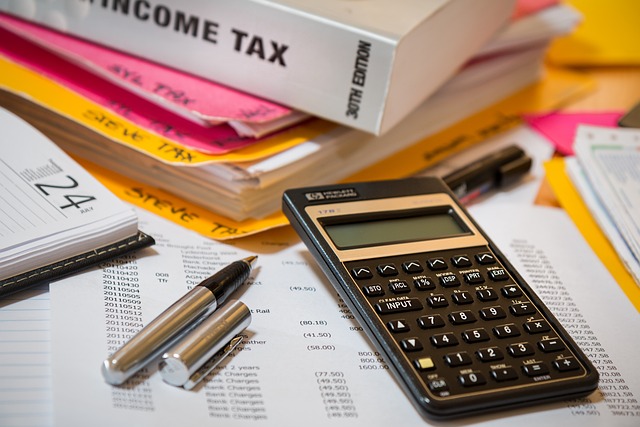

High-income earners have unique tax challenges that necessitate personalized strategies to optimize their financial situations. This comprehensive guide delves into tax-saving tips and income tax reduction techniques specifically designed for individuals with higher earnings. By leveraging tax-efficient investments, strategic wealth management tax strategies, and proactive small business tax planning, high-income earners can significantly reduce their tax liabilities. Additionally, retirement tax planning ensures that one’s wealth is managed effectively to provide both financial security and legal tax advantages. Regular reviews of these strategies, in conjunction with staying abreast of changing tax laws, are essential for maintaining tax optimization and achieving personal financial goals. This article will navigate through the key areas of tax planning for high-income earners, offering actionable insights to minimize tax obligations and secure a financially sound future.

- Maximizing Tax-Efficient Investments: A Strategic Approach for High-Income Earners

- Income Tax Reduction Tactics for High-Income Individuals

- Charitable Contributions: A Double Benefit for High-Income Earners' Tax Planning

- Wealth Management Tax Strategies: Advanced Planning for High-Income Earners

- Tax Optimization for Small Business Owners with High Incomes

- Retirement Tax Planning: Ensuring Your Wealth Works for You, Legally

Maximizing Tax-Efficient Investments: A Strategic Approach for High-Income Earners

High-income earners have unique financial landscapes that necessitate a strategic approach to tax-saving tips and income tax reduction. To minimize one’s taxable income, it is imperative to allocate resources into tax-efficient investments. These are designed to offer concessional treatment by the tax authorities, thereby reducing the amount of income tax an individual must pay. For instance, retirement accounts often come with attractive tax advantages, allowing high earners to defer taxes on contributions and earnings until a later date when they may be in a lower tax bracket. Furthermore, exploring small business tax planning can yield additional benefits; by utilizing specific vehicles such as SEP IRAs or solo 401(k)s, entrepreneurs can channel profits into tax-deferred accounts, effectively shielding a portion of their income from immediate taxation.

In addition to leveraging the inherent advantages of tax-efficient investments, high-income earners should consider wealth management tax strategies as part of their broader tax optimization strategies. These strategies encompass a range of sophisticated financial instruments and planning techniques that can provide substantial tax savings. For example, trusts and estates can be structured to minimize estate taxes and pass more wealth to heirs. Additionally, charitable donations can offer immediate tax deductions while supporting causes the individual cares about. Regularly revisiting one’s tax plan in light of changing tax laws ensures that high-income earners continue to benefit from the most advantageous arrangements. This proactive approach to retirement tax planning and small business tax planning is crucial for maintaining financial health and achieving long-term wealth preservation.

Income Tax Reduction Tactics for High-Income Individuals

High-income individuals have unique challenges and opportunities when it comes to income tax reduction. Tax-saving tips for this demographic often revolve around employing tax-efficient investments, which can provide both financial growth and tax advantages. For instance, contributing to retirement accounts like a Roth IRA or a 401(k) can be particularly beneficial, as these accounts often offer tax-deferred growth potential. Additionally, utilising tax optimization strategies such as income averaging, where allowed, can spread out income over multiple tax years, thereby reducing the tax liability in any single year.

Small business tax planning and wealth management tax strategies are critical components for high-income earners who may have diverse income streams. Business owners can take advantage of deductions related to their operations, such as depreciation on equipment or office expenses, to lower their taxable income. Furthermore, wealth management tax strategies often involve the careful allocation of assets across various accounts designed for different tax treatments. By engaging in proactive retirement tax planning and leveraging tax-advantaged vehicles like trusts or life insurance policies, high-income earners can effectively shield their wealth from unnecessary tax burdens. Regularly reviewing one’s financial plan in light of evolving tax laws ensures that these strategies remain effective and aligned with personal financial goals. This diligent approach to tax planning for high-income earners is essential for maintaining financial stability and maximizing after-tax income.

Charitable Contributions: A Double Benefit for High-Income Earners' Tax Planning

Charitable contributions can serve as a dual advantage for high-income earners in their tax planning strategies, offering both philanthropic value and tax-saving benefits. By donating to qualified charitable organizations, these individuals can reduce their taxable income, thereby lowering their income tax liability. This is particularly impactful for those with substantial earnings, as the deduction can be significant enough to noticeably decrease their tax burden. Moreover, identifying charitable causes that align with personal values adds a layer of meaning to the act of giving, making it not just a financial decision but a reflective one as well. High-income earners should explore tax-efficient investments, such as donor-advised funds or charitable trusts, which can further enhance their tax optimization efforts. These vehicles allow for the accumulation of assets, the growth of which is sheltered from taxes, and provide a structured approach to distributing funds to charity over time. When integrating charitable contributions into one’s tax planning, it’s crucial to stay informed about changing tax laws and to work closely with financial advisors who specialize in small business tax planning and retirement tax planning. This ensures that the contributions are both strategically timed and structured to maximize their tax benefits while supporting the causes that matter most to the individual.

