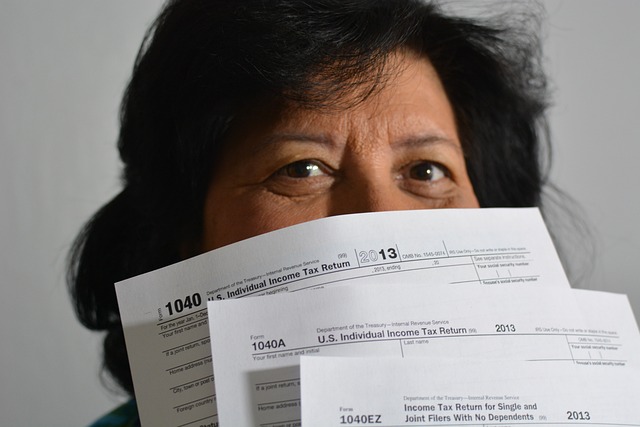

Navigating the complexities of investment tax planning is a pivotal step in maximizing returns while mitigating liabilities. Strategic tax planning involves understanding the specific tax implications associated with various investments and leveraging tax exemption eligibility where applicable. For instance, contributions to Roth IRAs offer potential tax-free growth and income, making them a favored choice for those who qualify. Similarly, investing in municipal bonds can provide a steady stream of income that is often exempt from federal taxes, and sometimes state and local taxes as well. The IRS imposes penalties and interest for failures to comply with tax laws, underscoring the importance of staying informed about current regulations.

Individuals must keep abreast of tax code changes, which can significantly impact investment decisions. Nonprofit tax filing statuses, for example, may offer certain advantages in terms of tax-efficient investments. Optimizing one’s filing status can also result in substantial savings, as it directly influences the amount of tax owed. Regularly reviewing and adjusting one’s investment strategy to align with both personal financial goals and evolving tax laws is essential for maintaining a tax-advantaged portfolio. This proactive approach ensures that investors are positioned to take full advantage of legal tax benefits, ultimately enhancing their overall return on investment.

Leveraging Tax-efficient Investments for Enhanced Financial Growth

Investors can significantly enhance their financial growth by leveraging tax-efficient investments, which are designed to navigate the complexities of the tax code and provide favorable treatment for income earned from these investments. Understanding tax exemption eligibility is crucial for individuals aiming to shield their earnings from federal taxes. For instance, Roth IRAs offer a unique advantage where contributions are made with post-tax dollars, allowing for tax-free withdrawals in retirement, thus providing a strategic solution to potential IRS penalties and interest that could accrue on untaxed funds.

Moreover, municipal bonds are another avenue for tax-efficient investments as they often provide income exempt from federal taxes and, in some cases, state and local taxes as well. These instruments are particularly beneficial for investors in higher tax brackets. Staying abreast of tax code changes is imperative, as these can alter the landscape of tax-efficient investment opportunities. Additionally, optimizing filing status can lead to further tax savings, as certain statuses offer specific advantages. By regularly reviewing and adjusting investment strategies to align with current tax laws and financial objectives, investors can ensure they are taking full advantage of the tax benefits available to them, thereby contributing to their overall financial growth and stability. Nonprofit tax filing entities, for example, must be particularly diligent in navigating these changes to maintain their tax-exempt status and fulfill their mission without unnecessary financial burdens.

Navigating Tax Exemption Eligibility and IRS Penalties

Navigating Tax Exemption Eligibility requires a keen understanding of the intricacies within the U.S. tax code. Investors must carefully assess their financial situation and investment choices in relation to current tax laws to determine eligibility for tax exemptions. For instance, nonprofit organizations that provide charitable contributions can offer tax deductions to donors, which can significantly reduce taxable income. Similarly, individuals exploring tax-efficient investments like Roth IRAs or municipal bonds should be aware of the conditions that render their earnings exempt from federal taxes. It’s crucial to stay informed about Tax Code Changes, as these can alter eligibility criteria and the benefits associated with such investment vehicles.

Understanding IRS Penalties and Interest is equally important for prudent tax planning. The Internal Revenue Service (IRS) imposes penalties and interest on late or incorrect filings, which can erode investment returns. Therefore, it’s imperative to file accurately and on time, utilizing the appropriate filing status to optimize tax benefits. For example, married couples may benefit from filing jointly, whereas single individuals may find that their filing status allows for more favorable treatment under the tax code. Staying abreast of Tax Code Changes is vital, as updates can affect not only the penalties and interest but also the strategies used to minimize liabilities and maximize returns. Regularly reviewing and adjusting one’s investment strategy in light of these changes ensures that investors are leveraging tax-efficient investments to their advantage and adhering to IRS guidelines to avoid unnecessary financial burdens.

