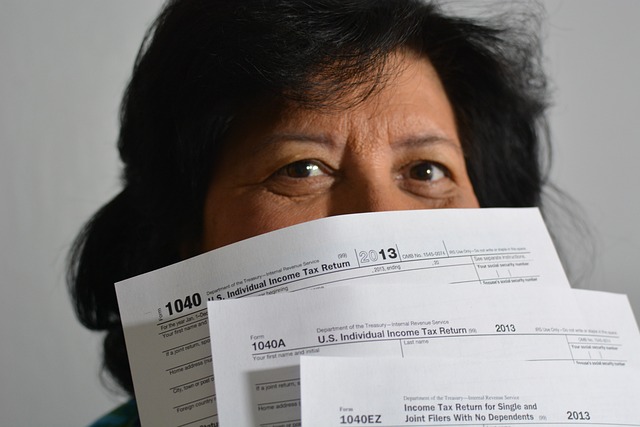

High-income earners have unique financial profiles that necessitate a personalized approach to income tax reduction. This article delves into the intricacies of tax-saving tips tailored for those in higher income brackets, emphasizing tax optimization strategies such as strategic income management, leveraging charitable donations, and utilizing philanthropic planning. It also explores the importance of tax-efficient investments, small business tax planning, retirement tax planning, and advanced wealth management tax strategies. By understanding and implementing these strategies, individuals can effectively align their financial plans with personal objectives, all while navigating the complexities of evolving tax laws to minimize their income tax obligations.

- Maximizing Tax Savings through Strategic Income Management for High-Income Earners

- Leveraging Charitable Donations and Philanthropic Planning to Reduce Income Tax Obligations

- Navigating Small Business Tax Planning: Deductions, Credits, and Efficiency

- Effective Retirement Tax Planning Strategies for High-Income Individuals

- Exploring Tax-Efficient Investments for Long-Term Wealth Accumulation

- Implementing Advanced Wealth Management Tax Strategies for High-Income Earners

Maximizing Tax Savings through Strategic Income Management for High-Income Earners

High-income earners have unique opportunities to maximize their tax savings through strategic income management. By leveraging tax-saving tips, individuals can effectively reduce their income tax burden. One effective approach is to engage in income shifting, where legal methods are used to recharacterize income to lower-taxed periods or entities, thereby optimizing the overall tax position. For instance, small business owners can defer income or accelerate deductions to minimize current year taxes. Additionally, choosing tax-efficient investments is crucial; high-income earners should prioritize investment vehicles that offer tax advantages, such as tax-deferred accounts like IRAs or 401(k)s for retirement tax planning. These accounts can significantly reduce taxable income now and defer taxes until a later date when the individual may be in a lower tax bracket.

Furthermore, wealth management tax strategies are integral to long-term financial success for high earners. These strategies involve a comprehensive plan that considers various aspects of an individual’s finances, including the timing and structure of income, investment decisions, and the utilization of various tax credits and deductions. A proactive approach to tax planning, which involves regular reviews of one’s financial plan in light of evolving tax laws, ensures that strategies remain effective and align with personal goals. By staying informed and adapting to changes in tax legislation, high-income earners can maintain a competitive edge in their income tax reduction efforts, ensuring their wealth management plans are both robust and tax-optimized.

Leveraging Charitable Donations and Philanthropic Planning to Reduce Income Tax Obligations

High-income earners have a unique opportunity to leverage charitable donations and philanthropic planning as effective tax-saving tips to reduce their income tax obligations. By making contributions to qualified charitable organizations, individuals can deduct these donations from their taxable income, thereby lowering the amount of income tax they owe. This strategy not only provides financial support to causes that matter but also offers a tangible income tax reduction. To maximize this benefit, it’s advisable to carefully select the timing and method of the charitable gifts, ensuring alignment with personal philanthropic goals and tax optimization strategies.

Moreover, integrating philanthropic planning as part of comprehensive wealth management tax strategies can lead to significant long-term income tax reduction. Beyond mere monetary donations, high-income earners can engage in more complex giving vehicles like charitable trusts or donor-advised funds, which can further enhance tax efficiency. Additionally, for small business owners and those engaged in retirement tax planning, these tax-saving measures can be particularly impactful, allowing them to conserve capital while fulfilling their altruistic objectives. Regularly consulting with tax professionals to stay abreast of the latest tax laws and strategies ensures that high-income earners’ charitable actions are not only commendable but also contribute to the optimization of their overall financial health.

Navigating Small Business Tax Planning: Deductions, Credits, and Efficiency

For small business owners, crafting effective tax-saving tips is a year-round endeavor. Engaging in tax optimization strategies that align with business activities can significantly reduce income tax obligations. Utilizing deductions pertinent to your trade, such as expenses for equipment, office supplies, and employee wages, serves as a foundational element in small business tax planning. Additionally, leveraging tax-efficient investments within the company’s retirement plans, like SEP IRAs or SIMPLE plans, can fortify your financial stability for the future. This dual focus on current deductions and long-term wealth management tax strategies not only alleviates the immediate tax burden but also ensures that your business is positioned to thrive in the face of evolving tax laws. By staying abreast of changes in tax legislation and employing strategic planning, small businesses can optimize their financial health, ensuring they retain more of their hard-earned income while adhering to regulatory requirements. Regularly consulting with a tax professional is pivotal in this process, as they can offer tailored advice that considers the unique aspects of your business, from day-to-day operations to retirement tax planning. This proactive approach to tax optimization is essential for small businesses aiming to maintain a competitive edge and secure financial longevity.