In addition to charitable contributions, high-income earners must consider a comprehensive array of tax optimization strategies. These include leveraging tax credits, utilizing tax-deferred accounts like IRAs or 401(k)s for retirement tax planning, and employing wealth management tax strategies that address capital gains, dividends, and interest income. By taking a proactive stance and regularly reviewing one’s financial plan, high-income earners can ensure their strategies remain aligned with both personal goals and the intricacies of the tax code. This diligence not only facilitates income tax reduction but also positions individuals to safeguard and grow their wealth in a tax-efficient manner. Small business owners, in particular, must be meticulous in their approach, as smart tax planning can have a profound impact on their bottom line and long-term financial security.

Wealth Management Tax Strategies: Advanced Planning for High-Income Earners

High-income earners have distinct financial landscapes that necessitate sophisticated tax-saving tips and strategies to optimize their income tax reduction potential. Wealth management tax strategies are pivotal in this context, offering a suite of tailored solutions that transcend the scope of standard advice. By leveraging tax-efficient investments, these individuals can harness the power of diverse financial instruments to yield both growth and tax advantages. For instance, deploying assets into tax-advantaged accounts or utilizing municipal bonds can significantly reduce exposure to income taxes.

Moreover, a proactive approach to claiming deductions and credits is essential for high earners looking to minimize their tax liabilities. Small business tax planning often overlaps with personal tax optimization strategies, particularly for those who own a side venture or have passive income streams. In the realm of retirement tax planning, employing strategies such as Roth conversions or maximizing contributions to tax-deferred accounts can ensure financial preparedness while navigigating the complexities of the tax code. Regular reviews of one’s financial plan in conjunction with evolving tax laws are indispensable for maintaining alignment with personal goals and achieving long-term tax efficiency. This diligent process ensures that high-income earners can capitalize on every legal opportunity to preserve their wealth, all while staying compliant and maximizing their after-tax income.

Tax Optimization for Small Business Owners with High Incomes

Small business owners with high incomes face unique challenges when it comes to managing their tax liabilities effectively. Implementing tailored tax-saving tips is crucial for these individuals to reduce their income tax burden while remaining compliant with tax regulations. One effective strategy involves leveraging small business tax planning, which includes identifying all possible deductions and credits applicable to the business’s operations. By meticulously categorizing business expenses, from office supplies to vehicle usage, entrepreneurs can minimize their taxable income.

Furthermore, retirement tax planning is an integral part of comprehensive wealth management tax strategies for high earners. These individuals should consider tax-efficient investments that offer both growth potential and favorable tax treatment. For instance, contributing to a Self-Directed Solo 401(k) allows high-income earners to save significantly more compared to traditional IRAs. Additionally, exploring Roth options can provide long-term tax benefits by paying taxes upfront in exchange for tax-free withdrawals later on. By aligning their financial plans with evolving tax laws and employing a proactive approach to tax optimization strategies, small business owners with high incomes can effectively navigate the complexities of the tax code, ensuring they maximize their after-tax income. Regularly reviewing these plans and staying informed about changes in tax legislation is essential for maintaining tax efficiency throughout various life stages.

Retirement Tax Planning: Ensuring Your Wealth Works for You, Legally

High-income earners can significantly benefit from tailored retirement tax planning strategies that ensure their wealth is utilized effectively and legally. As individuals approach retirement, they must consider tax-efficient investments as a cornerstone of their financial strategy. These investments are designed to minimize taxes during both the accumulation phase and the distribution phase of retirement. By selecting accounts like Roth IRAs or Roth 401(k)s, which offer tax-free withdrawals, high earners can strategically plan for a future with less tax burden. Additionally, employing tax optimization strategies such as converting traditional IRA balances to Roth IRAs, when advantageous, can provide substantial income tax reduction benefits down the line.

Moreover, wealth management tax strategies are pivotal in this phase of life. These strategies often involve a comprehensive analysis of all income sources and the potential for income shifting, where possible, to lower-taxed brackets or into future years when tax rates may be more favorable. Charitable donations can also play a role, offering both tax savings and the opportunity to support causes that matter. Small business owners, in particular, must navigate complex tax rules; thus, small business tax planning requires a nuanced approach, considering entities like S corporations or LLCs that might offer distinct tax advantages. Regular reviews of financial plans are essential to ensure they remain aligned with both personal goals and the ever-changing tax landscape, allowing high-income earners to maintain control over their financial future and secure their retirement years in the most tax-efficient manner possible.

High-income earners have unique tax challenges that necessitate a bespoke strategy to optimize their financial situation. As detailed in this article, leveraging tax-saving tips such as income shifting and charitable donations, alongside strategic investment choices, can significantly reduce income tax obligations. Emphasizing tax-efficient investments is a cornerstone of any effective tax planning for high-income earners, offering both financial growth and tax benefits. Similarly, wealth management tax strategies provide advanced planning opportunities that can shield assets and minimize taxes. Small business owners with high incomes can also benefit from tailored tax optimization strategies to ensure their entrepreneurial endeavors complement their personal tax planning. Retirement tax planning emerges as a critical component for these individuals, ensuring their later years are both comfortable and legally tax-efficient. Regularly revisiting these plans in light of changing tax laws ensures longevity and adaptability in tax strategies. By integrating these comprehensive approaches, high-income earners can achieve significant tax savings while aligning with their broader financial objectives.