Understanding Tax Code Changes and Their Impact on Investments

As tax codes evolve, investors must stay informed about changes that could affect their investment strategies and returns. Tax code changes often involve alterations to eligibility for tax exemptions, which can shift the landscape of tax-efficient investments. For instance, updates to the rules governing Roth IRAs or changes in the taxation of municipal bonds can have a significant impact on investors’ after-tax income. It is crucial for individuals to monitor these developments to maintain their financial goals and maximize returns. The IRS regularly updates its penalties and interest policies to encourage compliance, so staying ahead of these changes is key to avoiding unnecessary expenses. Additionally, nonprofit tax filing adjustments can influence charitable contribution deductions, further emphasizing the need for continuous monitoring of tax-related legislation.

In response to these dynamic tax laws, investors should consider optimization of their filing status to align with the most favorable tax treatment possible. This includes a thorough review of their investment portfolio, ensuring that it is composed of tax-efficient investments that are in sync with the current tax environment. Strategic investment decisions, such as timing the realization of capital gains or income from dividends, can lead to substantial tax savings. By proactively adjusting their investment strategies, investors can not only mitigate tax liabilities but also position themselves to take full advantage of any tax benefits that arise from favorable tax code changes. Regular consultations with financial advisors who are well-versed in the nuances of tax law and its implications for investments can provide invaluable guidance throughout this process.

Optimizing Filing Status for Tax Efficiency in Investment Portfolios

In pursuit of tax efficiency within investment portfolios, optimizing one’s filing status is a strategic move that can yield substantial benefits. Tax Exemption Eligibility varies based on individual circumstances and the chosen filing status can significantly influence the amount of taxes owed or refunded. For instance, certain filing statuses may provide access to specific tax credits or deductions that are not available to those who file under a different status. It is imperative for investors to be familiar with their eligibility and how it interplays with their financial situation, as this can lead to a more advantageous tax position.

Moreover, staying abreast of the ever-changing Tax Code Changes is crucial. The Internal Revenue Service (IRS) periodically updates its guidelines, which may alter the optimal filing status for an individual. Failure to comply with these changes can result in IRS Penalties and Interest, potentially eroding investment returns. Investors should thus regularly review their filing status to ensure it aligns with their current financial goals and tax-efficient investments. Nonprofit Tax Filing entities, for example, must meticulously adhere to these regulations due to their tax-exempt nature. This diligence is not only a legal necessity but also a best practice for individuals managing their portfolios, as it ensures compliance and maximizes the benefits of tax-efficient investments. By carefully considering Filing Status Optimization in conjunction with one’s investment strategy, taxpayers can position themselves to take full advantage of their eligibility for tax savings, thereby enhancing their overall financial well-being.

The Role of Nonprofit Tax Filing in Investment Strategy and Tax Planning

Nonprofit organizations play a pivotal role in investment strategy and tax planning due to their unique tax status, which includes Tax Exemption Eligibility as stipulated by the IRS. As entities that operate for the benefit of the public rather than for private gain, nonprofits are often exempt from certain taxes, including income taxes on donations and grants they receive. This tax-exempt status can influence individual investors and philanthropists to contribute to such organizations as part of their own tax planning strategies, thereby providing a dual benefit: furthering the organization’s mission and potentially reducing the contributor’s taxable income.

For nonprofit entities themselves, Navigating the intricacies of Nonprofit Tax Filing is essential to maintain this tax-exempt status. The IRS imposes stringent requirements and reporting obligations on nonprofits. Failure to adhere to these can result in IRS Penalties and Interest, which can undermine the financial stability of the organization. Therefore, nonprofits must stay abreast of Tax Code Changes and ensure their investment strategies are aligned with the latest tax regulations. This includes optimizing their Filing Status to maintain eligibility for tax exemptions. By doing so, nonprofits not only avoid potential financial setbacks but also can allocate more resources towards their core activities, thereby enhancing their impact and effectiveness in their respective fields. Investors and donors, in turn, can leverage Tax-efficient Investments within these organizations as part of their broader tax planning strategies, contributing to a symbiotic relationship that benefits both the investors and the nonprofit sector.

In conclusion, effective investment tax planning is a cornerstone for savvy financial management. By leveraging tax-efficient investments, understanding tax code changes, and optimizing filing status, investors can strategically position their portfolios to maximize returns while minimizing liabilities. The eligibility for tax exemptions and the potential for IRS penalties and interest underscore the importance of careful planning. Furthermore, staying abreast of Nonprofit Tax Filing nuances can offer additional insights into shaping an investment strategy that withstands the dynamic tax landscape. As tax laws evolve, so too must investors’ approaches to ensure their financial growth trajectory remains unhindered by tax burdens. Regularly reviewing and adjusting one’s investment strategy in light of these factors is key to long-term success and achieving personal financial objectives.