2023 heralds a new era for personal finance management with the advancement of online tax preparation. This article delves into the transformative impact of income tax e-filing, a digital innovation that streamlines the tax submission process for individuals and self-employed alike. By harnessing the capabilities of easy tax filing software, taxpayers can navigate complex financial obligations with ease, access a plethora of online tax forms, and optimize their returns through informed understanding of available deductions. With the convenience of real-time tax refund tracking and robust security measures in secure online tax filing, individuals can confidently manage their fiscal responsibilities from anywhere at any time. Explore how this digital evolution not only simplifies tax season but also offers tailored tax filing assistance for those who work independently, ensuring compliance and maximizing savings.

- Maximize Your Tax Refund with Income Tax E-Filing

- Simplifying Your Taxes: Easy Tax Filing for All

- Access to Diverse Online Tax Forms for Accurate Filings

- Real-Time Tracking of Your Tax Refund Status

- Secure Online Tax Filing: Protecting Your Financial Information

- Tailored Tax Filing Assistance for the Self-Employed

- Efficient and User-Friendly Self-Assessment with E-Filing Software

Maximize Your Tax Refund with Income Tax E-Filing

Engaging in income tax e-filing offers a plethora of benefits for individuals looking to maximize their tax refunds. Unlike traditional paper-based filing methods, online platforms streamline the process through user-friendly interfaces and easy tax filing options. These platforms provide access to comprehensive online tax forms tailored to various financial scenarios, ensuring that self-employed individuals and those with complex income structures can also benefit from this efficient system. With income tax e-filing, you can effortlessly identify and claim all eligible tax deductions, thereby increasing the potential of your refund.

Furthermore, the convenience of online tax filing extends beyond mere submission; it includes robust tax refund tracking features that allow taxpayers to monitor the status of their returns in real-time. This feature alleviates the anxiety typically associated with waiting for a refund. The security measures implemented by reputable online tax preparation services guarantee the confidentiality and integrity of your financial information, making self-employed tax filing as secure as possible. With 24/7 customer support and detailed filing assistance, these platforms stand out as the go-to solution for anyone looking to handle their income tax obligations with ease and confidence.

Simplifying Your Taxes: Easy Tax Filing for All

The advent of income tax e-filing has significantly simplified the process for individuals and self-employed taxpayers alike, making easy tax filing a reality for many. Online tax forms are now readily accessible, eliminating the need to manually search for and fill out paper forms. These user-friendly digital platforms guide users through each step of the tax preparation process, ensuring that every deduction and credit is accurately accounted for. For those who have navigated the complexities of traditional tax filing, this transition to online systems represents a welcome ease and efficiency. The convenience continues with tax refund tracking; taxpayers can monitor their refund status in real-time, reducing uncertainty and anxiety during the processing period. Security measures are in place to protect sensitive financial information, making secure online tax filing a viable and responsible option for millions. With professional tax filing assistance often integrated into these platforms, individuals no longer need to be tax experts themselves; they can confidently prepare and file their taxes accurately and efficiently, freeing up valuable time and energy to focus on other aspects of their lives. The shift towards digital tax solutions is not just a matter of convenience but also an essential step in the modernization of personal finance management.

Access to Diverse Online Tax Forms for Accurate Filings

The advent of income tax e-filing has significantly streamlined the process for individuals and self-employed taxpayers alike, offering seamless access to a plethora of online tax forms tailored to various financial situations. Gone are the days of manually sifting through complex paperwork; taxpayers can now effortlessly select from an array of digital forms, including but not limited to the familiar 1040 and state-specific filings. These platforms are designed with user experience in mind, ensuring that taxpayers can accurately report their income and deductions without the risk of human error associated with paper submissions. The ease of accessing these forms online allows for meticulous attention to detail, as tax filing assistance is often integrated into these services, providing guidance on how to optimize your filings for a potentially higher tax refund.

Moreover, the process of e-filing taxes is not only user-friendly but also secure, employing advanced encryption and authentication measures to protect sensitive financial information. With the capability to file taxes electronically, taxpayers can submit their returns with confidence, knowing that their data is safeguarded throughout the submission and processing stages. Additionally, once a return is filed, taxpayers have the advantage of tracking their tax refund status in real-time, which eliminates uncertainty and provides peace of mind during the waiting period. This level of accessibility and transparency further underscores the benefits of online tax filing, making it an indispensable tool for those looking to manage their self-employed tax filing with precision and efficiency.

Real-Time Tracking of Your Tax Refund Status

In the realm of income tax e-filing, the advent of real-time tracking systems has significantly streamlined the process for taxpayers. Utilizing online tax filing platforms, individuals can submit their returns with ease, accessing a wide array of easy tax filing tools and online tax forms. These resources enable users to understand and claim their rightful tax deductions, thereby optimizing their potential refunds. The real-time tracking feature is particularly beneficial, allowing filers to monitor the status of their tax refunds with unparalleled precision. This means that self-employed individuals and those relying on professional tax filing assistance can receive updates on their returns as they are processed by the tax authorities, eliminating uncertainty and reducing the time typically spent waiting for refunds. The security measures implemented in these online systems ensure that sensitive financial information is safeguarded throughout the electronic filing process, providing a reliable and efficient alternative to traditional paper-based methods. As a result, taxpayers gain peace of mind along with valuable time, as the complexities of tax season are simplified through technology’s advancements in secure online tax filing.

