Temporary car insurance provides flexible, short-term vehicle coverage options for specific needs like vacation rentals or temporary vehicle use. It saves money and offers peace of mind with customizable liability and collision choices. Comparing quotes from multiple providers through online platforms is crucial to finding the best value based on individual requirements, ensuring financial security during transitional periods or occasional rental car usage.

In a landscape where car insurance costs have surged by 19.2% nationwide since November 2022, drivers are increasingly seeking flexible and cost-effective solutions. This article guides you through the options that offer short-term relief without the commitment of long-term policies. From temporary car insurance to rental car coverage, understanding these alternatives can save you from unexpected expenses. By exploring these possibilities and comparing quotes tailored to your needs, you gain control over your insurance choices, ensuring appropriate protection during transitional periods.

- Unlocking Flexibility: Temporary Car Insurance Explained

- Rental Car Coverage: Short-Term Solutions for Drivers

- Comparing Quotes: Securing Appropriate, Temporary Protection

Unlocking Flexibility: Temporary Car Insurance Explained

Temporary car insurance provides drivers with an adaptable solution for their automotive coverage needs. Unlike traditional policies that offer ongoing protection, this type of insurance is designed for short-term use. It’s ideal for individuals who don’t need comprehensive long-term coverage but require reliable protection for specific periods. Whether renting a vehicle for a vacation or driving someone else’s car temporarily, temporary insurance ensures drivers are covered without committing to years of expensive policy payments.

This flexible option allows users to choose the level of coverage they need, often with customizable options for liability, collision, and other add-ons. By understanding these variations, drivers can select the most suitable plan based on their immediate requirements, saving them money and offering peace of mind during transit.

Rental Car Coverage: Short-Term Solutions for Drivers

Rental car coverage provides a practical solution for drivers who need short-term protection while their primary insurance is in process or if they’re temporarily without a vehicle. This type of coverage is especially beneficial for those who frequently rent cars, whether for business trips or leisure travel. It offers flexibility and convenience, ensuring that you have liability and collision protection during these periods without committing to an extended policy.

For instance, if you’ve recently moved to a new city and are waiting for your permanent insurance to start, temporary rental car coverage can fill the gap. Similarly, if your vehicle is in for repairs or you’re attending an event that requires transportation, this option allows you to secure appropriate coverage without overpaying for long-term insurance. By understanding and utilizing these short-term solutions, drivers can navigate unexpected situations with financial peace of mind.

Comparing Quotes: Securing Appropriate, Temporary Protection

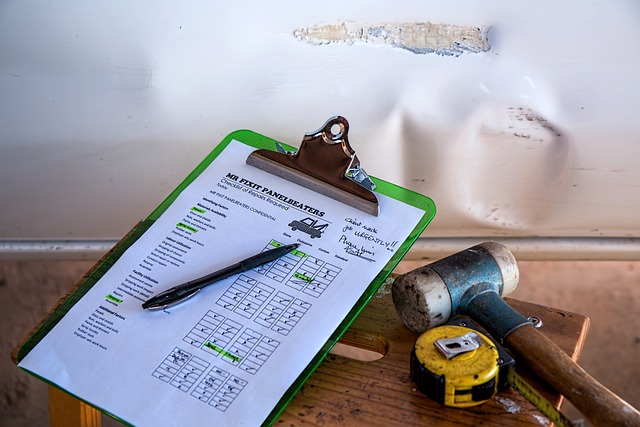

When considering temporary car insurance, comparing quotes is crucial to securing appropriate protection. Start by gathering information on different providers and their offerings tailored for short-term needs. Online platforms make this process efficient; enter your details, expected period of coverage, and desired levels of liability or comprehensive protection. These tools generate side-by-side comparisons, highlighting price differences and policy specifics.

Choose a provider that aligns with your requirements. If you only need temporary coverage while waiting for your long-term policy to kick in or during occasional rental car usage, opt for policies with lower premiums. Regularly review quotes as rates fluctuate based on various factors. This proactive approach ensures you find the best value without overpaying for temporary car insurance.

In light of the significant surge in car insurance premiums, drivers now have a heightened need to explore flexible, short-term coverage options. By understanding temporary car insurance and rental car coverage, individuals can gain control over their financial obligations, preventing unexpected costs associated with lengthy commitments. Through comparison shopping and assessing personal needs, drivers can secure appropriate protection for specific periods, ensuring peace of mind without breaking the bank.