naviguating the complexities of tax strategies is an integral aspect of a business’s financial health. As businesses strive to maintain fiscal responsibility and compliance, mastery of tax exemption eligibility and understanding IRS penalties and interest can prevent costly legal entanglements. This article delves into the nuances of nonprofit tax filing, guiding charitable organizations through their unique compliance requirements. Additionally, it explores the importance of identifying tax-efficient investments that align with business objectives, ensuring every financial decision contributes to both short and long-term goals. Staying abreast of impending Tax Code Changes is imperative for proactive planning, as is optimizing filing statuses for maximum advantage. By year-end, businesses must assess their financial performance and implement strategic last-minute tax moves. This comprehensive guide aims to equip businesses with the knowledge and strategies necessary to navigate the intricacies of tax planning, enhancing efficiency and compliance in the fiscal year ahead.

- Maximizing Tax Exemption Eligibility for Enhanced Financial Health

- Navigating IRS Penalties and Interest: The Importance of Tax Compliance

- Strategic Nonprofit Tax Filing: A Guide for Charitable Organizations

- Identifying Tax-efficient Investments to Align with Business Goals

- Staying Ahead of Tax Code Changes: Proactive Planning for Businesses

- Year-end Tax Planning: Assessing Financial Performance and Implementing Last-Minute Strategies

- Optimizing Filing Status for Maximum Benefit and Compliance

Maximizing Tax Exemption Eligibility for Enhanced Financial Health

To maximize tax exemption eligibility and bolster a business’s financial health, it is imperative to stay abreast of the intricacies within the IRS tax code. Nonprofit organizations, in particular, must meticulously navigate the nuances of tax-exempt status to ensure they are fully leveraging their eligibility. This involves understanding and adhering to the stringent requirements set forth by the IRS, which governs how nonprofits can use and report funds. By maintaining rigorous compliance with these guidelines, organizations can avoid costly IRS penalties and interest, thereby preserving their tax-exempt status and financial integrity.

Furthermore, businesses should consider the impact of tax code changes on their eligibility for tax exemptions. These changes can alter the landscape of allowable deductions and credits, necessitating a dynamic approach to tax planning. Investment decisions must be evaluated through the lens of tax efficiency, ensuring that capital gains are managed in a manner that aligns with financial goals while minimizing tax liabilities. Filing status optimization is another strategic move that can yield significant tax savings. By carefully selecting the most advantageous filing status, businesses can position themselves to take full advantage of the tax benefits for which they are eligible, enhancing their overall financial health and ensuring compliance with complex tax regulations.

Navigating IRS Penalties and Interest: The Importance of Tax Compliance

Navigating IRS penalties and interest is a critical aspect of maintaining the financial health of any business. The Internal Revenue Service (IRS) imposes penalties and charges interest on the tax amount owed if it’s not paid by the due date, regardless of whether a tax return was filed on time or not. These penalties can accumulate quickly, often compounding month-to-month, which can significantly impact a company’s cash flow and financial stability. Therefore, businesses must prioritize accurate and timely tax compliance to avoid such repercussions. Understanding the intricacies of the tax code, including any recent tax code changes, is essential for businesses to stay ahead of these issues. This includes being aware of their eligibility for tax exemptions, particularly if they operate as a nonprofit organization. Nonprofit Tax Filing requires meticulous attention to detail due to the stringent reporting and compliance standards that apply to such entities.

Moreover, businesses must strategically plan their investments with an eye on tax-efficient options. By selecting tax-efficient investments, companies can reduce their overall tax liabilities, which in turn enhances their financial performance. Filing status optimization is another crucial factor that can yield substantial savings. A properly optimized filing status can lead to significant reductions in taxes owed and may even provide access to additional tax benefits. Businesses must continuously assess their tax situation throughout the year to ensure they are positioned to take advantage of these strategies, particularly as tax laws and regulations evolve. This proactive approach not only helps in avoiding IRS penalties and interest but also ensures that businesses utilize all available resources to remain financially efficient and compliant with tax regulations.