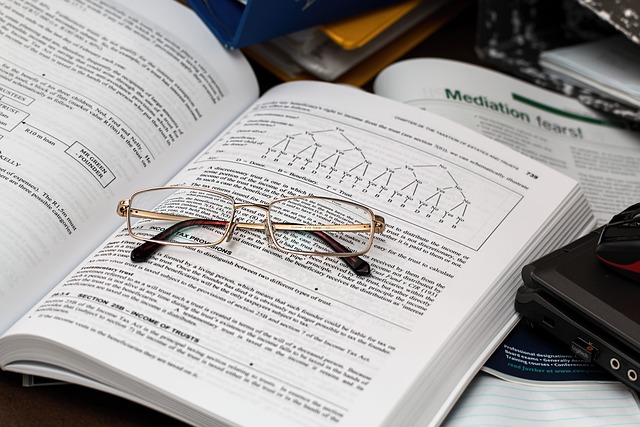

Secure Online Tax Filing: Protecting Your Financial Information

Income tax e-filing has significantly streamlined the tax submission process, offering a user-friendly and efficient approach for individuals and self-employed taxpayers alike. With easy tax filing software at their disposal, filers can now access a wide array of online tax forms, which are designed to guide them through each step of the process. These digital platforms not only simplify the submission of returns but also incorporate robust security measures to ensure that sensitive financial information remains protected throughout the tax filing process. The secure online tax filing system employs encryption and other cybersecurity protocols to safeguard personal data against unauthorized access, providing peace of mind to users who might otherwise be apprehensive about submitting their tax information over the internet. Furthermore, these platforms are regularly updated to comply with the latest data protection regulations, ensuring that taxpayers’ confidentiality is maintained even as they navigate the complexities of tax laws and maximize their potential refunds through understanding available deductions online.

For those seeking additional assistance, online tax filing services often provide resources such as customer support and detailed guides to help users through each step of the process. This support is particularly beneficial for self-employed individuals who may have more complex tax situations. Tax filing assistance is readily available to answer questions or clarify uncertainties, reducing the likelihood of errors and ensuring compliance with tax laws. Additionally, taxpayers can track their tax refund status in real-time, thanks to the integrated tax refund tracking features within these online services. This feature allows for a more transparent and responsive interaction with tax authorities, leading to quicker resolution and receipt of any owed refunds, thereby enhancing the overall experience of managing one’s tax obligations online.

Tailored Tax Filing Assistance for the Self-Employed

The digital transformation in income tax e-filing has opened new avenues for self-employed individuals to streamline their tax filing processes. With a plethora of online tax forms readily available, these professionals can now navigate their financial obligations with ease. Online tax filing platforms are specifically designed to cater to the unique needs of the self-employed, offering tailored tax filing assistance that simplifies complex tax scenarios. These services ensure that every deduction and credit is accurately calculated and claimed, maximizing refund potential while minimizing the risk of errors or omissions. The intuitive nature of these platforms allows users to effortlessly input their business income and expenses, automatically computing total liabilities and generating a complete and accurate tax return. Additionally, the security measures in place for secure online tax filing give self-employed individuals peace of mind that their sensitive financial data is protected throughout the process.

Moreover, the convenience of tracking tax refunds online cannot be overstated. Self-employed individuals no longer need to wait anxiously by the mailbox. Instead, they can monitor their tax refund status in real-time, with updates available at a moment’s notice. This feature is particularly beneficial for those who require an infusion of capital to support their business operations or personal finances. The ease of use and efficiency of these online tax filing solutions mean that self-employed taxpayers can file their returns promptly and confidently, ensuring they meet all necessary deadlines without the stress traditionally associated with tax season. With the right online tool, the complexities of self-employed tax filing are transformed into a straightforward and manageable task.

Efficient and User-Friendly Self-Assessment with E-Filing Software

The advent of income tax e-filing software has significantly streamlined the self-assessment process for individuals and the self-employed alike, offering an Easy tax filing experience that was once a laborious task. These sophisticated platforms are designed with user-friendliness in mind, guiding users through each step of the tax preparation process. With online tax forms readily available within these e-filing systems, filers can accurately input their financial data without the need for physical copies. The software’s intuitive interface makes it simple to understand and apply for tax deductions, thereby maximizing one’s potential for a larger refund. Moreover, these platforms are equipped with secure online tax filing mechanisms that protect sensitive personal and financial information throughout the process. Taxpayers can confidently submit their returns, knowing that their data is safeguarded against unauthorized access. The convenience of e-filing extends beyond the submission itself; it allows for real-time tracking of tax refund statuses, providing taxpayers with a transparent view of the processing stage of their returns. This feature eliminates uncertainty and ensures that individuals are kept informed every step of the way. By leveraging these online tax return services, taxpayers save valuable time, avoid the complexities of manual filing, and enjoy a more efficient and secure method to manage their taxes throughout the year. E-filing software not only simplifies the process for those familiar with their finances but also offers comprehensive tax filing assistance for those who may need additional guidance, making it an indispensable tool for anyone looking to navigate the intricacies of tax season with ease and precision.

In conclusion, the shift towards online tax preparation represents a significant advancement in managing personal finances and fulfilling income tax obligations. With user-friendly e-filing software, taxpayers, including self-employed individuals, can navigate the complexities of tax laws with ease, accessing a comprehensive suite of tools such as easy tax filing, diverse online tax forms, and real-time tax refund tracking. The inherent security in secure online tax filing ensures that sensitive financial information is protected throughout the process. By leveraging these resources, individuals maximize their tax refund potential while saving valuable time and resources. Embracing the digital transformation in tax filing not only streamlines this annual task but also provides a more accurate, efficient, and tailored approach to self-assessment. As tax seasons continue to unfold, it is clear that e-filing stands as a testament to innovation in personal financial management.