Effective Retirement Tax Planning Strategies for High-Income Individuals

For high-income individuals, effective retirement tax planning is a critical component of their overall financial strategy. Utilizing tax-saving tips is paramount; this includes maxing out contributions to tax-advantaged accounts such as IRAs and 401(k)s, where earnings can grow tax-deferred until withdrawal—often in retirement when the individual may be in a lower tax bracket. Additionally, exploring tax-efficient investments is a key strategy for income tax reduction. High-income earners should consider municipal bonds, which are often exempt from federal income taxes and sometimes state and local taxes as well. Furthermore, tax optimization strategies for retirement savings can involve the strategic use of Roth accounts, where contributions are made with after-tax dollars but grow and distribute tax-free.

Incorporating wealth management tax strategies into small business tax planning is another avenue for high-income earners to reduce their tax burden in retirement. Business entities like S-Corps or LLCs can offer pass-through tax treatment, potentially reducing the overall tax liability. It’s also advantageous to defer income and accelerate deductions where possible. Regularly reviewing and updating one’s financial plan is essential, as tax laws evolve and personal circumstances change. This ensures that the strategies remain effective and aligned with both your retirement goals and the current tax environment. By leveraging a combination of tax-advantaged investment vehicles, understanding the nuances of tax law, and maintaining a proactive approach to financial planning, high-income earners can significantly enhance their retirement years while optimizing their tax position.

Exploring Tax-Efficient Investments for Long-Term Wealth Accumulation

High-income earners seeking to accumulate wealth over the long term must consider tax-efficient investments as a cornerstone of their financial strategy. These investments are designed to offer both growth potential and tax advantages, which can significantly contribute to income tax reduction. By selecting tax-saving tips such as municipal bonds that generate tax-free income or contributing to Roth IRAs where withdrawals are tax-exempt, individuals can shield a portion of their earnings from current taxes. Additionally, employing tax-optimization strategies like Health Savings Accounts (HSAs) for those eligible can provide triple benefits: tax deductions for contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses.

In the realm of small business tax planning, owners can leverage retirement tax planning tools such as SEP IRAs or Solo 401(k)s to defer taxes and invest in their business’s growth concurrently. Wealth management tax strategies for high-income earners often involve a diversified portfolio that includes tax-advantaged accounts, real estate investments with potential for tax deductions, and careful timing of capital gains and losses. Regular reviews of these investments, in alignment with evolving tax laws, ensure that high-income earners can continue to optimize their tax positions and maintain the trajectory toward their long-term financial goals. By staying proactive and informed, individuals can maximize the benefits of tax-efficient investments, thereby reducing their overall income tax burden and securing their financial future.

Implementing Advanced Wealth Management Tax Strategies for High-Income Earners

High-income earners have a unique set of financial considerations when it comes to tax planning. Advanced wealth management tax strategies are pivotal in reducing income tax obligations while ensuring long-term financial security. A key tax-saving tip is the strategic utilization of tax-efficient investments, which can provide both capital growth and tax benefits. These investments often include tax-advantaged accounts such as IRAs or 401(k)s for retirement tax planning, where contributions can reduce taxable income. Furthermore, small business owners within this income bracket can leverage tax optimization strategies by structuring their business in a manner that minimizes tax liabilities, such as through S Corporations or partnerships that may afford pass-through tax treatment.

Beyond investments, wealth management tax strategies for high-income earners involve a proactive and detailed approach to claiming deductions and credits. This includes meticulously documenting charitable donations, which not only contribute to social causes but also offer a tax deduction. Additionally, tax planning for high-income earners should account for the ever-evolving tax laws and seek to align financial plans with these changes. Regular reviews of one’s portfolio and tax situation are essential to capitalize on opportunities for income tax reduction and to avoid potential pitfalls. By staying informed and consulting with tax professionals, high-income individuals can navigate the complexities of the tax code and secure their financial future through informed, strategic planning.

High-income earners have unique financial landscapes that necessitate specialized tax planning. The strategies outlined in this article—from income shifting to leveraging charitable donations and beyond—serve as effective tools for high-income individuals to reduce their income tax obligations. By adopting a proactive approach, utilizing tax-efficient investments, and staying informed about the latest deductions and credits, individuals can optimize their tax positions. Small business owners, too, can benefit from tailored tax planning that aligns with their operational structure and financial goals. As for retirement, strategic planning within this sphere offers a pathway to both financial security and tax savings. Advanced wealth management strategies further complement these efforts, ensuring high-income earners’ financial plans remain robust and adaptive to the ever-changing tax environment. By implementing these comprehensive tax optimization strategies, high-income earners can secure their financial future while minimizing their tax liabilities effectively.