Strategic Nonprofit Tax Filing: A Guide for Charitable Organizations

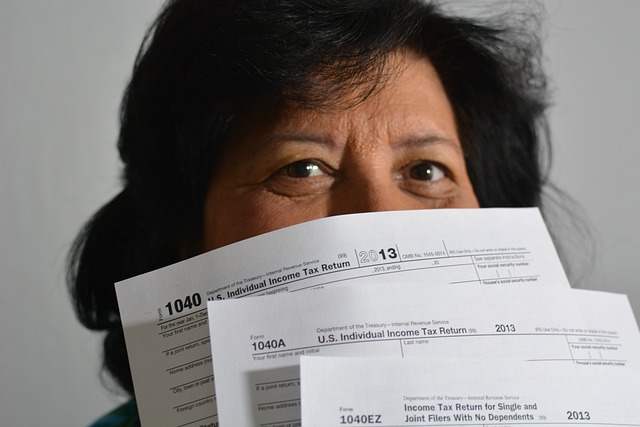

Charitable organizations must navigate the complexities of nonprofit tax filing to maintain their tax-exempt status and ensure financial integrity. Understanding Tax Exemption Eligibility is paramount, as it dictates the organization’s ability to operate without paying income taxes on certain types of income. To maintain this privilege, organizations must adhere to stringent IRS guidelines and file annual returns, such as Form 990, which provide a detailed account of their finances and activities. Nonprofit Tax Filing requires meticulous attention to detail, as missteps can lead to IRS Penalties and Interest that could undermine the organization’s financial stability.

Organizations should stay abreast of Tax Code Changes, as these can affect eligibility for tax-exempt status and impact funding sources. Strategic planning for Nonprofit Tax Filing involves identifying tax-efficient investments that align with the organization’s mission while optimizing its financial resources. By leveraging tax-advantaged investment vehicles and understanding the intricacies of the current tax code, charities can maximize their impact without compromising their nonprofit status. Additionally, organizations should focus on Filing Status Optimization to ensure they take full advantage of available tax benefits. This includes careful planning of donations, grant management, and other financial transactions to minimize taxes and enhance the organization’s ability to fulfill its charitable objectives. By prioritizing these strategic considerations, nonprofit entities can effectively manage their tax responsibilities and contribute more effectively to their intended causes.

Identifying Tax-efficient Investments to Align with Business Goals

Businesses aiming to optimize their financial outcomes must navigate the complex landscape of tax-efficient investments. Identifying opportunities that align with business goals while considering Tax Exemption Eligibility is a strategic move that can yield substantial benefits. The IRS provides guidelines for various investments that may offer exemptions, which savvy businesses can leverage to enhance their financial portfolio without incurring undue taxes. It’s imperative to stay abreast of the ever-changing Tax Code Changes as they can significantly impact investment decisions and long-term financial health.

For instance, entities that qualify as nonprofit organizations must adhere to specific tax filing requirements, which differ from those of for-profit businesses. These entities often rely on donations and grants, making it crucial to understand the nuances of Nonprofit Tax Filing to maintain their exempt status and avoid IRS Penalties and Interest. By optimizing their Filing Status, nonprofits can ensure they are not unintentionally subjecting themselves to taxable income, thereby preserving the resources necessary to fulfill their missions. Similarly, for-profit businesses must also navigate the tax code with precision, selecting Tax-efficient Investments that align with both immediate and long-term business objectives while ensuring compliance and financial efficiency.

Staying Ahead of Tax Code Changes: Proactive Planning for Businesses

businesses must remain vigilant and proactive in their approach to tax planning, particularly as tax codes evolve with increasing complexity. Staying ahead of tax code changes is not merely a matter of compliance but a strategic move that can yield substantial financial benefits. The Internal Revenue Service (IRS) regularly updates its regulations, which can lead to new opportunities for tax exemption eligibility for certain business activities or investments. By staying informed and agile, companies can capitalize on these updates, ensuring they do not incur IRS Penalties and Interest that often accompany non-compliance or late filings.

