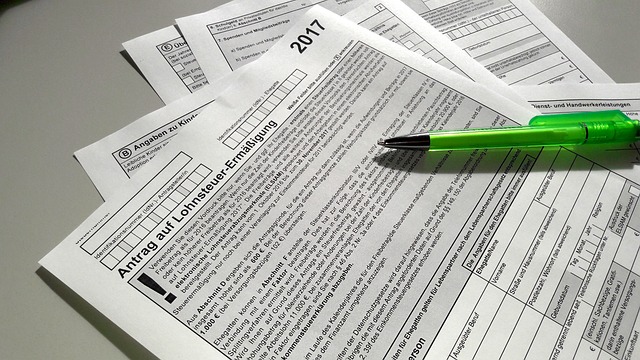

“Unlocking financial freedom through strategic tax planning is a smart individual’s key to prosperity. Our comprehensive services are designed to optimize deductions and align with your unique goals, ensuring compliance and minimizing liabilities. From year-end preparations to corporate tax solutions, we guide you through the complexities.

Discover the power of certified tax preparers, who offer expertise in navigating IRS regulations. Explore taxpayer relief services and strategies for significant savings. Whether self-employed or a business owner, our tailored advice revolutionizes your approach to income tax calculation.”

- Understanding Year-End Tax Planning

- – Importance of year-end tax planning for individuals and businesses

- – Common mistakes to avoid during tax preparation

- The Role of Certified Tax Preparers

Understanding Year-End Tax Planning

Year-end tax planning is a crucial strategy for maximizing taxpayer relief services and minimizing liabilities. As the year comes to a close, individuals and businesses should focus on optimizing their financial positions through strategic tax saving strategies. Certified tax preparers play a vital role in this process by offering specialized knowledge and expertise in navigating complex income tax calculations. They help clients take advantage of various deductions, credits, and exemptions that can significantly reduce tax burdens.

For self-employed individuals and business owners, year-end tax planning becomes even more critical as it allows for a structured approach to managing corporate tax solutions. By working with experienced professionals, businesses can ensure compliance while exploring legal ways to optimize their tax liabilities. This proactive strategy not only saves money but also fosters a healthier financial landscape, setting the stage for continued success and growth.

– Importance of year-end tax planning for individuals and businesses

Year-end tax planning is a crucial strategy for both individuals and businesses to optimize their financial positions. With the right approach, taxpayers can take advantage of various deductions, credits, and exemptions, leading to significant tax savings. Certified tax preparers play a vital role in this process, offering expertise in navigating complex tax laws and regulations. They assist in accurately calculating income tax, ensuring compliance with IRS guidelines, and providing valuable insights into strategic planning.

For businesses, year-end planning is even more critical due to the potential for significant tax liabilities. Corporate tax solutions tailored to each company’s unique circumstances can help minimize these burdens. By employing effective tax saving strategies, business owners can optimize their operations, enhance profitability, and ensure they are making the most of available deductions. This proactive approach not only reduces tax obligations but also fosters a culture of financial responsibility and growth.

– Common mistakes to avoid during tax preparation

Many individuals and businesses make preventable mistakes during tax preparation that can lead to unnecessary penalties and higher taxes. One of the most common errors is failing to keep detailed records throughout the year. This includes receipts, invoices, and any financial documents related to business activities or deductions. Without proper documentation, it becomes challenging to accurately calculate income and claim valid deductions, potentially resulting in audits or incorrect tax assessments.

Another blunder is waiting until the last minute to begin year-end tax planning. Time is of the essence when it comes to maximizing taxpayer relief services and taking advantage of tax-saving strategies. Certified tax preparers recommend starting early to ensure all necessary forms are completed accurately and to benefit from any potential deductions or credits. Additionally, neglecting to consider long-term financial goals when structuring a tax plan can lead to missed opportunities for growth and compliance with corporate tax solutions and income tax calculation guidelines.

The Role of Certified Tax Preparers

When it comes to year-end tax planning, engaging certified tax preparers can significantly ease the process and ensure accurate compliance. These professionals are equipped with in-depth knowledge of complex tax laws, allowing them to navigate the intricate world of taxation on your behalf. By leveraging their expertise, individuals and businesses alike can take advantage of available taxpayer relief services, uncovering valuable tax savings strategies that may have otherwise been overlooked.

Certified tax preparers play a pivotal role in optimizing corporate tax solutions, especially for self-employed individuals and business owners. They meticulously scrutinize financial records, identify deductions, and apply the latest tax laws to minimize income tax calculation liabilities. By employing their services, businesses can structure tax plans that foster growth while adhering strictly to IRS guidelines, avoiding costly penalties and ensuring a competitive edge in the market.

Year-end tax planning is a crucial aspect of smart financial management, especially for self-employed individuals and business owners. By leveraging the expertise of certified tax preparers and taking advantage of taxpayer relief services, businesses can optimize deductions, minimize liabilities, and align their tax strategies with their financial goals. With the right approach, including effective tax-saving strategies and accurate income tax calculation, companies can navigate complex regulations while ensuring compliance, ultimately leading to significant corporate tax solutions.