For instance, nonprofits must navigate the intricate world of nonprofit tax filing to maintain their exempt status. This involves a diligent process of tracking all financial transactions and adhering to specific reporting requirements set forth by the IRS. Additionally, businesses looking to invest should prioritize identifying tax-efficient investments that can provide both financial growth and favorable tax treatment. Filing status optimization is another critical aspect for individuals who own or operate a business and file taxes personally. This strategic planning can significantly reduce overall tax liabilities, ensuring that the business not only adheres to current tax laws but also leverages them to enhance its financial efficiency. By doing so, businesses position themselves to not only avoid legal issues and penalties but also to thrive in an ever-changing fiscal landscape.

Year-end Tax Planning: Assessing Financial Performance and Implementing Last-Minute Strategies

As year-end approaches, businesses are well-advised to engage in meticulous tax planning to optimize their financial outcomes and ensure compliance with IRS regulations. This critical period allows for a thorough assessment of the company’s performance throughout the fiscal year. It is an opportune time for organizations to identify their eligibility for tax exemptions, which can significantly reduce their overall tax liability. For instance, nonprofit entities must navigate the complexities of their specific tax filing requirements to maintain their exempt status and avoid IRS penalties and interest.

During year-end tax planning, businesses must stay abreast of any recent changes to the tax code, as these can have profound implications on their tax position. Strategic decisions on investment choices should be informed by a focus on tax-efficient investments, ensuring that capital gains are managed effectively to avoid unnecessary taxes. Additionally, optimizing filing statuses can yield additional benefits. By carefully considering all available deductions and credits, businesses can not only enhance their financial efficiency but also position themselves to take advantage of any last-minute strategies that may emerge as the year closes. This proactive approach to tax planning is essential for safeguarding against the uncertainties of tax law fluctuations and ensuring that a business’s financial health remains robust.

Optimizing Filing Status for Maximum Benefit and Compliance

Navigating the intricacies of the tax code is a pivotal aspect for businesses aiming to optimize their filing status for maximum benefit while ensuring compliance with IRS regulations. Understanding one’s eligibility for Tax Exemption Eligibility is fundamental, as it can significantly reduce liability or even render certain income non-taxable. For instance, nonprofit organizations must adhere to specific tax filing requirements, such as Form 990, which not only fulfills the obligation to disclose financial information but also helps maintain public trust.

To maximize benefits, businesses should actively monitor and adapt to Tax Code Changes, as these can alter eligibility criteria or introduce new opportunities for exemptions. Filing status optimization is a strategic move that can lead to substantial savings and compliance assurance. This involves selecting the most advantageous filing status based on one’s marital status, dependents, and other relevant factors. Additionally, businesses should consider the tax implications of their investments, focusing on Tax-efficient Investments that align with their financial goals while minimizing exposure to IRS Penalties and Interest. By leveraging these strategies, businesses can not only enhance their financial efficiency but also navigate the complexities of tax laws with greater confidence and precision.

businesses must proactively engage with tax strategies to secure their financial well-being. By maximizing Tax Exemption Eligibility, entities can fortify their finances while adhering to the letter of the law, thereby avoiding IRS Penalties and Interest that often accompany non-compliance. Nonprofit Tax Filing requires particular attention to detail, ensuring that charitable organizations navigate this complex process effectively. Similarly, selecting Tax-efficient Investments is pivotal in aligning financial decisions with strategic business goals. As the tax code evolves, staying abreast of Tax Code Changes through proactive planning is essential for maintaining a competitive edge. Finally, Year-end Tax Planning offers a critical window to evaluate financial performance and execute decisive strategies that can lead to substantial savings, particularly in Filing Status Optimization. In essence, these strategic approaches not only enhance compliance but also contribute to the overall financial efficiency of businesses in diverse sectors.